Harmony produced a very solid set of interim results for the six months ended 31 December 2017. The result exceeded my earlier expectation and is characterised by higher gold production at higher grade, reduced costs, and improving cash flow profile for the future. Interestingly, hedging contracts account for almost 80% of earnings this period. For yield seekers, there is no interim dividend. But Harmony ranks as one of my preferred gold exposures and I retain it as a Buy. Investors should note that Harmony got a good deal for its purchase of three assets from AngloGold Ashanti, on my estimates a discount to intrinsic value, depending on the assumptions made with respect to the Zaaiplaats project. Harmony is valued on a DCF basis at R41 and on a sum-of-the parts basis at R25.

“A hedged half”

HARMONY GOLD [JSE:HAR]

Gold Mining

Share price: R20,36

Net shares in issue: 441 million

Market cap: R9,0 billion

DCF value: R41,00

Sum-of-the-parts value: R25,00

Trading Buy and Portfolio Buy

What you need to know:

The key takeways are as follows from the interim result:

Headline earnings up 51% to R990 million and up 57% in US dollar to $74 million. EPS is up 49% to 224 cents. Of the total earnings, hedging contacts are estimated to account for almost 80% of the contribution.

Hedging has become a notable feature of Harmony. A currency hedge gain was R403 million, the gold hedge gain was R503 million, whilst the zero cost collars on silver from Hidden Valley had a loss of R43 million.

South African gold production increased by 6% with grade improving by 4%. This resulted in a 4% fall in cash operating unit costs to R419 440/kg, which in US dollar was flat at US$974/oz. All-in sustaining costs for all operations decreased by 2% to R500 248/kg and in US dollar increased by 2% to US$1 161/oz as a result of the stronger rand, up 4% to R13,40/$.

Total Harmony production was 1% higher at 17,418kg or 560 003oz. Target 1, Tshepong, Doornkop, Masimong, and Kusasalethu all contributed positively.

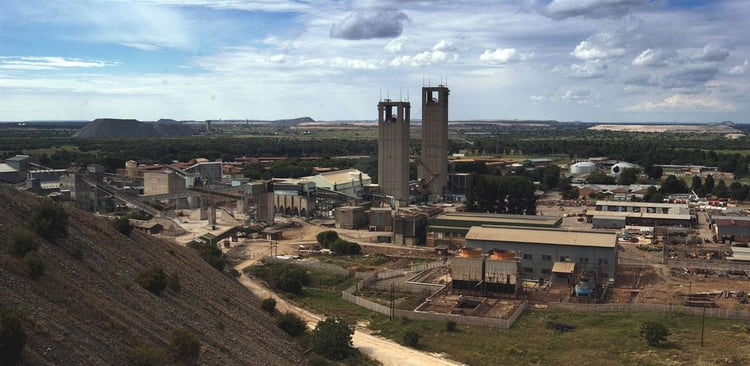

On Hidden Valley, the processing infrastructure project is finished inside budget and time. Once up and running at the end of 2018, production is expected to be 180 000 oz. This will mean total Group production of 1,5 million oz, including the acquired AngloGold Ashanti assets and Hidden Valley.

Hidden Valley

Net debt is now R1,5 billion, a modest 5% of shareholder equity of R30 billion or R67 per share.

The purchase of three assets from AngloGold Ashanti for $300 million, the most significant being Moab Khotsong mine in the Vaal River region of the Witwatersrand goldfields, I estimate will only have a temporary dilutive effect on EPS, assuming a rights issue eventuates. The circular issued in December alluded to this.

Moab Khotsong has a positive cash flow benefit for Harmony, boots underground recovered grade, and increases the South African underground mineral resource by 38% (i.e. 17,5 million oz). The deal adds a quarter of a million new ounces of gold in a full year at all-in sustaining cost below Harmony's target of US$950/oz. The average underground recovered grade rises to 5,7g/ton.

Moab Khotsong

If a rights issue was at around R21 per share for the issue of 135 million new shares, that would take total shares in issue to 576 million. Assuming Harmony makes R1,4 billion or 318 cents per share in earnings in F2019 then issuing share at today’s share price would dilute EPS temporarily by about 18%. Pro form earnings increase to R1,5 billion, which on 575 million shares is EPS of 260 cents.

At this stage we have no further detail on the funding, but investors should take this in to account in their exposure to Harmony shares.

Recommendation:

On a net present value DCF basis, I value Harmony at R41 per share, which is substantially higher than the current share price of R20. On a sum-of-the-parts basis I get to R25. The Moab deal adds some short-term uncertainty as we don’t know final funding proposals but it also present opportunity, dependent on what happens with respect to developing Zaaiplaats. Harmony ranks as one of my preferred gold exposures and I retain it as a Buy.

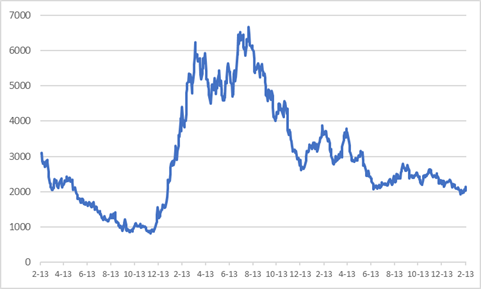

Harmony share price in ZA cents

Wishing you profitable investing, until next time.

Mark N Ingham

Read more fundamentals by Mark Ingham:

- Brait

- Sibanye

- Barclays

- Sun International

- Telkom

- Sasol

- Naspers

- Woolworths

- Attaq

- AngloGold Ashanti

- Massmart

- Bidvest

- SARB

- Glencore

- Shoprite

- Vodacom

- Pick n Pay

- FirstRand

- Taste

- Mediclinic

- Long4Life

- AVI

- Steinhoff