I am on record as being cautious about exposure to consumer stocks. However, I have also maintained that one size doesn’t fit all, some companies will do better than others even though the going is tough. Management, inevitably, makes a difference. Shoprite is a good example of resilience in grocery retail and AVI is a good example of the same characteristic as a diversified food & beverage, personal care, and footwear & apparel business. Although the price earnings ratio is on the pricey side, there is solid underlying cash flow and a generous forward dividend yield of 4,4%.

“Stepping Out”

AVI

Sector: Food Products

Share price: R98,70

Net shares in issue: 324,2 million

Market cap: R32,0 billion

Forward PE year one: 18,1x

Forward PE year two: 15,4x

Dividend yield year one: 4,4%

Dividend yield year two: 4,7%

Fair value: R100,00

Target price: R108,00

Trading Buy and Portfolio Buy

Mark Ingham's Fundamental analysis

What you need to know:

AVI put in another solid result for the year to 30 June 2017. Headline earnings per share grew by 9,4% to 507,7 cents, ahead of my forecast of 503 cents. A final dividend of 243 cents per share was declared for a total annual dividend of 405 cents, an increase of 9,5%.

AVI is well prepared and positioned to withstand the current tougher trading environment – which includes costs, currency, and spending power of customers. In refining and investing in the portfolio of businesses, AVI management has captured the urban demographic factors shaping the country well. There is growth abroad, with international sales exceeding R1 billion, 7,7% of Group revenue, and operating profit approaching R200 million, 8,3% of Group total.

Innovation, brand extension, market positioning and affordable luxury have been important determinants of AVI’s continuing appeal and growth and it continues to strike the right balance. There is a range of offerings in food & beverage, fish products through I&J, personal care, and footwear & apparel, which includes Spitz and Green Cross, with a powerful but affordable non-commodity appeal.

Organic and acquisitive growth is managed according to what is optimal for the portfolio and by smart factors such as trading density, price vs. volume, external markets, and customer loyalty.

Operating margin in F2017 was 18,1% and is 1,5% higher than five years previously, notwithstanding the variability of the fishing contribution.

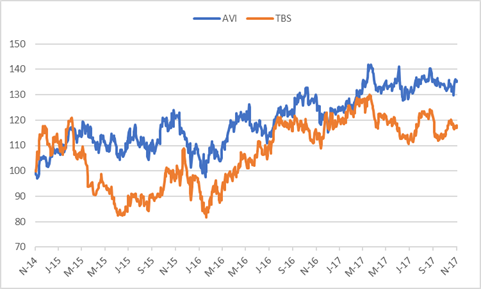

AVI has grown EBITDA by a compound rate of 12% and EPS by a compound rate of 10,0% over five years, substantially outperforming Tiger Brands. Dividend per share has grown at a 14,8% compound rate, excluding special dividends. The Group pays out 80% of earnings.

This growth is achieved whilst maintaining a high level of solvency, an important consideration for analysts. Free cash flow last year was R1,1 billion, doubling since 2013. Cash flow after working capital is around 100% of operating profit. Net debt of R1,4 billion is 23% of capital employed and the interest cover ratio is a healthy 18x. Reinvestment is good with the Group spending R1,4 billion this past two years with a further R564 million planned in F2018.

The Group is currently under cautionary due to having received a number of expressions of interest for certain business units. Given the quality of the assets an approach such as this is not surprising. AVI does say this may be value enhancing for shareholders and meantime has appointed external advisors to assist it in evaluating these approaches.

The mix of assets within AVI is superior to Tiger Brands, with a degree of resilience, and there is a solid management track record.

At the AGM on 2 November, the company stated that gross profit margin had improved in the first quarter of the new financial year with expenses increasing at a rate below inflation. Operating profit for the quarter was also higher. Exchange rates have been hedged favourably relative to 2017.

Recommendation:

The three-year, price-earnings-to-growth ratio is high at 2,4x – which means the PE ratio is twice my forecast compound earnings growth of 8%. The rolling exit PE ratio is 19,0x. This may seem high but as the cautionary announcement indicates, bidders see value in quality, cash generating assets. Free cash flow per share is 66% of headline earnings per share.

The expressions of interest from potential buyers of some assets is at an opportune time as it underscores the investment merits of AVI. It also shows that AVI management will consider realising assets if value could be realised.

Despite the negative macros, management is confident in a further year of growth and progress in F2018.

Given the generous payout ratio, AVI has an attractive dividend yield is 4,4%.

Trading Buy and Portfolio Buy maintained on AVI.

AVI and Tiger Brands based to 100 over three years

Wishing you profitable investing, until next time.

Mark N Ingham

Read more fundamentals by Mark Ingham:

- Brait

- Sibanye

- Barclays

- Sun International

- Telkom

- Sasol

- Naspers

- Woolworths

- Attaq

- AngloGold Ashanti

- Massmart

- Bidvest

- SARB

- Glencore

- Shoprite

- Vodacom

- Pick n Pay

- FirstRand

- Taste

- Mediclinic

- Long4Life