The damage Steinhoff faces, following acknowledgement by the Supervisory Board that there are in fact “accounting irregularities requiring further investigation”, is arguably more one of reputation rather than financial per se. The distinction between Supervisory and Management Board, from which the CEO has resigned, is important in this context, given application of the Dutch Corporate Governance Code. Steinhoff has generated positive cash flows and is profitable. Accounting irregularities could relate to the German tax investigation but there could be more to unearth. The accounts of the Group, which are audited by Deloitte, have previously been given a clean bill of health and so there is a possible sinister aspect relating to management disclosure. In the absence of detail, conjecture and rumour fill the vacuum and sentiment is driving trading behaviour. Short sellers and shareholders dumping stock, with abnormal volumes meaning an ongoing stock exchange auction, are shaping pricing but this is a market clearing price and not an indication of where fundamental value may eventually settle. For those holding Steinhoff, widely owned by institutions, now is hardly the time to join a crowded exit corridor. This is an unfolding saga and I’ll keep you posted.

“Ruptured Reputation”

Steinhoff

Fundamental Analysis

Sector: Household Goods

Share price: SNH:GR EUR1,10

Share price: SNH:SJ ZAR17,61

Issued share capital: 4,23 billion

Market cap SNH:GR: EUR4,7 billion

Market cap SNH:JSE: R74,5 billion

What you need to know:

The damage Steinhoff faces, following acknowledgement by the Supervisory Board that there are in fact “accounting irregularities requiring further investigation”, is arguably more one of reputation rather than financial per se. The distinction between Supervisory and Management Board, from which the CEO has resigned, is important in this context, given application of the Dutch Corporate Governance Code. Steinhoff has generated positive cash flows and is profitable. Accounting irregularities could relate to the German tax investigation but there could be more to unearth. The accounts of the Group, which are audited by Deloitte, have previously been given a clean bill of health and so there is a possible sinister aspect relating to management disclosure. In the absence of detail, conjecture and rumour fill the vacuum and sentiment is driving trading behaviour. Short sellers and shareholders dumping stock, with abnormal volumes meaning an ongoing stock exchange auction, are shaping pricing but this is a market clearing price and not an indication of where fundamental value may eventually settle. For those holding Steinhoff, widely owned by institutions, now is hardly the time to join a crowded exit corridor. This is an unfolding saga and I’ll keep you posted.

Steinhoff International CEO Markus Jooste has resigns

Steinhoff International CEO Markus Jooste has resigns

Background:

In a note dated 25 July 2014, I advised that “there is also a taxation aspect when assessing Steinhoff as a whole, a creative brand management structure, inter alia, keeps the tax rate very low”. I unpacked what that meant and what effect there was on earnings per share. There was a roughly 18,5% differential over more than a decade between reported EPS and what EPS would be at a normalised higher rate.

In August last year, I commented that “there is no further clarity on the German tax investigation so with the outcome unknowable it could have potential negative valuation consequences, as I’ve cautioned since 2014 …my sense is that it relates to transfer pricing”. And, in June this year, I further commented that “the tax challenge by the German authorities has yet to be resolved…whilst management is confident in reaching a favourable settlement we don’t know the exact nature of the investigation or the ultimate consequences.”

In fact, in the 2016 annual report, the risk section refers to transfer pricing arrangements and that the company is currently subject to ongoing investigations. The Group was confident that the “matter will be resolved amicably” and that a low tax rate of 15% was maintainable.

Steinhoff owns and manages its brands via Switzerland, where taxation on intellectual property holding companies is 8% to 12%. Brand management revenue is earned from royalties received from customers and group entities. It seemed that off balance sheet structures could also have been deployed but it was impossible to say with any conviction.

Because of this uncertainty, I built in more conservative earnings assumptions in my valuation of the Group that took account of the tax arbitrage.

In the ten years 2006 to 2015, the Group reported a cumulative pre-tax profit of R64,1 billion. The cumulative tax charge was R7,4 billion, with the effective rate averaging 11,9%. After-tax profits were therefore R56,7 billion.

The effective rate of corporate tax was between 30% and 33% in Germany, 19% in Poland, a minimum of 38% in France, and of late 28% in South Africa. In Eastern Europe, there are some tax incentives too for inward investment. Steinhoff had a tax charge significantly lower than the South African standard rate and other jurisdictions. That boosts earnings per share.

In that ten-year period, if the South African average rate had applied, the cumulative tax charge would have been R17,9 billion, which is R10,5 billion more than the actual. That would have reduced cumulative earnings to R46,2 billion from R56,7 billion. In round numbers, on a period average ZAR/EUR rate, that is a €1 billion differential.

The investigation dates to 26 November 2015, when German authorities searched the Westerstede offices of Steinhoff Europe Group Services GmbH. The authorities are reviewing the balance sheet treatment of certain transactions involving transfers of participations and intangible assets among SEGS, additional subsidiaries and third parties. The investigation focuses on adherence to an arms’ length valuation and proper accounting regarding German generally accepted accounting practice.

There is another legal tussle with a former joint venture partner but that is separate.

Where there is smoke, there is fire, despite protestations by the CEO at analyst’s briefings that all was well.

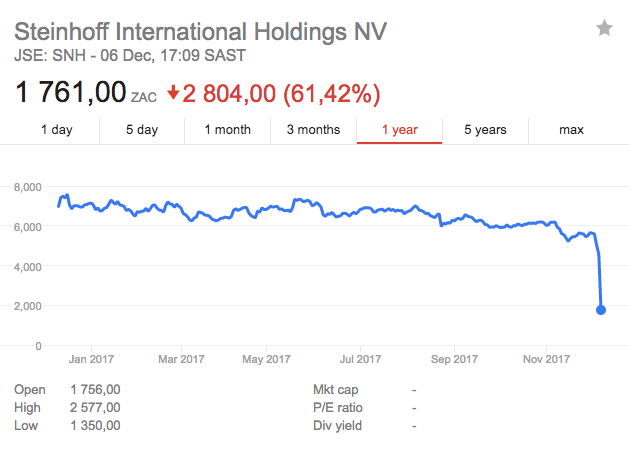

Image (c) Google Finance Steinhoff Share Price.

Steinhoff was scheduled to release annual results on 6 December at 9am local time. Less than an hour before that, the company postponed until further notice the financial results announcement and the analyst’s webcast. Steinhoff had previously said it would release unaudited results. The delay in the audit was due to a review of matters arising from a legal and regulatory point of view.

The announcement late on 5 December by the Supervisory Board that new information had come to light, that in consultation with Deloitte an independent investigation would be done by PricewaterhouseCoopers, that the Board had accepted the resignation of the CEO, and that it would be determined whether a restatement of prior financial statements was necessary, is important from a governance point of view.

Steinhoff International Holdings N.V. is incorporated in the Netherlands and listed on the prime standard of the Frankfurt Stock Exchange as a primary listing, and therefore bound to apply the Dutch Corporate Governance Code. Steinhoff therefore has a Supervisory Board and a Management Board.

The Management Board must provide the Supervisory Board in due time with the information required for the performance of its duties. The Management Board is required to inform the Supervisory Board in writing of the main aspects of the strategic policy, the general and financial risks and the Company’s management and auditing systems, at least once per year.

The Supervisory Board, of which Mr Christo Wiese is Chairman, has an oversight role therefore. It does not involve itself with day-to-day minutiae, that is the role of the executives. The Management Board is the executive body and is entrusted with the management of the Company’s operations and strategy, subject to supervision by the Supervisory Board.

What seems to have occurred, although we’ll only know what has actually happened in future, is that the executive may have been a bit economical with the truth and disclosure. Separately, the CEO of Steinhoff Africa Retail, and the Chief Financial Officer of Steinhoff, has stepped down as CEO of STAR.

Mr Wiese has been appointed Executive Chairman on an interim basis whilst Mr Pieter Erasmus, who has a wealth of experience at Pepkor, is supporting Mr Wiese in an executive advisory role. Steinhoff has a very good depth of operational management capacity.

The Group needs to be forthright as soon as practicably possible on what information has come to light and the implications. Meantime, uncertainty and unknowns will depress the share and encourage volatility.

So, is their intrinsic value? Ostensibly yes. Steinhoff has routinely reported cash flows after working capital and before cash tax in line or higher than operating profit. Deloitte have never issued a qualification to the accounts nor a going concern caveat. If, as some detractors aver, this is an elaborate pyramid scheme, Steinhoff has fooled the auditors and many financial professionals for years.

Cash flow after working capital and before tax in F2017 could be around €2 billion, which compares with estimated operating profit of €1,8 billion and EBITDA of €2,2 billion. Profit attributable to owners of the parent is estimated to be €1,22 billion or 28,8 euro cents per share. The actual figures, subject to scrutiny, will only be published at some undetermined date.

The balance sheet is open to question. It is goodwill heavy and has built up over the years of acquisitions. Maintaining goodwill, in the literal sense of the word, in the business is therefore imperative. Customers, suppliers, and funders, among others, need to have confidence in the business they either patronise or have terms with.

I have assumed €18 billion in goodwill and intangibles, 70% of non-current assets. Property, plant, and equipment is 20% of non-current assets. Goodwill and intangibles are effectively equivalent to the total equity of the business, which in an extreme assumption means there is no real equity if goodwill is excluded. Shoprite, by contrast, another Wiese asset, has 75% of non-current assets in PPE and 9% in intangibles.

Gross debt is around €10 billion and assuming cash of €3 billion net debt will be around €7 billion (R100 billion). Unused facilities amount to about €1,5 billion.

Debt includes bonds. Steinhoff has been able to raise euro debt at competitive interest rates, most recently at below 2%. Convertibles though carry a conversion price of over €7 per share, which was fine when the share price was over €5. In the market panic, the bonds were priced down too and yielded over 10% at one point.

The debt to equity ratio is a relatively modest 39% only if goodwill and intangibles are included. However, annualised EBITDA interest cover is 8,5x, which is a reasonably healthy cover. So, absent a material deterioration in profitability the Group would be able to comfortably service obligations.

Deciding that its shares were cheap, Steinhoff recently bought back of 78,4 million shares. The shares being bought were 1,84% of the net shares in issue, roughly €300 million or R4,8 billion.

Steinhoff has not been shy to issue new shares. In 2006 there were 1,1 billion shares in issue, now there are 4,23 billion shares in issue of which 2,4 billion were issued in the past three years. With effect from 28 September 2016, Steinhoff raised €2,4 billion in new equity through the issue of 332 million shares at €5,055 with a further 152 million in treasury shares sold (a total of 484 million shares).

However, earnings have risen too, from attributable income of R659 million in 2002 to R19 billion this year (€1,2 billion), a 29-fold rise. Measured in earnings per share, the rise is 5-fold.

Management too have been recent buyers, with the Chairman executing on 20 000 single stock futures contracts in November, equivalent to 2 million shares at R61 each.

Insiders have had a clear idea of where value was but developments in the past day put a dark cloud of doubt on the entire enterprise unless there can be substantiated quantification of the what is at stake and thus the risk priced accordingly.

STAR has faced the negative backdraft too, although there is no spill over from the parent and its accounts are clean. The stock is down around 20%. Steinhoff owns 76,8% of STAR. The market cap of STAR, based on 3,45 billion shares and a share price of R19,00 is R66 billion and the Steinhoff share of this is R51 billion (€3,2 billion). That means that STAR is equivalent to R12 per Steinhoff share or 67% of the Steinhoff share. Steinhoff has a currently depleted market cap of R75 billion (€4,7 billion) at R17,61 per share so the parent is worth only R24 billion.

Recommendation:

My previous caution has been warranted. In that note in July 2014, I concluded with the observation that “a conundrum is that Steinhoff tends to be rated as an ex-growth stock that does not compensate with a chunky yield; historically, it has been beguilingly cheap”. The stock was cheap but arguable cheap for a reason.

There has been a split between bulls and bears on Steinhoff. Even today, analyst’s target prices on the stock on Bloomberg reach as high as R100. At its peak last year, the share price was over R90 and subsided to around R50 prior to the Supervisory Board announcement.

On the basis of what we know, not what we don’t know as yet, R50 is a more realistic level. That would price the parent, excluding STAR, at R38 rather than R6. But we are a long way from that, if at all, until clear and unambiguous information is revealed.

The PWC investigation cannot come soon enough. As an aside, the CFO completed his articles with PWC and spent two-and-a-half years in its international and corporate tax division.

Current stock shorting activity will also unwind and that too will have implications for scrip demand and thus pricing. Geared positions could still find double down opportunity. Whilst there is the potential for fundamental value to be released off depressed levels, this takes a back seat to extreme negative sentiment for now.

Wishing you profitable investing, until next time.

Mark N Ingham

Read more fundamentals by Mark Ingham:

- Brait

- Sibanye

- Barclays

- Sun International

- Telkom

- Sasol

- Naspers

- Woolworths

- Attaq

- AngloGold Ashanti

- Massmart

- Bidvest

- SARB

- Glencore

- Shoprite

- Vodacom

- Pick n Pay

- FirstRand

- Taste

- Mediclinic

- Long4Life

- AVI