"Trolley for trolley it's worth paying more"

[JSE:SHP] Shoprite

Sector: Grocery Retail

Share price: R203

Net shares in issue: 555 million (net of treasury and delisted Bassgro shares)

Market cap: R114 billion

Forward PE year one: 18,6x

Forward PE year-two: 16,8x

Forward dividend yield: 2,7%

Fair value: R210

Target price: R225

Trading Buy and Portfolio Buy

Mark Ingham's Fundamental analysis

What you need to know:

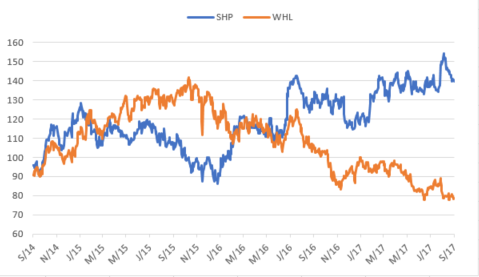

I’ve had a Sell recommendation on Woolworths for some time as the future fundamentals looked questionable. Once the darling of retail, it levitated for a while at around R100 per share and then started to slip as doubts about its local retail positioning, not least food, and the Australian market an uncertain and challenging place. Shoprite had also quietly taken the view that two can play the fancy food game, without a need for salary gouging prices.

At face value, Woolies, at a share price of R59, is cheap relative to Shoprite. Woolies is on a forward PE ratio of 14x and a dividend yield of 5,3%, which by retail standards is generous. Shoprite meantime, at a share price of R205, is on a forward PE ratio of 18,6x based on my updated 2018 EPS of 1100 cents with a forward yield of 2,7% assuming a 2018 dividend of 550 cents.

So, Woolies offers a yield double that of Shoprite. The only catch is the ability to sustain earnings growth, which in any event has stalled.

For the 52 weeks to 25 June 2017, David Jones profit was down by 25% in Australian dollars with Country Road flat. Food in South Africa managed to grow profits by 8%, but only helped by new stores. Clothing and general merchandise profits fell by 6% and turnover was flat, despite internal inflation of 6,6%, so backwards in real terms. I discussed this topic in a note entitled “Knotted” dated 29 June and further observed that “the stock is roughly 40% off its highs but that does not mean it is a great buy”.

Shoprite ended the financial year strongly, despite currency headwinds. It was a 52-week year to 3 July 2017 compared with 53 weeks. Disclosure is slowly improving. Stripping out the extra week previously, EBITDA grew by 8,9% to R10,0 billion, trading profit by 15,7% to R8,1 billion, and earnings per share by 16% to 1007 cents. The annual dividend grew by 11,5% to 504 cents.

Total stores now number 2 689, of which 437 are external to South Africa with a further 43 being added in 2018.

Like-for-like sales, grew 10,6% to R141 billion. They now strip out Checkers separately and this business made R38,6 billion in sales, up 10,8%, across 239 shops. Shoprite sales grew by 8,6% to R52 billion.

South Africa still accounts for 72% of sales and 84% of profit before tax but other Africa has been growing quickly, despite recent weakness in the Angolan kwanza, Nigerian naira, Zambian kwacha, and Mozambique metical. A currency loss on exchange rate differences was R236 million in 2017 due to the stronger rand.

I estimate that other Africa will have pre-tax profits of around R1,7 billion in 2018 and hit R2 billion within two years. To put that in perspective, Shoprite will make as much profit in Africa next year as Pick n Pay’s South Africa operations.

Shoprite is already taking Woolies on at its own game with selected Checkers stores increasingly offering premium selections at competitive pricing. Given that it has historically had a low representation in this upper end there is scope to take market share without undermining group margins. The group is probably light on private label products so this too is an opportunity.

Investors should recall that there is a second phase to the recent Steinhoff Africa listing involving Shoprite. However, Shoprite is going to maintain a separate JSE listing and Shoprite management will remain independent.

Steinhoff and STAR entered into call option agreements whereby STAR will acquire a 23,1% interest in Shoprite and a voting interest of 50,6%. Inter alia, the call option agreements include Wiese family interest in Shoprite. STAR is not required to extend an offer to Shoprite minorities. The amount is calculated at a share price of R215 for approximately 128,2 million underlying Shoprite ordinary shares, R4,0 billion attributable to deferred voting shares, and R4,0 billion in cash.

STAR will pay by issuing shares equal to 33,6% of its combined share capital post the listing and the investment in Shoprite through the call options. That means the shares in issue rise to 5,2 billion, of which Steinhoff will have 2,65 billion shares or 51%.

The combination of STAR and the interest in Shoprite means approximate pro forma adjusted earnings of R5 billion or earnings per share of 96 cents.

Shoprite has 555 million shares in issue now, net of the recently cancelled and delisted 8,7 million Whitey Basson shares and 36,3 million in treasury stock. This means a net current Shoprite market capitalisation of R114 billion. STAR has a current market value of R75 billion so the two make for a formidable presence on the JSE.

Recommendation:

I’ve mentioned before that fresh money is unlikely to get access to Shoprite much cheaper than R200 per share.

Relative operating momentum, both in South Africa and other parts of Africa, where it has determinedly stayed the course, give it an edge at a difficult time for retail in general. The recently announced corporate action with STAR is a further underpin to the stock.

Much like STAR is a force to be reckoned with in affordably priced non-grocery so too is Shoprite dominant in grocery.

Trading Buy and Portfolio Buy with fair value at R210 and the target price at R225.

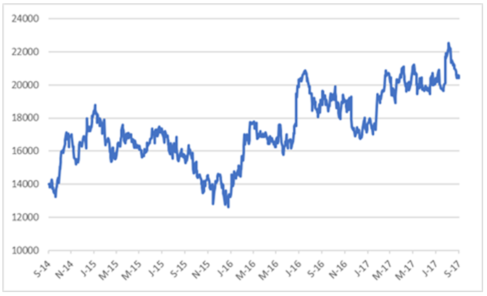

Shoprite share price in ZA cents

Shoprite and Woolies based to 100 over three years

Wishing you profitable investing, until next time.

Mark N Ingham

Read more fundamentals by Mark Ingham:

- Brait

- Sibanye

- Barclays

- Sun International

- Telkom

- Sasol

- Naspers

- Woolworths

- Attaq

- AngloGold Ashanti

- Massmart

- Bidvest

- SARB

- Glencore