Harmony is getting a good deal for its purchase of three assets from AngloGold Ashanti, the most significant being Moab Khotsong mine in the Vaal River region of the Witwatersrand goldfields. My estimates indicate a roughly 40% to 70% discount to the intrinsic value of the asset, depending on the assumptions made with respect to the Zaaiplaats project. Moab is a relatively young, deep-level mine with potentially long life and competitive all-in-sustaining costs of below $900/oz. AngloGold Ashanti has made it known that it is downscaling its SA exposure, affecting 30% of the staff complement locally. Harmony is capitalising on an opportunity and is likely to be a more engaged steward of Moab. The deal should close before 30 June 2018. However, whilst the deal is on favourable terms investors need to price in the possibility of a rights issue if the Zaaiplaats potential within Moab is to be realised over the next few years. This could mean temporary future dilution and possibly a damper on the share price. Nonetheless, Harmony is fairly pitched at R24,62, not least with the gold price now $1 280/oz or R565 000/kg. My DCF calculation remains at R41 per share.

“Moab moolah”

Harmony Gold

Fundamental Analysis

Sector: Gold Mining

Share price: R24,62

Net shares in issue: 440 million

Market cap: R10,8 billion

DCF value: R41

Trading Buy and Portfolio Buy

What you need to know:

Harmony is getting a good deal for its purchase of three assets from AngloGold Ashanti, the most significant being Moab Khotsong mine in the Vaal River region of the Witwatersrand goldfields. My estimates indicate a roughly 40% to 70% discount to the intrinsic value of the asset, depending on the assumptions made with respect to the Zaaiplaats project. Moab is a relatively young, deep-level mine with potentially long life and competitive all-in-sustaining costs of below $900/oz. AngloGold Ashanti has made it known that it is downscaling its SA exposure, affecting 30% of the staff complement locally. Harmony is capitalising on an opportunity and is likely to be a more engaged steward of Moab. The deal should close before 30 June 2018. However, whilst the deal is on favourable terms investors need to price in the possibility of a rights issue if the Zaaiplaats potential within Moab is to be realised over the next few years. This could mean temporary future dilution and possibly a damper on the share price. Nonetheless, Harmony is fairly pitched at R24,62, not least with the gold price now $1 280/oz or R565 000/kg. My DCF calculation remains at R41 per share.

In October, AngloGold Ashanti entered into a sale and purchase agreement to dispose of assets to Harmony for $300 million cash, with the key asset being Moab Khotsong mine, which has included the Great Noligwa mine since 2015. Moab is between the West Wits and Free State operations of Harmony.

The deal, providing all conditions are satisfied, should close before Harmony’s year-end on 30 June 2018.

Moab is a relatively new deep-level shafts, with development dating back to 1993 and having a potentially long-life. The mine produced 280,000 oz of gold in the year to 31 December 2016 at an all-in-sustaining-cost of $884/oz. The ore reserve is 5 million oz and the mineral resource 17,5 million oz, including Project Zaaiplaats with 3,3 million oz of the ore reserve and 6,8 million oz of the mineral resource.

Moab Khotsong has a positive cash flow benefit for Harmony, boots underground recovered grade, and increases the South African underground mineral resource by 38% (i.e. 17,5 million oz). The deal adds a quarter of a million new ounces of gold in a full year at all-in sustaining cost below Harmony's target of US$950/oz. The average underground recovered grade rises to 5,7g/ton from 5,07g/ton in F2017.

There are three vertical shafts and the orebody has three separate blocks, called the top mine (Great Noligwa), the middle mine and the lower mine (Zaaiplaats). The mineral resource is mainly within the lower mine block and is 60% of reserves. Great Noligwa and Moab Khotsong have been merged for three years now. As mining graduates from top to middle mine, so costs rise. There is a complexity to the orebody and so mining is of the scattered method with backfill support and pillars. Mining is 1 800 meters to 3 000 meters below ground.

Moab generated revenue of R5,3 billion, EBITDA of R2,1 billion, and attributable profit of R852 million in 2016. In the first half of F2017, Moab generated revenue of R2,2 billion, EBITDA of R664 million, and attributable profit R214 million. Net asset value if R3,0 billion. Importantly, on a free cash flow basis, Moab has generated a compound R3 billion in the last four and a half years.

In F2019, Moab would contribute about 28% of Harmony EBITDA of R7 billion on a pro forma basis. Group gearing would increase to over 20% based on borrowing to fund the deal. However, with other spending commitments, particularly Gopul, gearing would increase to 30% over the following five years.

Currency and gold hedges are important in this regard. Harmony has ongoing hedging activity to underpin cash flows. In F2018, 20% of production is hedged at R706,750/kg and 3% at US$1,268/oz. For F2019, 9% of production is hedged at R658,375/kg and 3% at US$1,274/oz. These dollar hedges are for Hidden Valley in Papua New Guinea.

Cash operating costs of $1 000/oz and all-in-sustaining costs of $1 200/oz are reasonable expectations through F2020.

On my calculations, Harmony is getting a reasonable deal. But, it only really adds exceptional value if Zaaiplaats is developed. The $300 million is only 2x 2016 EBITDA for Moab whilst the EV/reserve cost of $60/oz is peanuts compared with other deals struck internationally. The deal also takes management to their target of an extra 1,5 million ounces by 2019/2020.

Moab, excluding Zaaiplaats, is a worth approximately $500 million on a DCF basis whilst Zaaiplaats, which takes life-of-mine to 2035 or beyond, could add a further $500 million in value, taking the potential total value to $1 billion. On this basis, by paying $300 million Harmony is getting the Moab assets at a 40% discount and potentially as much as a 70% discount.

However, to realise the Zaaiplaats potential would require at least $150 million, possibly $200 million, in development funding through to 2023. This would require a rights issue.

Should Harmony go this route, it could be very profitable. If I take a view through to 2035, that investment could generate free cash flow of around $1,5 billion over and above the $300 million paid for the Moab assets. Internal rates of return of 25% to 30% are realistic and the payback is five years or less.

If Zaaiplaats isn’t developed the picture is very different. Life of mine only extends to 2023. At best Harmony gets $150 million in free cash flow over and above the $300 million spent, a small increment in the larger scheme of things. And it gives an internal rate of return below the Harmony threshold of 15%.

My sense is that management have had Zaaiplaats in mind in securing this deal and so I’d give an odds-on chance of it going ahead.

If Harmony issues shares at the current share price of R26 it means 110 million new shares, taking total new shares to 550 million. If a rights issue was at a 20% discount to spot, or R21 per share, that implies 135 million new shares, taking the new total to 575 million.

Assuming Harmony makes R1,4 billion or 318 cents per share in earnings in F2019 then issuing share at today’s spot would dilute EPS temporarily by about 13,5%. Pro form earnings increase to R1,5 billion but on 550 million shares that is EPS of around 275 cents. If we assume a 20% discount to the current share price then pro forma EPS is 263 cents, a 17,3% dilution on the base assumption.

Recommendation:

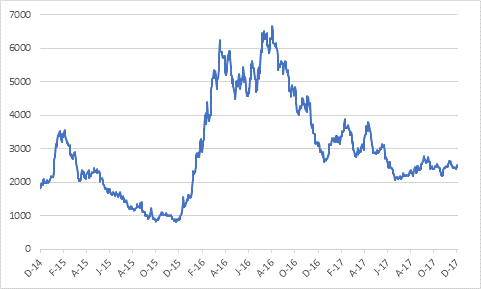

On a net present value DCF basis, I value Harmony at R41 per share, the most conservative measure. This is substantially higher than the current share price. All commodity stocks have had a volatile run, with Harmony raging between roughly R20 and R40 this past twelve months. The Moab deal does add a new level of uncertainty but there is also opportunity, dependent on what management decide with respect to developing Zaaiplaats.

Wishing you profitable investing, until next time.

Mark N Ingham

Read more fundamentals by Mark Ingham:

- Brait

- Sibanye

- Barclays

- Sun International

- Telkom

- Sasol

- Naspers

- Woolworths

- Attaq

- AngloGold Ashanti

- Massmart

- Bidvest

- SARB

- Glencore

- Shoprite

- Vodacom

- Pick n Pay

- FirstRand

- Taste

- Mediclinic

- Long4Life

- AVI