"Growth stock rating"

[JSE:DSY] Discovery

Sector: Life Insurance

Share price: R142.00

Net shares in issue: 646,8 million

Market cap: R91,8 billion

Embedded value per share: R88,83

Exit PE ratio: 19,3x

Forward PE ratio: 18,1x

Price to EV: 1,60x

Fair value: R140

Target price: R157

Trading Buy and Portfolio Buy

Discovery is evolving very well organically, growing strongly abroad, supported by a solid South African platform. These growth initiatives are detracting from earnings for now but this will change. The latest results underscore the degree to which the group strategy is paying off and Discovery is likely to continue outperforming its listed peers. However, the price is quite rich now, having accelerated by over 20% year to date, and I’d be cautious about chasing the stock at these levels.

Mark Ingham's Fundamental analysis

What you need to know:

Health and life insurer Discovery has reported a solid full year result with underlying earnings up by 8% to R4,7 billion and underlying EPS up by 7% to 722,2 cents. The final dividend of 98 cents makes the annual dividend 186 cents.

Whilst the percentage increase in earnings may seem relatively modest at face value, Discovery nonetheless is a growth stock and we should see increasing leverage in this regard as developing businesses begin to contribute to the group result. Over five years, profit from operations has doubled.

Recent initiatives include expansion of the business model into banking, the Chinese business Ping An Health, development of VitalityHealth in the UK, and the John Hancock and Manulife partnerships in North America. In 2015, Discovery had an underwritten renounceable R5 billion rights issue, the purpose of which, inter alia, was for growth in Vitality Life and DiscoveryCard.

Ping An Health in China is playing its part to grow the health insurance industry in China. New business is growing exponentially, up 80% for the year, with new annualised premium income up 103% in Chinese yuan.

Developing and emerging businesses detracted from earnings to the extent of R747 million. What is encouraging is that emerging business losses fell by 61% and at this rate will soon be making a positive contribution.

Whilst investment in growth and new lines of business has a depressive effect on earnings in the short term, underlying profitability remains robust and the strategy clearly defined. Potential regulatory risks around healthcare are a limiting factor but I reiterate that I don’t see this as a reason to avoid the stock.

Embedded value is R57,3 billion which on a per share basis is 8883 cents, growth of 8%. From an actuarial point of view, the concept of embedded value is key to understanding how underlying present value of business on the books is derived. Typically, embed value is higher than net asset value, an accounting calculation. NAV is R32,3 billion so EV is 77% more than NAV.

Discovery attracts a premium rating, arguably for good reason. The current share price of R142,00 is a 60% premium to EV, higher than a year ago.

Sanlam, at R68,65 per share, trades at a 25% premium to EV. MMI, at a share price of R19,18, trades at a 27% discount to EV.

The divergence in valuation metrics does not necessarily make Discovery or Sanlam a poor buy in relation to MMI.

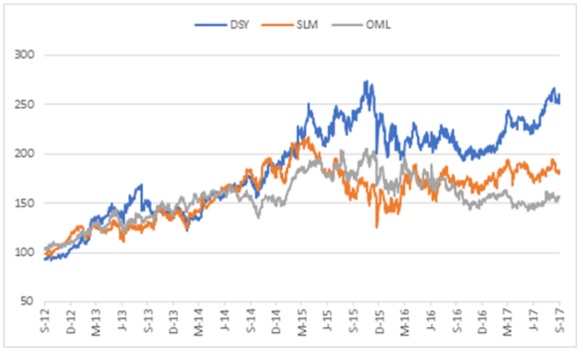

Discovery, Sanlam, and Old Mutual based to 100 over five years

The established businesses within Discovery have the capacity to grow at a nominal rate of around 10% whilst emerging businesses should be able to grow profitability at 30% or more for some years. The Group overall is capable of 15% nominal profit growth, well ahead of its peers.

Discovery is on a rolling exit price earnings multiple of 19,3x and a forward price earnings ratio of 18,1x based on my current estimates.

I’ve maintained a cautious stance on all interest rate sensitive stocks, not least because of unpredictable political risks and the impact that has on bond pricing and thus present values of stocks. I’d be cautious on Discovery at this rich rating as the stock is up over 20% year to date.

As a growth stock, Discovery pays out much less in dividends than peers. The company has an annual cover ratio of 3,9x. The gross yield is currently 1,3% or 1,0% after dividend withholding tax.

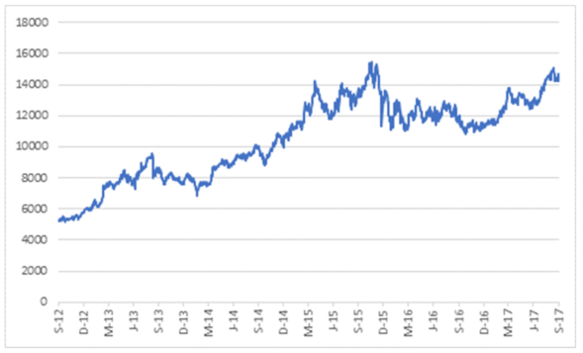

Discovery share price in ZA cents

Wishing you profitable investing, until next time.

Mark N Ingham

Read more fundamentals by Mark Ingham:

- Brait

- Sibanye

- Barclays

- Sun International

- Telkom

- Sasol

- Naspers

- Woolworths

- Attaq

- AngloGold Ashanti

- Massmart

- Bidvest

- SARB

- Glencore

- STAR