Mark Ingham's Fundamental analysis

Sasol [JSE:SOL] "Over a barrel of Brent"

Share price: R397,52

Net shares in issue: 610,7 million

Market cap: R242,8 billion

Forward PE F2017: 11,5x

Forward PE F2018: 13,9x

Forward dividend yield year one: 3,0%

Fair value and target price: maintained in the region of R400

Trading Buy and Portfolio Buy (sell rallies into strength)

What you need to know

Sasol reports results for the year ended 30 June 2017 on 21 August. Earnings will be right in line with my estimates whilst Q4 production figures, released last week, are encouraging.

Headline earnings per share (HEPS) will decrease by 16% at the mid-point of the range, which aligns with my forecast of a 16,2% decline to 3471 cents per share from 4140 cents. There will be differing component pieces that make up this number and we’ll have finer detail when the company reports.

Sasol paid an interim dividend of 480 cents, down 16% from the previous 570 cents. As I forecast a full year dividend of 1200 cents, down from 1480 cents, it implies a final dividend of 720 cents, which would be 21% lower than the 910 cents in 2016.

A 53% increase in EPS to 3299 cents from 2166 cents in F2017 is off a deflated base, brought about by prior year impairments relating to a low-density polyethylene unit in the United States and Sasol’s share in the Montney shale gas asset in Canada.

Included in earnings will be a translation loss of 253 cents due to the exchange rate being 6% stronger at R13,61 on average.

However, against that is a large mark-to-market gain on forex hedges of 205 cents.

A strike in the first half at Sasol Mining affected production, meaning higher external coal purchases. This negatively affects HEPS by 106 cents.

HEPS is also negatively affected to the extent of 200 cents by litigation and rehabilitation provisions.

There is a partial impairment on the North American GTL project of R1,7 billion but there is a reversal of a partial impairment of the Lake Charles Chemicals Project of R0,8 billion due to a lower discount rate and the extension of the life of the project to 50 years. These items don’t impact headline earnings.

There is a 1% increase in production out of Sasol Synfuels, which is at a record production level. Counter to this is lower production at the Natref refinery due to a shutdown and an incident in May. White product sales volumes are down 2%.

Base Chemicals is up 4,7% but this increase was mostly in H1 as sales are down around 10% for H2 because of a fire and an unplanned shutdown in polypropylene and PVC.

Performance Chemical volumes are up and feedstock costs are down, which means a boost to gross margin.

The Oryx GTL utilisation rate improved sharply to 95%.

The production report also shows cumulative capex on Lake Charles at $7,5 billion with completion at 74%.

The average Sasol oil price for the twelve months ended 30 June 2017 will be approximately $50/bbl with the currency in the region of $13,80/$.

The real question is F2018. I still believe the consensus earnings estimates are too bullish, with the Bloomberg consensus, for example, at just below 3600 cents. My EPS number for F2018 is 2858 cents, down 18% on my F2017 estimate of 3471 cents. My F2018 EPS estimate is 20% below Bloomberg consensus. I also have the annual dividend falling 17% to 1000 cents from 1200 cents.

Net debt will likely peak at around R100 billion in 2019 and interest expense will rise sharply, which will dilute EPS. Sasol has capitalised interest, which lowers actual interest reflected on the P&L. Cash outflow on interest paid is higher than reflected on the P&L. There will be a sharp rise in interest through the P&L in F2019.

Most of the forecasts captured on Bloomberg reflect a “house” view of investment banks’ strategists on exchange rates or oil. This means forecasts can be behind the curve.

Sasol remains sensitive to oil and currency although earnings will start to be assisted by Lake Charles from F2021 onwards.

A $1/bbl move in the annual average crude oil price in F2017 compared with F2016 would affect EPS by almost R1 per share whilst a 10 cent move up or down in the annual average rand/ dollar exchange rate would have a roughly 70 cents per share effect on earnings.

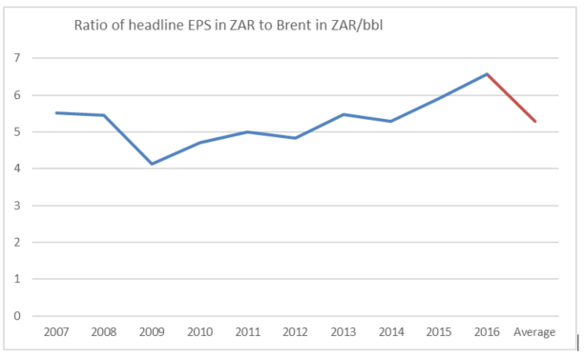

There has been a close relationship between the ZAR price of a barrel of Brent oil and Sasol earnings for many years – roughly a 5x multiple. Even over a shorter period, such as 2007 through 2016, the 5 to 1 relationship holds (see graph below).

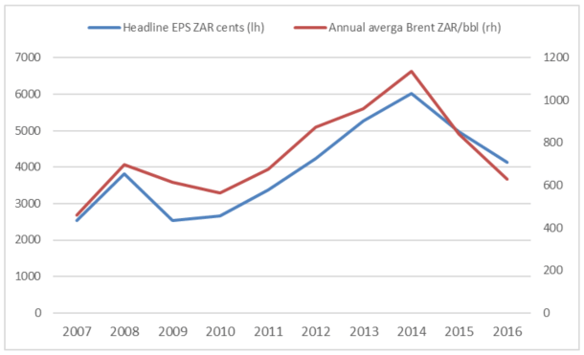

Earnings trend in line with the ups and downs in oil (see graph below).

Recommendation

I hold to the view of selling rallies in to strength. The stock is too cheap at levels closer to R350 on current earnings variables. Fair value and target price maintained in the region of R400 on longer run considerations.

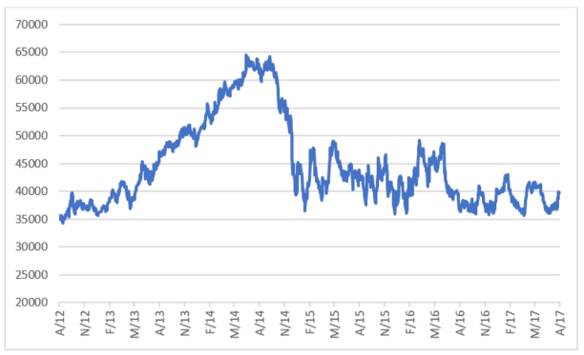

Sasol share price ZAR cents

Wishing you profitable investing, until next time.

Mark N Ingham

Read more fundamentals by Mark Ingham:

- Brait

- Sibanye

- Barclays

- Sun International

- Telkom

- Sasol

- Naspers

- Woolworths

- Attaq

- AngloGold Ashanti

- Massmart

- Bidvest