European Indices advance along with U.S Futures Wednesday morning as traders look beyond the renewed U.S-China tensions and focus on the easing of lockdown measures. The Asian market struggled this morning after protests flared up in Hong Kong over new national security laws proposed by the Chinese.

In this note you will find the technical analysis from our market analyst, Barry Dumas:

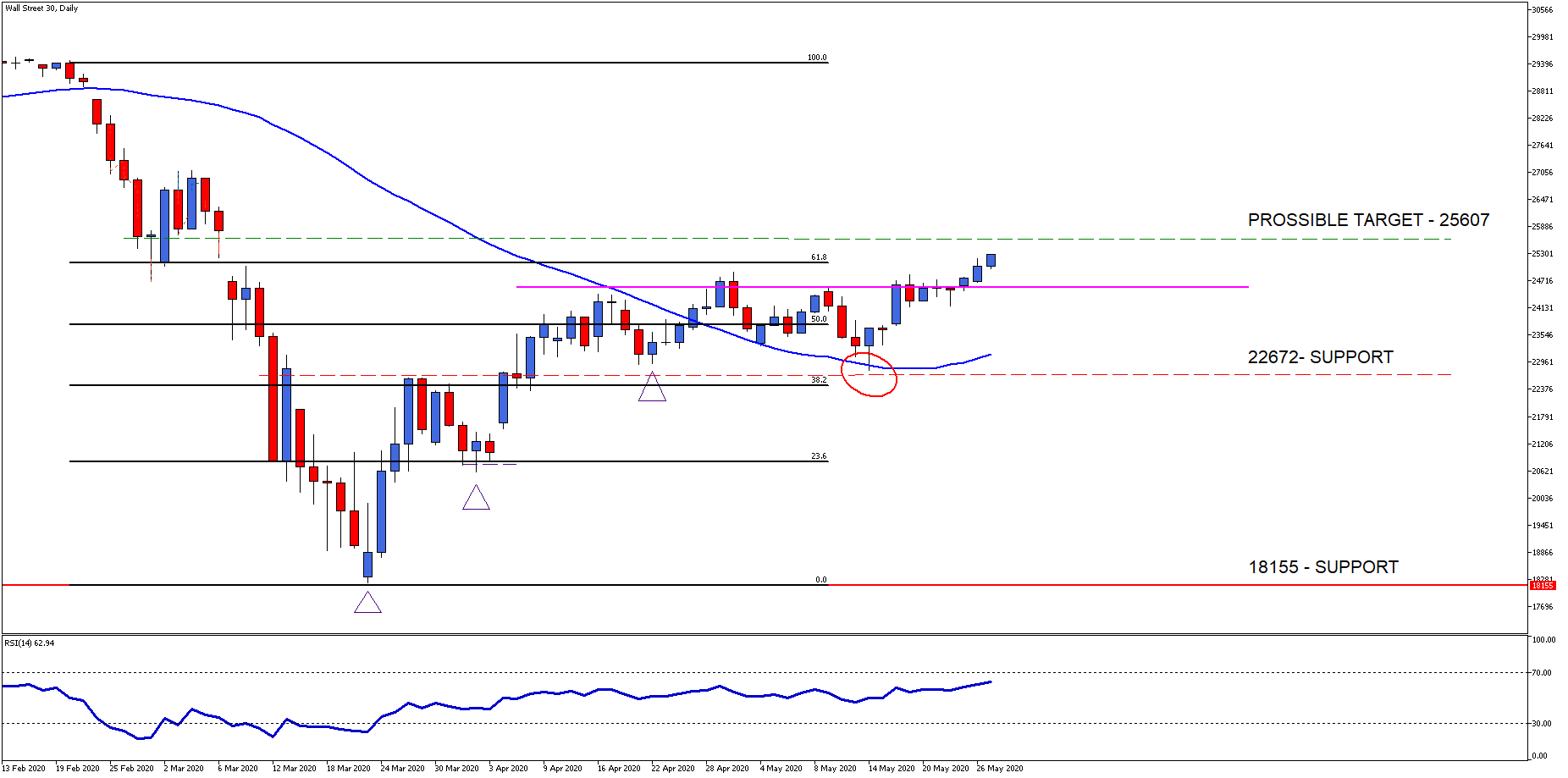

The Wall Street 30 Technical Analysis

The Wall Street 30 Index has closed above our 24545 – resistance level (pink line) on Monday and is advancing towards our possible target price of 25607 which was mentioned in our previous note.

The 61.8 Fib level becomes our next focal point as a close above this level is required to support a positive outlook on the price action. If upward momentum falters, then these levels will be looked to as new support levels of interest.

Technical points to look out for on the Daily Wall Street 30:

- The Wall Street 30 price action has broken out of the 24545 resistance (pink line) and is trending higher as of this morning.

- The 50-day SMA (blue line) is currently below the price action acting as support and is also pointing higher supporting the higher move now.

- The Relative Strength Index (RSI) is above the 50 mark and approaching the overbought levels at 70.

- The 61.8 Fib level should also be watched as price action needs to close above the golden ratio to support the move higher.

Chart Source: Wall Street 30 Daily Timeframe GT247 MT5 Trading Platform

Take note: that the outlook and levels might change as this outlook is released before the current days (Wednesday 27th of May 2020) U.S Market open.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.