The vaccine rally which started the week of to a flying start has started to falter on Wednesday, which saw the Asian Pacific session lower. This came after a press report dented hopes for a COVID-19 vaccine anytime soon which reignited fear about the global pandemic.

Safe havens were in high on the pecking order after the news broke which saw the demand for Gold increase and drove the U.S. Treasury yields back under 0.7%. European Futures were lower by 0.3% while the S&P 500 Futures were slightly higher at 0.6% on Wednesday morning.

In this note you will find the technical analysis from our market analyst, Barry Dumas:

The Wall Street 30 Technical Analysis

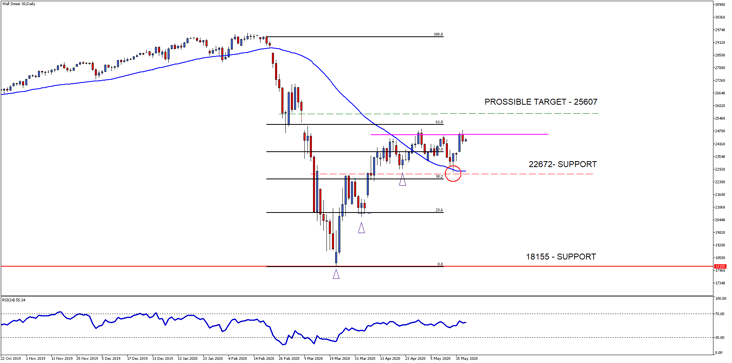

The price action of the Wall Street 30 Index is at a tipping point and consolidating sideways between two very important support and resistance levels as mentioned in our NFP note.

The 24545 – resistance level (pink line) nestled just under the 61.8 Fib level should be watched for a breakout to the upside. The 22672 – support level has been tested once already and is a level of interest now, as a break of support would see the market roll over and move lower significantly.

Technical points to look out for on the Daily Wall Street 30:

- The price action on the Wall Street 30 is trending in a sideways consolidation.

- The Relative Strength Index (RSI) is moving higher and is above the 50 level which needs to hold to support a move higher.

- The 61.8 Fib level should also be taken note of as the golden ratio is acting as major resistance to the price action.

- The 50-day SMA (blue line) is currently below the price action acting as support which could support the move higher if resistance levels do not hold.

Chart Source: Wall Street 30 Daily Timeframe GT247 MT5 Trading Platform

Take note: that the outlook and levels might change as this outlook is released before the current days (Wednesday 20th of May 2020) U.S Market open.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.