The World Economic Forum (WEF) held in Davos has kicked off with a bang, market fears followed by a selloff in the U.S markets were renewed as trade tensions flared up.

The Wall Street 30 relinquished over 350 index points at one stage as pessimism of a resolution between the U.S and China’s trade war might not come to an end any time soon. The S&P experienced its second worst day of 2019 down over 1.5%.

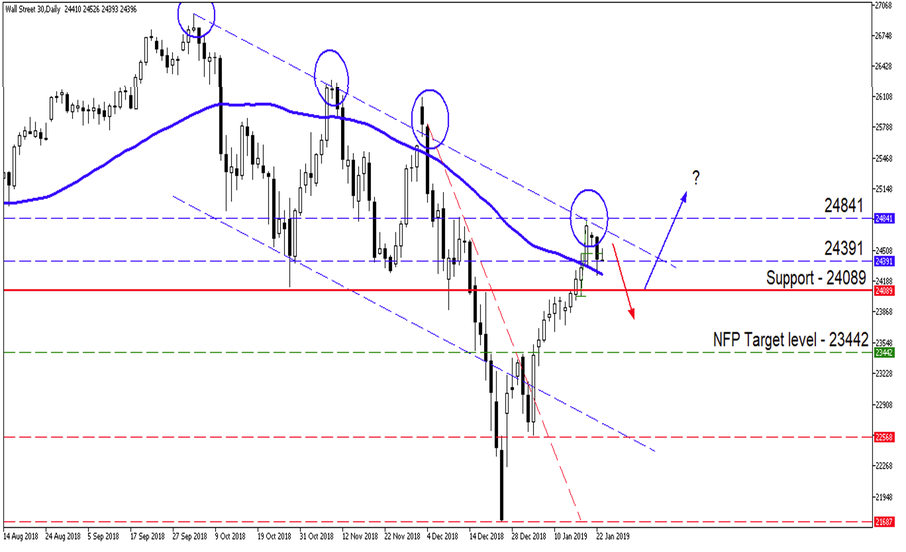

Wall Street 30

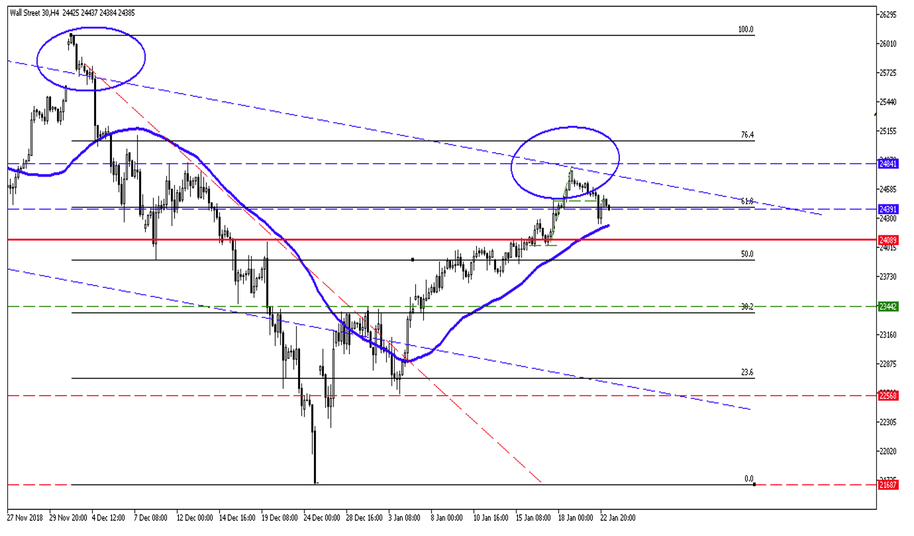

- The price action of the Dow has pushed past the 4 Hour charts 61.8 Fib target point from our previous Wall Street Wednesday note. The price reversed from the descending channel and might see more downside in the short term, depending on positive news from Davos which might just see the price move higher.

Looking at the Daily chart of Wall Street 30 we can see that price moved higher through 24089 (previous resistance) which will act as the new support level to watch. If the support level at 24089 does not hold then we might see the price action move lower down to 23442 (Previous NFP Target Level). There is also a good chance that we see the price action breaks out of the channel to a target level of 24841.

Source – MetaTrader5

The 4Hour chart of the Wall Street 30 might shed some light on a possible short-term target lower from current levels. The price is back at the 61.8 Fibonacci retracement level of 24089 which might act as support for a rebound. Take note that the price action might encounter some support at the 50-day Simple Moving Average (Blue line) if the Fib level does not hold.

Source – MetaTrader5

Image Source: Wolf of Wall Street

Remember that trading puts your capital at risk. Always trade cautiously and never above your means.

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.