As the European markets digest the Brexit situation it seems that the U.S market is just pushing higher despite the government shutdown. The after effect of the Government Shutdown should not be taken lightly as the economic growth being lost is piling up.

Market factors

- Government Shutdown: the shutdown is currently in its fourth week and some analysts are already saying that this could push the U.S economy into a contraction.

- Earnings season is in full swing and should be interesting to see how the Trade dispute between the U.S and China affected company earnings.

- Retail Sales (MoM) (Dec): the retail sales numbers will be released later this afternoon at 15:30 SAST and is expected to remain unchanged.

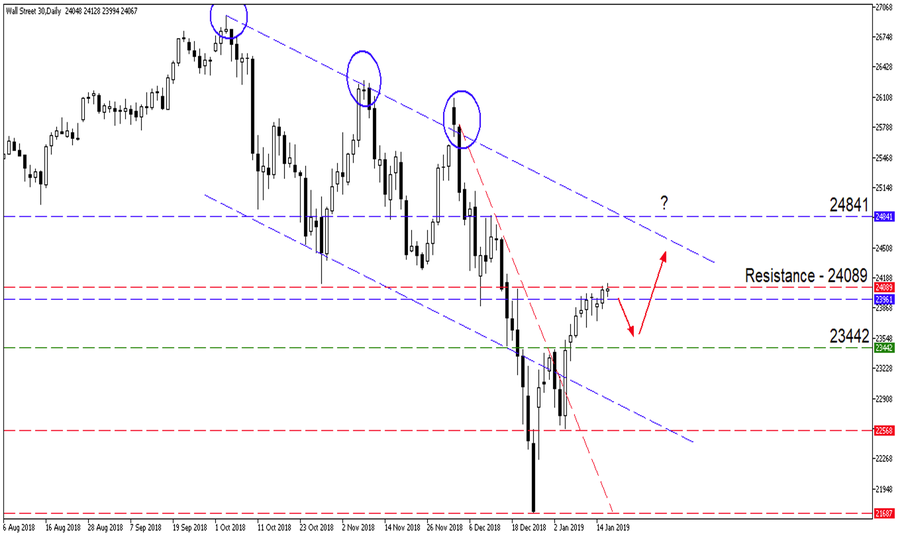

The price action of the Dow has finally arrived at our resistance line of 24089 as discussed in our Wall Street Wednesday note from last week.

Looking at the Daily chart we can see that we might expect a short-term selloff from the resistance line back lower to the 23442-price level. If the resistance does not hold then we might see the price action move higher to 24841, but this might not be realistic in the short term.

Source – MetaTrader5

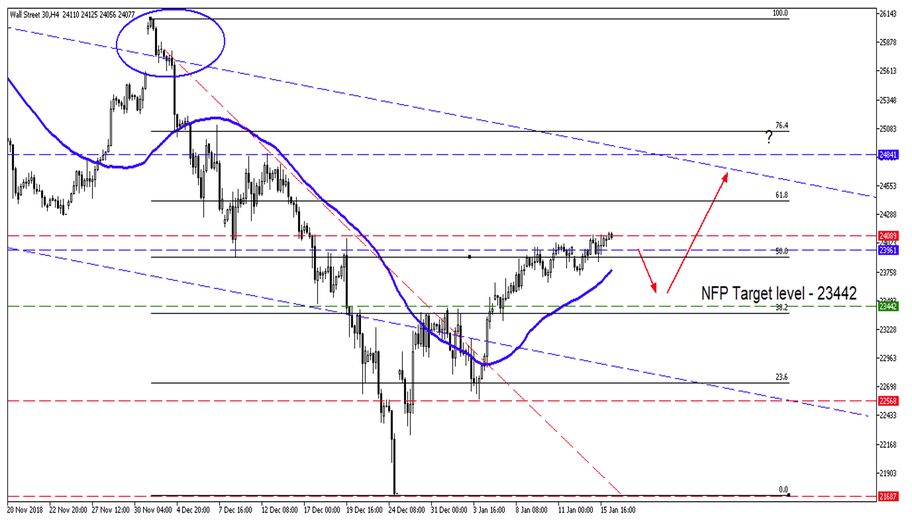

Taking a closer look at the 4 Hour Chart we can see the price action pushed higher from the NFP number release. The price action is trading above the 50-day simple moving average (SMA) (Blue line). The 4 Hourchart might give us a better target point to aim for if the resistance at 24089 does not hold. The first target point if the resistance does not hold might be the 61.8 Fibonacci Retracement level which coincides with the 24421-price level.

Source – MetaTrader5

Image Source: Wolf of Wall Street

Remember that trading puts your capital at risk. Always trade cautiously and never above your means.

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.