With a new President elect and positive vaccine news, U.S markets reached all-time highs with the Dow Jones reaching intraday record levels at the start of the week.

The news that Pfizer and partner BioNTech’s COVID-19 vaccine candidate was 90% effective in preventing infections saw the Dow Jones and S&P 500 gain nearly 4% and 1% respectively this week.

Asian equities held up in early Wednesday trade, despite tech stocks coming under pressure with Brent crude oil just below a two-month high. The U.S 10-year Treasury also saw gains, closing at levels last seen since March 2020.

The Wall Street 30 Technical Analysis

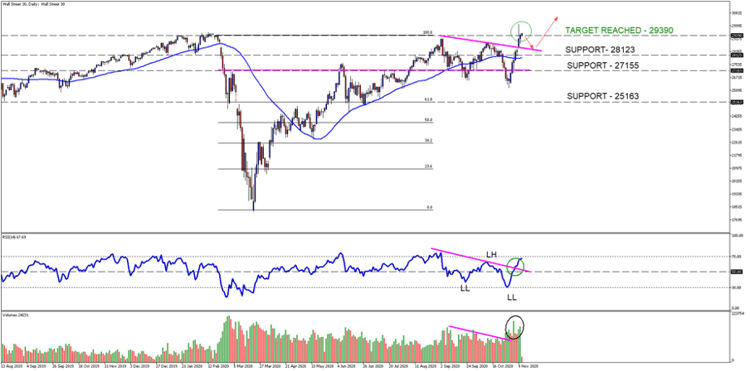

The Wall Street 30 (WS30) has reached our third profit target at the 29390 level after the price action regained the 28957-price level to negate the downtrend as mentioned last week.

We might expect a short term move lower as investors and traders take profits of the table before another move higher which brings the 28123-support level into focus. Best case scenario is the price actions continues higher. The price action has seen a 100% retracement from the February sell-off which supports the positive outlook.

- The WS30 needs to stay above the 29390-support level which could also act as support at some point and will be on our radar.

- The price action is well above the 50-day SMA (blue line) which supports a move higher.

- The Relative Strength Index (RSI) has negated the downtrend and is approaching overbought levels.

Chart Source: Wall Street 30 Daily Timeframe - GT247 MT5 Trading Platform

Take note: The outlook and levels might change as this outlook is released before the current days (Wednesday the 11th of November 2020) U.S Market open.

Sources – MetaTrader5, Reuters

Barry Dumas | Market Analyst at GT247.com

Barry has 12 years experience in the financial markets. He enjoys educating clients on trading / investing and providing punchy technical analysis on securities. He currently holds a Wealth Management qualification and is studying towards becoming a Chartered Market Technician® (CMT) designation holder.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.