Global markets are rising with optimism after peace talks between Russia and the Ukraine seem realistic as investors await the U.S. Federal Reserve (Fed) interest rate decision later today.

Asian markets rebounded slightly on Wednesday after a day of selling due to rising COVID-19 infections across China and fading expectations of an interest rate cut by policy makers.

Volatile oil prices are still a focal point ahead of the U.S Fed which is widely expected to raise rates for the first time in three years. The Federal Open Market Committee (FOMC) interest rate decision will be released today at 20:00 SAST followed by the FOMC press conference at 21:31 SAST.

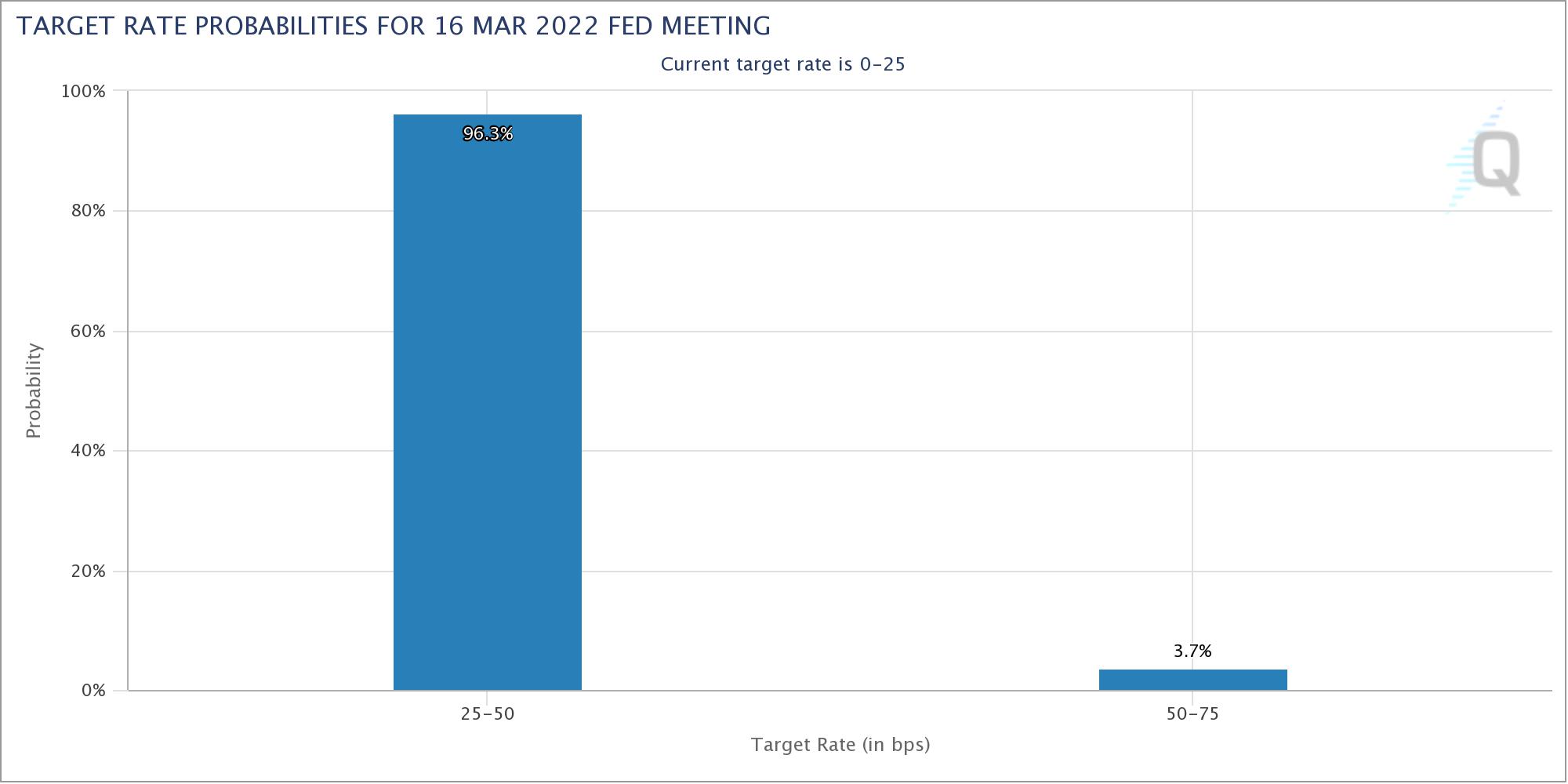

Looking at the CME Fed Watch Tool below we can see that a 25-basis point rate hike is almost guaranteed today with a 93.3% probability. Although market participants are expecting the hike, they, all eyes will be focussed on the press conference for guidance on future tightening.

Here is what’s expected this week:

The Wall Street 30 Technical Analysis

The price action on the Wall Street 30 (WS30) could not cross the major 34110 resistance level on the 4H chart as discussed in our previous WS30 note. This level of resistance to price is still a key level to watch and might be targeted again today as participants await the FOMC rate decision.

If the bulls take control today supported by positive geopolitical and fundamental news and the major resistance level at 34110 is crossed, then we might expect the 34692 level to be targeted.

The price action is starting to slightly trend higher on the smaller timeframes and is supported by the 50-day simple moving average (blue line) which is below price and pointing higher. The Relative Strength Index (RSI) has crossed the halfway mark and is also pushing higher to overbought levels.

![Wall Street 30H4[82]](https://blog.gt247.com/hs-fs/hubfs/Wall%20Street%2030H4%5B82%5D.png?width=751&name=Wall%20Street%2030H4%5B82%5D.png)

Current State / Chart Source: Wall Street 4H Timeframe - GT247 MT5 Trading Platform

Trading Term of the day:

Federal Open Market Committee (FOMC)

The Federal Open Market Committee (FOMC) is the branch of the Federal Reserve System (FRS) that determines the direction of monetary policy specifically by directing open market operations (OMOs). The committee is made up of 12 members: the seven members of the Board of Governors; the president of the Federal Reserve Bank of New York; and four of the remaining 11 Reserve Bank presidents on a rotating basis. – Investopedia

Take note: The outlook and levels might change as this outlook is released during the current days (Wednesday the 16th of March 2022) U.S Market open.

Sources – MetaTrader5, Reuters, Andrew Galbraith, CME Group, Investing.com, Investopedia.

Barry Dumas | Market Analyst at GT247.com

Barry has 12 years of experience in the financial markets. He enjoys educating clients on trading / investing and providing punchy technical analysis on securities. He currently holds a Wealth Management qualification and is studying towards becoming a Chartered Market Technician® (CMT) designation holder.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third-party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.