Global markets have been on a downward spiral as uncertainty around the Russia/ Ukraine situation intensifies while Western countries impose sanctions trying to avert a possible third world war.

The flight to safe havens waned on Wednesday as Western countries announced plans on Tuesday to target Russian banks while Germany halted a major gas pipeline project from Russia.

Commodity prices remain at elevated levels with oil reaching a seven-year high point as the European benchmark gas index increased close to 7% as the sanctions were announced.

U.S Indices continued lower on Tuesday with the S&P 500 moving into correction territory from its January record peak but did see some uptake as President Biden leaves the door open to diplomacy.

Here is what’s expected this week:

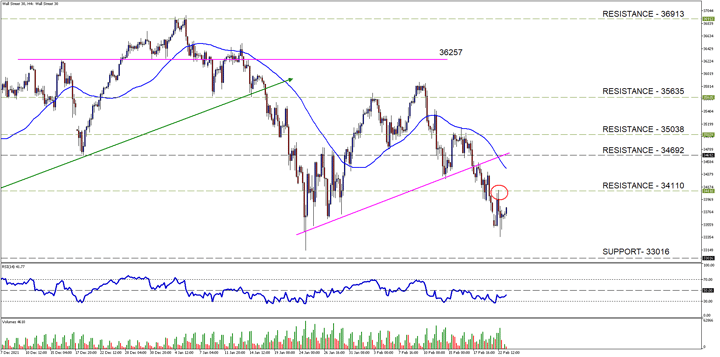

The Wall Street 30 Technical Analysis

The price action on the WS30 continued lower as pivotal resistance levels could not be cleared as mentioned in our previous Wall Street 30 (WS30) note. The short-term uptrend on the 4H chart was also broken as price moved lower over the last week.

We might expect more downside on the Wall Street 30 if the Russia/ Ukraine situation intensifies and the flight to safe havens continue. This would bring our 33016-suport level into focus for a lower possible target price for the bears. If these geopolitical events turn positive and optimism returns to the market, then we need to clear the major resistance levels overhead as shown on the chart.

Current State / Chart Source: Wall Street 4H Timeframe - GT247 MT5 Trading Platform

Trading Term of the day:

Trade Sanctions

Trade sanctions are laws passed to restrict or abolish trade with certain countries. Trade sanctions are a subcategory of economic sanctions, which are commercial and financial penalties imposed by one or more countries, and targeted against a country, organization, group, or individual. – Investopedia.

Take note: The outlook and levels might change as this outlook is released during the current days (Wednesday the 23rd of February 2022) U.S Market open.

Sources – MetaTrader5, Reuters, Tom Westbrook, Tom Balmforth, Polina Nikolskaya, Steve Holland, Investopedia.

Barry Dumas | Market Analyst at GT247.com

Barry has 12 years of experience in the financial markets. He enjoys educating clients on trading / investing and providing punchy technical analysis on securities. He currently holds a Wealth Management qualification and is studying towards becoming a Chartered Market Technician® (CMT) designation holder.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third-party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.