Asian markets were subdued in early Wednesday trade as market participants wait on the U.S Federal Reserve Bank (Fed)’s decision and outlook later today.

The focus will be on when the Fed will bring an end to its asset repurchase program and when the Federal Open Market Committee (FOMC) will start to raise interest rates. The FOMC interest rate decision will be released today at 21:00 SAST followed by Fed Chair Powell answering questions at the FOMC press conference at 21:31 SAST.

Although the Fed is widely expected to keep interest rates as they are later today, speculation has been running high as to timelines of rate increases as seen in a Bank of America (BofA) survey. The fund manager’s survey shows that at least two rate hikes are on the cards in 2022 and they see an end to the Fed’s tapering around April 2022.

Here is what’s expected this week:

The Wall Street 30 Technical Analysis

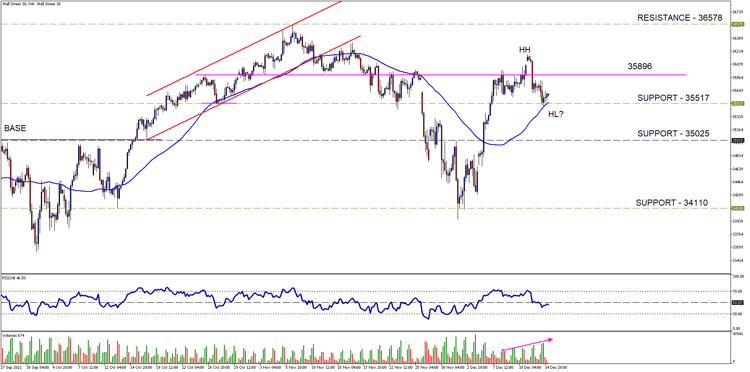

Movements on Wall Street are expected to be muted until the FOMC rate decision later today, which should be followed by elevated levels of volatility as the data is digested.

Many market participants speculate that the announcement is already priced in, which if true, will boast well for our technical levels to remain in place. The price action on the Wall Street 30 (WS30) is holding at the 35517-support level and attempting to make a higher low.

The 50-day SMA (blue line) is also acting as support to price but we still need a price above the 35896 level of interest as discussed in our previous WS30 note.

- Price is above our 35517-support level and attempting to make higher lows which could spark the much-anticipated Santa Clause rally.

- The 50-day SMA (blue line) is below the price action on the 4H chart and acting as support to a move higher.

- The Relative Strength Index (RSI) is below the neutral boundary and needs to push higher.

- Volume is also slowing in support of the price action and should be watched closely.

Current State / Chart Source: Wall Street 4H Timeframe - GT247 MT5 Trading Platform

Trading Term of the day:

Tapering

Tapering refers to policies that modify traditional central bank activities. Tapering efforts are primarily aimed at interest rates and at controlling investor perceptions of the future direction of interest rates. Tapering efforts may include changing the discount rate or reserve requirements.

Tapering may also involve the slowing of asset purchases, which, theoretically, leads to the reversal of quantitative easing (QE) policies implemented by a central bank. Tapering is instituted after QE policies have accomplished the desired effect of stimulating and stabilizing the economy. – Investopedia.

Take note: The outlook and levels might change as this outlook is released during the current days (Wednesday the 15th of December 2021) U.S Market open.

Sources – MetaTrader5, Reuters, Investing.com, Investopedia.

Barry Dumas | Market Analyst at GT247.com

Barry has 12 years of experience in the financial markets. He enjoys educating clients on trading / investing and providing punchy technical analysis on securities. He currently holds a Wealth Management qualification and is studying towards becoming a Chartered Market Technician® (CMT) designation holder.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third-party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.