Is this the start of the new Bull market? some say yes, but not without short term risk skewed to the downside while Covid-19 infections are rising.

Optimism has returned to the marketplace as Asian shares gain to record highs and U.S Indices rose off the back of continued vaccine news and efforts to introduce more fiscal stimulus.

The U.S fiscal stimulus injection negotiations are back in full swing which has seen increased levels of volatility across markets which is set to continue until an outcome is reached.

Then the Brexit negotiations seem to reach no resolution with both sides acknowledging a deal may not be achieved and this while Britain became the first country to start vaccinations.

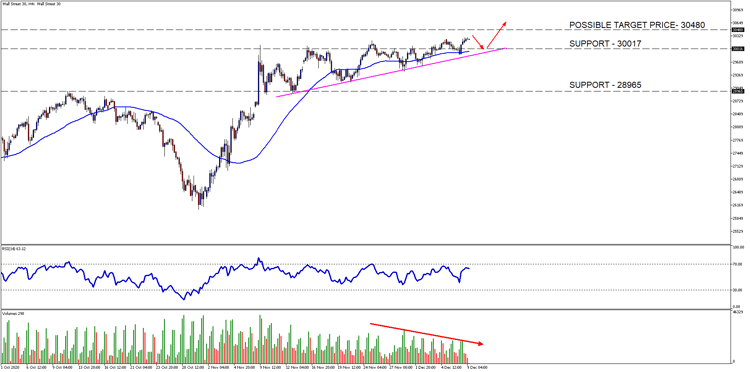

The Wall Street 30 Technical Analysis

Not even a lower than expected Jobs number could put a damper on investor optimism that the road to recovery has started despite rising infections. U.S markets are at all-time-highs and the Wall Street 30 is above our 30117-resistance level mentioned in our NFP note.

- The price action on the WS30 is in an uptrend on the 4H chart and above the 30117-support level which might be tested before another leg higher.

- The 50-day SMA (blue line) might also act as support if price moves lower.

- The Relative Strength Index (RSI) has moved higher to the overbought level.

- Volume is still moving lower supporting a bull run but could also signal a price action move is coming, which could be in either direction.

Chart Source: Wall Street 4H Timeframe - GT247 MT5 Trading Platform

The outlook and levels might change as this outlook is released during the current days (Wednesday the 9th of December 2020) U.S Market open.

Sources – MetaTrader5, Reuters

Barry Dumas | Market Analyst at GT247.com

Barry has 12 years experience in the financial markets. He enjoys educating clients on trading / investing and providing punchy technical analysis on securities. He currently holds a Wealth Management qualification and is studying towards becoming a Chartered Market Technician® (CMT) designation holder.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.