Global markets are alive with optimism after U.S markets reach all-time highs on hopes of additional economic stimulus set to be around $1.4 trillion. U.S Health officials are also planning coronavirus vaccinations in mid-December after regulatory approval.

The United Kingdom has also become the first country in the world to approve the Pfizer-BioNTech vaccine for use as early as next week. “Pfizer and BioNTech said their vaccine could be launched in the European Union as early as this month, though a European regulator clouded the schedule when it said it would complete its review of their vaccine by Dec. 29.” - Reuters

The Non-Farm Payrolls (NFP)

The U.S jobs market will be firmly in the spotlight this week to see if payrolls and jobless claims continue its current trajectory as the pandemic picks up once again.

Jobs number:

The number of new Non-Farm jobs for November is expected to come in a significantly lower than the previous reading for October of 638K.

- U.S Non-Farm Payrolls data is expected to remain in positive territory at 481K employed for the month of November 2020.

Hourly earnings:

The Average hourly earnings (M/M) data is expected to remain at 0.1% while the Average hourly earnings (Y/Y) for November is expected to see a slight decline to 4.3% from the previous months number at 4.5%

U.S. Unemployment Rate:

The U.S. Unemployment Rate measures the percentage of the total workforce that is unemployed and actively seeking employment during the previous month.

- The U.S. Unemployment Rate is watched closely for signs of economic recovery and is expected to show a slight decrease to 6.8% from the previous reading.

Why is the jobs number important?

The Non-Farm Payrolls report (NFP) is treated as an economic indicator for people employed during the previous month, and the number being released will have a direct impact on the markets. In the United States, consumer spending accounts for most of the economic activity, and the Non-Farm Payrolls report represents 80% of the U.S. workforce. Farmers are excluded from the employment figures due to the seasonality in farm jobs.

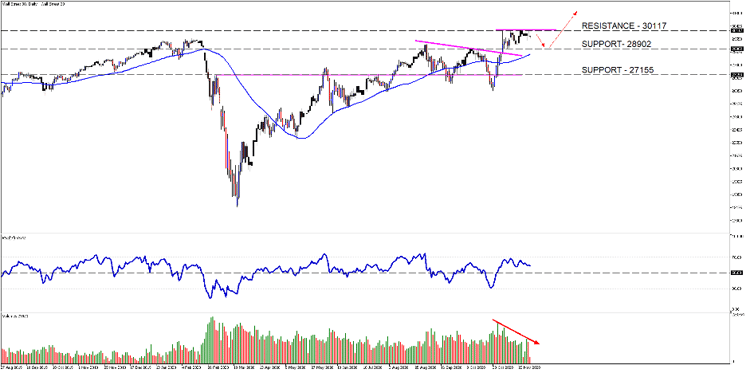

The Wall Street 30 Technical Analysis

We might continue to see some profit taking after the record month we saw for U.S markets during the month of November 2020. The price action on the Wall Street 30 is still below our 30117-resistance level mentioned in our previous note and might roll-over to the 28902-support.

Fundamentals and economic news like stimulus will affect the price action which brings into focus the current levels of interest, especially our 30117-resistance level. Price needs to close above this level to support our bullish outlook.

- The price action on the WS30 needs to close above the 30117-resistance level and preferably re-test the level to support another leg higher.

- The 50-day SMA (blue line) is well below price and pointing higher and below price which supports the continued move higher.

- The Relative Strength Index (RSI) is moving lower towards the 50 level which might start to signal divergence in price.

- Volume is still moving lower that could signal a price action move is coming, which could be in either direction.

Chart Source: Wall Street 30 Daily Timeframe - GT247 MT5 Trading Platform

Take note: The outlook and levels might change as this outlook is released during the current days (Wednesday the 2nd of December 2020) U.S Market open.

Sources – MetaTrader5, Reuters

Barry Dumas | Market Analyst at GT247.com

Barry has 12 years experience in the financial markets. He enjoys educating clients on trading / investing and providing punchy technical analysis on securities. He currently holds a Wealth Management qualification and is studying towards becoming a Chartered Market Technician® (CMT) designation holder.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.