U.S. Non-Farm Payrolls being released Friday at 14:30

Read: What is a Non-Farm Payroll and how does this affect your trading?

Friday is jobs day in the U.S.—with the Non-Farm Payrolls being released at 14:30 in South Africa. The results will set the trading tone for next week.

Economists are looking for job growth of 180,000 on the heels of an unexpected 222,000 increase in June. Average hourly earnings are expected to accelerate +0.3% m/m to an annual pace of 2.6 percent, while the unemployment rate decreases to 4.3%.

US markets are at record highs with the S&P 500 and Dow Jones reaching increased resistance at these high levels.

What happened last time:

- June non-farm payrolls: 222K vs. 175K expected

- May non-farm payrolls: upgraded from 138K to 152K (+14K)

- April non-farm payrolls: downgraded from 211K to 174K (-37K)

- May average hourly earnings growth m/m: 0.2% as expected

- May average hourly earnings annual growth: 2.5% (same as previous)

- April average hourly earnings growth m/m: downgraded from 0.3% to 0.2%

- Jobless rate: 4.4% vs. 4.3% expected, 4.4% previous

- Labour force participation rate: ticked higher from 62.7.0% to 62.8% (increasing participation)

The June NFP report printed an upside surprise (222K vs 175K expected) and so the US dollar strengthened as a result.

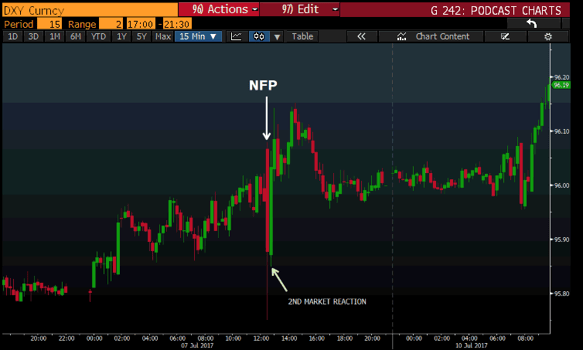

Taking a look at the 'dollar index' (the U.S. dollar against a basket of major currencies) - we can see the violent reaction to the data on the 15 minute chart. The dollar crashes for several minutes following the release of the economic numbers....then miraculously recovers all the losses and heads higher!

In the lead-up to the June data, we noted that the leading indicators were expecting jobs to meet target due to an increase in jobs growth readings from private jobs data.

The readings for May and April were reviser higher to show that the U.S economy generated 47K more jobs than originally recorded. (I don't know how they keep getting this wrong).

The jobless rate deteriorated from 4.3% to 4.4% it was offset by the labour force participation rate increasing from 62.7% to 62.8%. this put an end to two months of falling participation, which inidcates that the U.S. economy had expanded enough to encourage more Americans to join the labour force.

so a massive outperformance in jobs number should have shot the dollar into the sky right?...

unfortunatelly the entire move was capped by disappointing wage growth - with hourly earnings only increasing by 0.2% month-on-month (below the 0.3% expected)

To summarise; the NFP report for June painted a strong picture as growth in jobs exceeded expectations, added to this, the previous reading was upgraded. The jobless rate decreased while the labour force participation rate increased.

initially bears pushed the market lower by trying to pre-empt the move before the data was released, combined with bears who shorted the market on the back of less than expected wage growth.

Once the market digested the news that previous numbers had been revised higher, the dollar continued its upward trajectory and reversed the initial negative 'knee-jerk' reaction.

What can we expect this time?

- Non-farm payrolls: 180K expected vs. 222K previous

- Jobless rate: 4.3% expected vs. 4.4% previous

- Average hourly earnings m/m: +0.3% expected vs. +0.2% previous

The consensus is that the U.S created 180k non-farm jobs during July – this is an obvious decrease on the 222k created in June. There is concensus that job creation slowed in July - as the market nears closer and closer to full employment.

The United States appears to be hitting peak employment – it’s going to be harder every month to bring down unemployment because it is already low.

The basics of what to look for

An upside surprise form NFP may cause the U.S. dollar to rally. Alternatively, the dollar might slip on weaker NFP results.

A NFP that exceeds expectations, combined with higher hourly earnings would give the US Federal Reserve a good reason to increase interest rates more aggressively for inflation targeting purposes.

The expectations of higher interest rates could see the greenback firm against other major currencies – keep an eye on USD/JPY, EUR/USD and GBP/USD.

The S&P 500 has broken record highs, an increase in interest rates is a bad sign for equity investments – why would you want to hold riskier equity when you can get a decent return on a risk-free fixed income investment? A strong NFP result may then trigger a consolidation in the S&P 500 further.

A look at USDJPY

Currently the USD is trading around ¥110.00

A strong NFP result, whereby jobs generated exceeds 180k and the hourly earnings rate increases +0.3% could result in the dollar strengthening, near ¥112 per dollar.

If numbers miss estimates, the dollar could weaken to ¥108.50

- Be ready to short the USD if the numbers are weak

What is the Non-Farm Payroll?

The NFP report is treated as a key economic indicator for the United States. The NFP is considered the most comprehensive employment number released – as it represents 80% of the U.S workforce.

NonFarm Payrolls are reported on the first Friday of the month, whereby the number of additional jobs added from the previous month is released. The report contains valuable insights into the labour force that have a direct impact on the stock market, the value of the U.S. dollar and the price of gold.

The reason why farmers are excluded from employment figures is due to the seasonality in farm jobs.

The Strategy:

There are multiple ways of trading the NFP report; there are 3 basic strategies to be aware of:

- Traders who take a position early, before the data is announced, in anticipation for the directional movement the event will cause.

- Traders who take a position as the data is announced, hoping to scalp a quick profit off the volatility created by the data, be it negative or positive.

- Traders may wait for the market to digest the significance of the results, and after the initial swings have occurred, take a position on the side of the dominant momentum.

Trading Products Affected:

The NFP report affects major currency pairs as well as U.S. market index futures. Traders should take note of:

- GBPUSD

- JPYUSD

- EURUSD

- MEXICAN PESO

- S&P500 Index

- Wall Street Index

- Gold

- VIX