With U.S earning season in full swing and with the weeks positive PMI numbers across the globe, market participants are full of hope ahead of the Payrolls report this Friday the 7th of August 2020. Some concerns that the U.S and Latin America have become the epicentres of the coronavirus pandemic have seen investors rush to buy gold, sending the precious metal to new all-time highs.

In this note we take a look at the US economic data and Wall Street 30 technical setups.

FOMC - Federal Open Market Committee

Last week’s interest rate decision saw the Federal Open Market Committee (FOMC) leave rates unchanged as expected following sharp declines in economic activity. The FED expressed its commitment to its bond purchases along with its liquidity programs. “We are committed to using our full range of tools to support our economy in this challenging environment,” - Jerome Powell.

The Federal Reserve will also be completing a yearlong policy review which is set to be delivered in September 2020 while it plans to ramp up inflation by not raising rates until CPI hits 2%.

Events leading up to the U.S. Non-Farm Payrolls (NFP) release on Friday the 7th of August 2020:

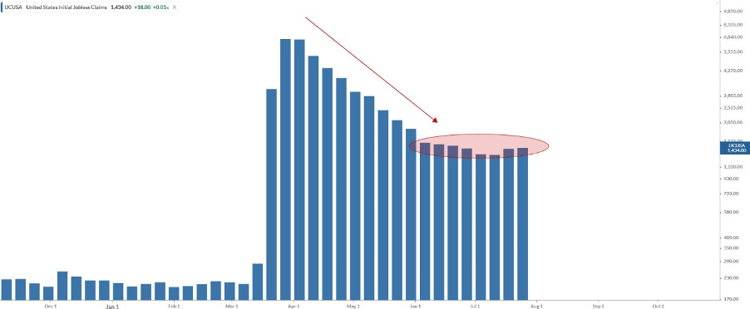

U.S Jobless claims

The initial jobless claims have piqued interest once again as it appears that jobless numbers are starting to remain around the 1.4 million and not moving lower as the pandemic picks up again.

This week the jobless data is expected to show initial jobless claims around 1.408 million and should be released on Thursday around 14:30 SAST.

Chart - Weekly U.S jobless claims

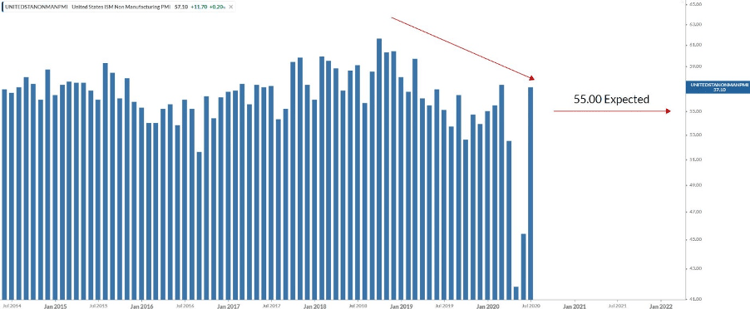

US ISM Non-Manufacturing Purchasing Managers Index (PMI)

Economic growth comes back into focus as ISM Manufacturing PMI data impressed and beat expectations on Monday. Market participants will look to the ISM Non-Manufacturing PMI data later today around 16:00 SAST. The number is expected to come in at 55 which is still above the 50 mark.

The ISM Non-Manufacturing PMI report is a composite index that reports on business and measures Business Activity, New Orders, Employment and Supplier Deliveries. The index is also used as an indicator to judge how well the economy is performing. A reading above the 50 indicates that the Non-Manufacturing sector is expanding while a reading below 50 indicates a contraction.

Chart - The ISM Non-Manufacturing PMI

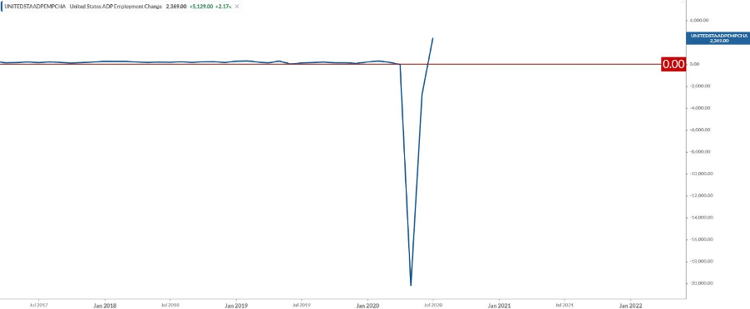

U.S. ADP Non-Farm Employment Change

The ADP Non-farm Employment Change is expected to come in lower than the previous month at around 1.5 million employment and the data is expected today the 5th of August 2020 at 14:15 SAST.

The U.S. ADP Non-farm Employment Change is an excellent predictor of the Non-Farm Payrolls report as the ADP Non-Farm Employment Change measures the monthly change in non-farm, private employment. The U.S. ADP Non-farm Employment Change is released two days ahead of the NFP jobs number.

Chart - The U.S. ADP Non-farm Employment Change

Non-Farm Payrolls (NFP) outlook

The expectations for another impressive jobs number this time around might be farfetched while the coronavirus pandemic reached new infection levels. This week’s jobs number will be watched closely to give analysts any indication as to whether the U.S economy is starting to stabilize or setting up for another rough ride.

Jobs number:

The number of new Non-Farm jobs for July is expected to be much lower than the previous reading but luckily remain in positive territory. The U.S. Non-Farm Payrolls number is expected to come in at 1.6 million from the previous month's surprise of 4.8 million Non-Farm jobs.

Hourly earnings:

The Average hourly earnings (M/M) number is expected to go remain negative at -0.5% from the previous months -1.2%. The Average hourly earnings (Y/Y) for July is expected to decrease to 4.2%.

U.S. Unemployment Rate:

The U.S. Unemployment Rate measures the percentage of the total workforce that is unemployed and actively seeking employment during the previous month. The U.S. Unemployment Rate is expected to show a slight decrease from the previous reading to 10.5%.

Why is the jobs number important?

The Non-Farm Payrolls report (NFP) is treated as an economic indicator for people employed during the previous month, and the number being released will have a direct impact on the markets. In the United States, consumer spending accounts for most of the economic activity, and the Non-Farm Payrolls report represents 80% of the U.S. workforce. Farmers are excluded from the employment figures due to the seasonality in farm jobs.

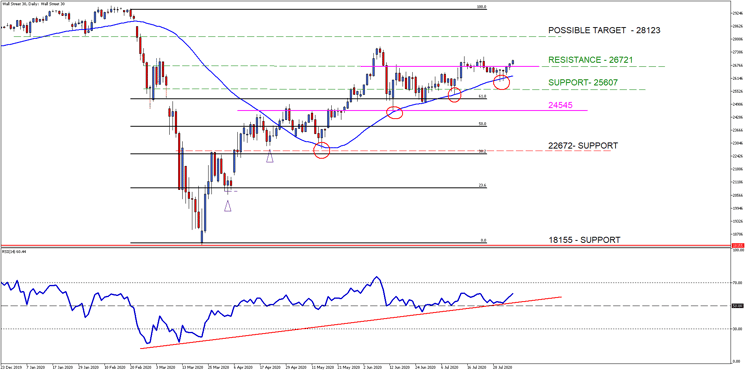

Technical Analysis outlook on U.S. Indices for the U.S Non-Farm Payrolls (NFP)

Wall Street 30

-

New optimism reign supreme as the next round of monetary policy stimulus draws near which has seen U.S markets push higher overnight. The Nasdaq has reached new all-time highs with the S&P 500 and the Wall Street 30 lagging the tech driven index.

Our Wall Street 30 Technical Analysis outlook from last week mentioned that price needs to stay above the 50-day SMA to support a move higher. The SMA did indeed hold up as support which saw prices move higher and settle above our 26721 point of interest (pink line).

Any positive news around the next stimulus package will drive markets higher but the telling factor this week might be the jobs report itself which is expected to disappoint.

Technical points to look out for on the Daily Wall Street 30:

- Price needs to stay above the 26721 level of interest which is currently actin as support to another leg higher to the 28123 possible next target level.

- The 50-day SMA (blue line) is still pointing higher supporting the higher price move.

- The Relative Strength Index (RSI) remained above the 50 level and seems to be pushing towards the overbought level.

Charting done on Metatrader5 GT247.com - WallStreet30 Daily

Take note: The outlook and levels might change as this outlook is released during the current days (Wednesday the 5th of August 2020) U.S Market open.

What to trade internationally:

- Major indices to look at will be the S&P 500, Wall Street 30, Nasdaq 100

- Major Forex pairs to look at will be EUR/USD, GBP/USD and USD/JPY

- Commodity to look at will be Gold.

What to trade locally:

- Index to look at will be the ALSI

- Forex pair to look at will be the USD/ZAR

- Rand Hedges (BTI, CFR) and Rand Sensitives (Banks and Insurers)

There are many ways to trade the Non-Farm Payroll (NFP) report, and here are a few strategies traders look at:

- The Early birds: traders who will take an early position before the jobs number is released in anticipation that the directional movement the event will cause will be in their favour.

- The Scalpers: as the data is released, these traders will scalp and try and capitalize on the volatility that is created by the data, positively or negatively.

- The calm and calculated: as the market digest the results of the Non-Farm Payroll (NFP) report and after the volatility swings have occurred, these traders will take a position on the momentum of the market.

When and what time is the US NFP (Non-Farm Payroll) announced in South Africa?

Non-Farm Payrolls are usually reported on the first Friday of the month, whereby the number of additional jobs added from the previous month is released. The US Non-Farm Payroll number will be released locally on Friday the 7th of August 2020 at 14:30 SAST.

Sources – CNBC, Reuters, MetaTrader5, Koyfin

Barry Dumas | Market Analyst at GT247.com

Barry has 12 years experience in the financial markets. He enjoys educating clients on trading / investing and providing punchy technical analysis on securities. He currently holds a Wealth Management qualification and is studying towards becoming a Chartered Market Technician® (CMT) designation holder.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice. Past performance is not necessarily an indication of future performance. The value of a financial product is not guaranteed. The value of a financial product can go down or up due to various market factors. The graphs are for illustrative purposes only.