Non-Farm Payrolls are usually reported on the first Friday of the month, whereby the number of additional jobs added from the previous month is released. The US Non-Farm Payroll number for the month of April will be released locally on Friday the 3rd of May 2019 at 14:30 SAST.

What happened previously?

The Non-Farm Payrolls number came in much higher than expected at 196K Non-Farm jobs against the 175K Non-Farm jobs forecast. The NFP number was also much lower than the ADP Non-farm Employment Change number.

The Average hourly earnings (M/M) did not beat expectations coming in lower at 0.1% over the expected 0.3% and the U.S Unemployment rate came in as expected at 3.8%.

Events leading up to the Jobs report on Friday are:

U.S ADP Non-Farm Employment change

The U.S. ADP Non-farm Employment Change is a very good predictor of the Non-Farm Payrolls report as the ADP Non-Farm Employment Change measures the monthly change in non-farm, private employment.

- The U.S. ADP Nonfarm Employment Change is released two days ahead of the NFP jobs number. The ADP number was released on Wednesday at 14:15 SAST.

The change in private employment overwhelmed market estimates and came in at 275K from the expected forecast number of 181K for the month of April 2019. All eyes will look to the comprehensive Non-Farm Payrolls report (NFP), especially wage growth numbers.

FOMC Interest Rate Decision

The Federal Reserve has spoken, and the markets reacted on Wednesday with the latest interest rate announcement which saw the interest rate unchanged. Markets came tumbling down as the FED chair Powell stated it is not a forgone conclusion that the FED will only cut rates this year. There is a possible increase in rates on the table if the data supports it.

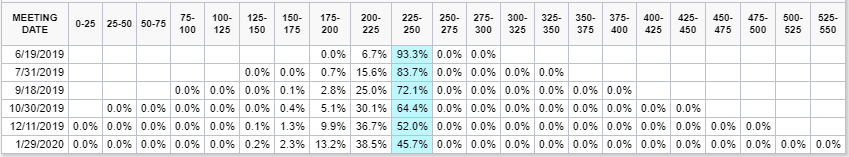

By looking at the CME Group’s FED watch tool we can see that the probability of a rate increase is not on the table and the odds are rates will remain unchanged until later in the year.

Source – CME Group

Why is the jobs number important?

The Non-Farm Payrolls report (NFP) is treated as an economic indicator for people employed during the previous month and the number being released will have a direct impact on the markets. In the United States consumer spending accounts for most of the economic activity and the Non-Farm Payrolls report represents 80% of the U.S workforce. Farmers are excluded from the employment figures due to the seasonality in farm jobs.

What is forecast this time?

The FOMC will be watching the Jobs numbers closely especially the wage numbers which might change the FED’s outlook moving forward. The U.S Economy has seen economic activity rise along with a strong labour market, but the personal income wage growth number released on Monday was much lower that expected. Wage growth comes into focus once more as the FED’s inflation growth target is subdued now which might lead to a rate cut if the CPI number does not increase.

Jobs number:

The number of new Non-Farm jobs are expected to decline to 185K from the previous months 196K Non-Farm jobs.

Hourly earnings:

The Average hourly earnings (M/M) number is expected to increase to 0.3% from the previous months 0.1% - This is a key figure to watch and if this number disappoints, it will signal a weak wage inflation outlook in the US.

- The Average hourly earnings will be watched closely once more as the wage growth rate has been subdued.

U.S. Unemployment Rate:

The U.S Unemployment Rate measures the percentage of the total work force that is unemployed and actively seeking employment during the previous month. The U.S. Unemployment Rate is expected to remain unchanged at 3.8% unemployed.

- This time around we might expect Analysts to start focussing on other factors in the Jobs market besides the actual NFP number and look to the Job participation rate which has been very low.

Forex Technical Analysis outlook for the U.S. Non-Farm Payrolls (NFP)

Looking at the chart of the Dollar Index (DXY)

The U.S Dollar has been gaining momentum since the FED statements on Wednesday that a rate hike is not necessarily of the table.

Some technical and fundamental points to look out for on the DXY:

- We have seen the DXY broke through the 97.70 resistance level, this level needs to hold as support going forward.

- 50-day Simple Moving Average is below the price action and supports a move higher.

- The Relative Strength Index (RSI) is also pointing higher away from the neutral 50 demarcation on the oscillator.

Source – Bloomberg

Technical Trade Outlook on the EURUSD

The EURUSD currency pair has started to move lower as was discussed in our Forex Technical Trade Note. The price action has continued to make lower highs and lower lows and is currently testing the 1.1207 support level.

Some technical and fundamental points to look out for:

- If the 1.1207 support level does not hold then we might see the price action move lower to the 1.1110 target level.

- The Relative Strength Index (RSI) is moving lower away from the 50-neutral level on the oscillator.

- The price action is trading well below the 50-day Simple Moving Average which supports the move lower.

Source – Bloomberg

Take note that the outlook and levels might change as this outlook is released before NFP and before the current days U.S Market open.

What to trade internationally:

Major indices to look at will be the S&P 500, Wall Street 30, Nasdaq 100

Major Forex pairs to look at will be EUR/USD, GBP/USD and USD/JPY

Commodity to look at will be Gold.

What to trade locally:

Index to look at will be the ALSI

Forex pair to look at will be the USD/ZAR

Rand Hedges (BTI, CFR) and Rand Sensitives (Banks and Insurers)

How to trade the Non-Farm Payroll (NFP) report: The Strategies

There are many ways to trade the Non-Farm Payroll (NFP) report and here are a few strategies traders look at:

- The Early birds: traders who will take an early position before the jobs number is released in anticipation that the directional movement the event will cause will be in their favour.

- The Scalpers: as the data is released these traders will scalp and try and capitalize on the volatility that is created by the data, positively or negatively.

- The calm and calculated: as the market digest the results of the Non-Farm Payroll (NFP) report and after the volatility swings have occurred these traders will take a position on the markets momentum.

When and what time is the US NFP (Non-Farm Payroll) announced in South Africa?

3rd of May 2019 at 14.30 SAST.

May your trading day be profitable!

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.