As we all know Interest rates are a hot topic when it comes to the Forex market and watched closely by market participants across the globe. On Wednesday we saw not only the FX market reacts to the FOMC interest rate decision but, the major indices as well.

The FOMC and Interest Rates

The Federal Reserve has spoken, and the markets reacted on Wednesday with the latest interest rate announcement which saw the interest rate unchanged. Markets came tumbling down as the FED chair Powell stated it is not a forgone conclusion that the FED will only cut rates this year. There is a possible increase in rates on the table if the data supports it.

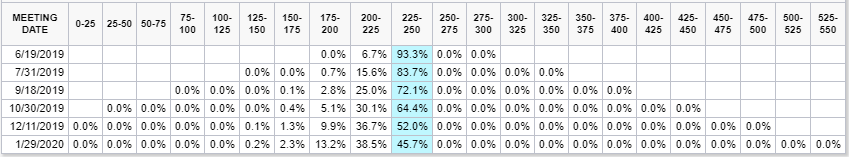

By looking at the CME Group’s FED watch tool we can see that the probability of a rate increase is not on the table and the odds are rates will remain unchanged until later in the year.

Source – CME Group

DXY

The FED stated that its labour market is growing and remains strong and that economic activity increased at a solid rate. These statements from the FED saw the U.S Dollar Index (DXY) surge with the news that an increase in rates is still possible if inflation starts to tick higher. The Dollar Index needs to clear the 97.70 level to0 support a move higher which would have the opposite effect on the EURUSD currency pair.

Source – Bloomberg

Let’s take a closer look at two major currency pairs:

EURUSD

The EURUSD currency pair has been in a downtrend since the start of the year which is confirmed by the lower highs and lower lows which can bee seen on the chart. This is mainly due to the U.S Dollar gaining strength over this period and if it continues there might be more downside for the EURUSD.

Some technical points to look out for on the EURUSD:

- If the price action moves lower from the 1.1207 support level due to Dollar (USD) strength, then we might see the 1.1110 level come into focus as a possible target level.

- The 50-Day Simple moving average (blue line) is above the price action which supports a move lower.

- The Relative Strength Index (RSI) is neutral at this stage just below the 50 level and is pointing to the lower end of the oscillator.

Source – Bloomberg

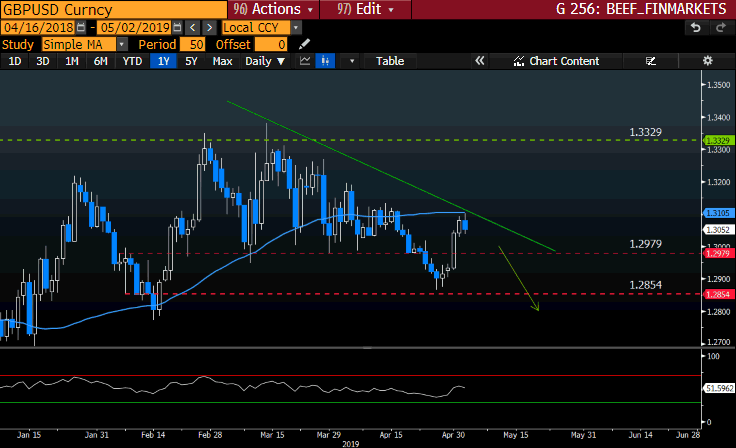

GBPUSD

The British Pound (GBP) has seen some strength filter through from recent positive growth numbers from the Eurozone but it remains to be seen if it can continue. Looking at the bigger picture we might expect to see the currency pair move lower in the near term. The price action needs to move higher and close above the 1.3105 level to negate the move lower.

Take note that later today at 13:00 SAST we are expecting the Bank of England (BoE) Interest Rate decision which is widely expected to remain unchanged at 0.75%.

Some technical points to look out for on the GBPUSD:

- The price action has cleared the 1.2979 resistance level which might act as support in the short term.

- The 50-day Simple Moving Average (blue line) is acting as resistance and price is below the SMA which might support a move lower, but trade with caution.

- If the 1.2979 support level does not hold, we might see a move lower to the 1.2854 level which might be a future target level.

- The Relative Strength Index (RSI) is neutral at this stage at 51.59.

Source – Bloomberg

Economic event to look out for today while trading Forex:

- Bank of England (BoE) Interest Rate decision at 13:00 SAST.

- Bank of England (BoE) Inflation Report at 13:00 SAST.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.