Non-Farm Payrolls are usually reported on the first Friday of the month, whereby the number of additional jobs added from the previous month is released. The US Non-Farm Payroll number for the month of July will be released locally on Friday the 2nd of August 2019 at 14:30 SAST.

Why is the jobs number important?

The Non-Farm Payrolls report (NFP) is treated as an economic indicator for people employed during the previous month, and the number being released will have a direct impact on the markets. In the United States, consumer spending accounts for most of the economic activity, and the Non-Farm Payrolls report represents 80% of the .U.S. workforce. Farmers are excluded from the employment figures due to the seasonality in farm jobs.

What happened previously?

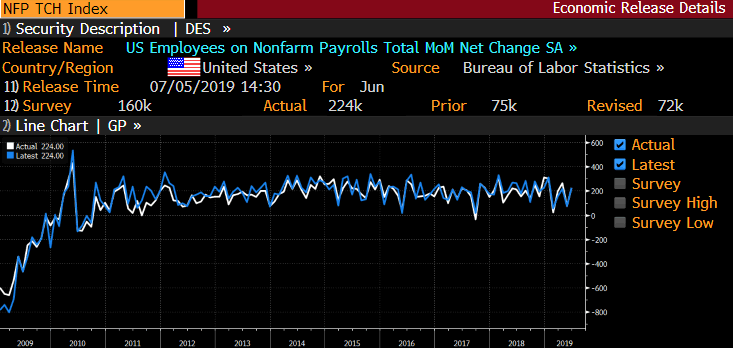

- The Non-Farm Payrolls number surprised and gained 224K Non-Farm jobs against the 164K Non-Farm jobs expected by forecasters.

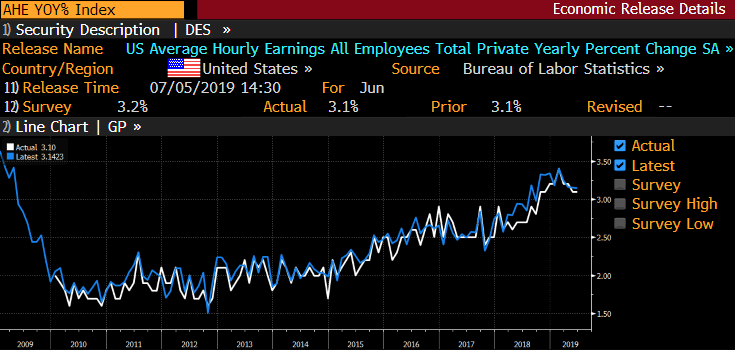

- The Average hourly earnings (M/M) did not beat expectations coming in lower at 0.2% over the expected 0.3%

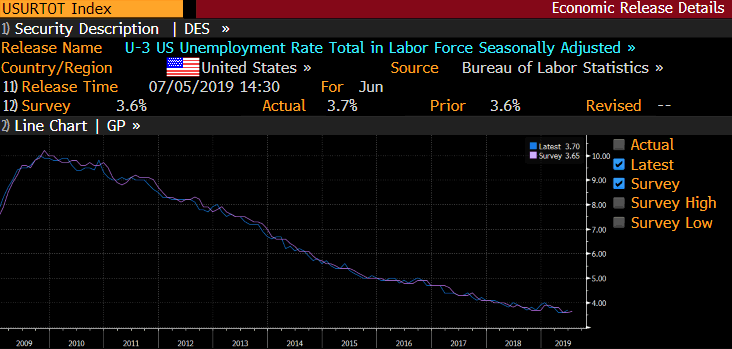

- U.S. Unemployment rate came in slightly higher than expected at 3.7%.

Events leading up to the Jobs report on Friday are:

U.S. ADP Non-Farm Employment change

The U.S. ADP Non-farm Employment Change is an excellent predictor of the Non-Farm Payrolls report as the ADP Non-Farm Employment Change measures the monthly change in non-farm, private employment.

The U.S. ADP Non-farm Employment Change is released two days ahead of the NFP jobs number. The ADP number was released on Wednesday at 14:15 SAST.

The change in private employment surprised and came in slightly higher at 156K from the expected forecast number of 150K for July 2019. All eyes will look to the comprehensive Non-Farm Payrolls report (NFP), especially wage growth numbers.

What is forecast this time for the Non-Farm Payrolls (NFP)?

After the market sell-off from the FED's interest rate decision on Wednesday, which saw the S&P 500 lower by 1.8% at one stage, all eyes will be focused on the Jobs number this coming Friday. Inflation is still below the FED's target rate, so that means the next Jobs data will be of some significance.

The FED chair Powell hinting that this is not the start to a long interest rate easing cycle but also that future rate cuts are not entirely off the table. These statements drove the Dollar (USD) to highs last seen two years ago, which in turn saw the major indices turn lower. The Non-Farm Payrolls (NFP) number is expected to come in much lower than the previous month's number, which might see markets move even lower.

Jobs number:

The number of new Non-Farm jobs is expected to decrease to 169K from the previous month's stellar 224K Non-Farm jobs.

Source - Bloomberg

Source - Bloomberg

Hourly earnings:

The Average hourly earnings (M/M) number is expected to remain unchanged at 0.2% from the previous month. This is a key figure to watch and if this number disappoints, it will signal a weak wage inflation outlook in the US. Take note that the Average hourly earnings will be watched closely once more as the wage growth rate has been subdued.

The chart below indicates the Average hourly earnings (Y/Y) number which has increased over the last decade and is expected to increase to 3.2% from 3.1%.

Source - Bloomberg

Source - Bloomberg

U.S. Unemployment Rate:

The U.S Unemployment Rate measures the percentage of the total workforce that is unemployed and actively seeking employment during the previous month. The U.S. Unemployment Rate is expected to remain unchanged at 3.7% unemployed.

By looking at the chart below we can see that unemployment has gone down over the last decade and holding steady around current levels.

Source - Bloomberg

Source - Bloomberg

Technical Analysis outlook on U.S Indices for the U.S Non-Farm Payrolls (NFP)

S&P 500

The S&P 500 has seen a sell-off from the FED interest rate decision to cut interest rates by 25 basis points. The move lower which is not what one would expect from a rate cut has seen the S&P 500 move lower to the major support level of 2961. The S&P 500 closed lower on Wednesday by 1.1% as the market digested the information from the FED.

Technical points to look out for on the S&P 500:

- Divergence on the S&P 500 still noticeable on the Relative Strength Index (RSI) and will be watched closely.

- Price action has found technical support at the 2961 level which is currently holding up but a break from this level might target lower levels at 2909.

- Price is still above its 50-day Simple moving average (SMA) (Blue line) which supports the move higher now and might act as support soon.

Source - Bloomberg

Source - Bloomberg

Nasdaq 100

The FAANG stocks have been a clear winner this year but not even Apple’s surprise in earnings could curb the FED decision on Wednesday. The Nasdaq also moved lower but started to rebound much earlier than the other major Indices. Another leg lower today is not off the table and the major support levels will be watched closely.

Technical points to look out for on the NASDAQ 100

- The 50-day Simple Moving Average (SMA) (Blueline) is fast approaching the price action and might act as support.

- Divergence on the Nasdaq still noticeable on the Relative Strength Index (RSI) and will be watched closely.

Source - Bloomberg

Source - Bloomberg

Wall Street 30

The Wall Street 30 was down over 300 points after the rate decision and is currently holding above major support. The earnings season has also put a damper on the Dow as it has been lagging the other major U.S Indices by some margin.

Technical points to look out for on the Wall Street 30

- The 26687-support level will be watched closely as we expect more companies to release earnings today which might see the Dow move lower.

- The Relative Strength Index (RSI) is still moving lower to oversold level and we will be looking for a rebound to support a move higher in price.

- The 50-day Simple Moving Average (SMA) (Blueline) is also fast approaching the price action.

Source - Bloomberg

Source - Bloomberg

Take note that the outlook and levels might change as this outlook is released before NFP and before the current days U.S Market open.

What to trade internationally:

- Major indices to look at will be the S&P 500, Wall Street 30, Nasdaq 100

- Major Forex pairs to look at will be EUR/USD, GBP/USD and USD/JPY

- Commodity to look at will be Gold.

What to trade locally:

- Index to look at will be the ALSI

- Forex pair to look at will be the USD/ZAR

- Rand Hedges (BTI, CFR) and Rand Sensitives (Banks and Insurers)

How to trade the Non-Farm Payroll (NFP) report: The Strategies

There are many ways to trade the Non-Farm Payroll (NFP) report and here are a few strategies traders look at:

- The Early birds: traders who will take an early position before the jobs number is released in anticipation that the directional movement the event will cause will be in their favour.

- The Scalpers: as the data is released these traders will scalp and try and capitalize on the volatility that is created by the data, positively or negatively.

- The calm and calculated: as the market digest the results of the Non-Farm Payroll (NFP) report and after the volatility swings have occurred these traders will take a position on the markets momentum.

When and what time is the US NFP (Non-Farm Payroll) announced in South Africa?

2nd of August 2019 at 14.30 SAST.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.