Mixed signals from global markets have seen Indices push higher despite reports from the International Monetary Fund (IMF) on global economic slowdown concerns.

The U.S

Earnings season is of to a bang as some of the major investment banks have reported better than analysts expected which include J.P Morgan, Citibank. Goldman Sachs also reported better than expected earnings, but its top line did not impress sending the stock lower by 3.1%.

The Federal Reserve has come under fire again by President Donald Trump as he states the FED is not doing a proper job and that the stock market should be 5000 to 10000 points higher.

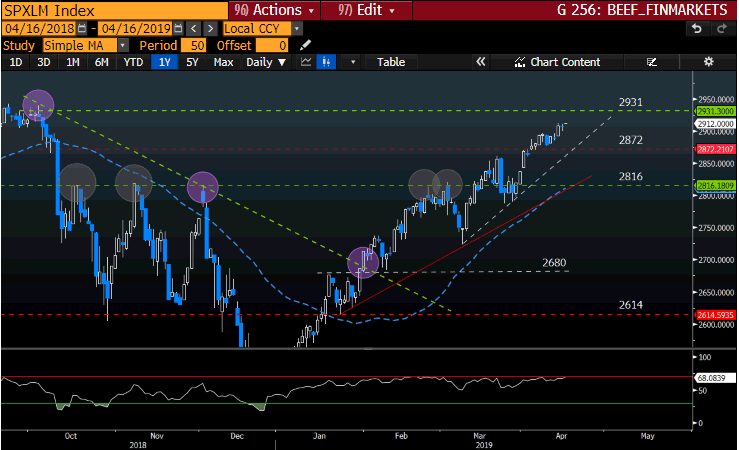

Looking at the chart of the S&P 500

The market expects the U.S-China trade negotiations will come to an agreement soon just as the next round of trade negotiations are set to start with Japan and the European Union. Better than expected earnings season might just give the S&P500 a much-needed lift to new highs.

Some technical points to look out for:

- The S&P 500 is pushing higher as per our previous S Index Technical Trade Note and in reach of the target price of 2931.

- The Index is still trading well above its major moving averages and above the 50-day Simple Moving Average (blue dotted).

- The Relative Strength Index (RSI) is still below the 70 which signals that the price action is not technically overbought

Source – Bloomberg

Germany

The Eurozone and its largest economy might be under pressure for some time to come as Trump has shifted his focus to the U.S-EU trade talks. The European Union has given the go ahead for talks to start before we see another trade dispute dragging on for months.

Francois Villeroy de Galhau, stated the European Central Bank (ECB) is committed to keep monetary policy loose until its inflation target is reached. “We are clearly determined to maintain an ample degree of monetary accommodation for as long as necessary to reach our target of inflation below but close to 2 percent,” - Francois Villeroy de Galhau

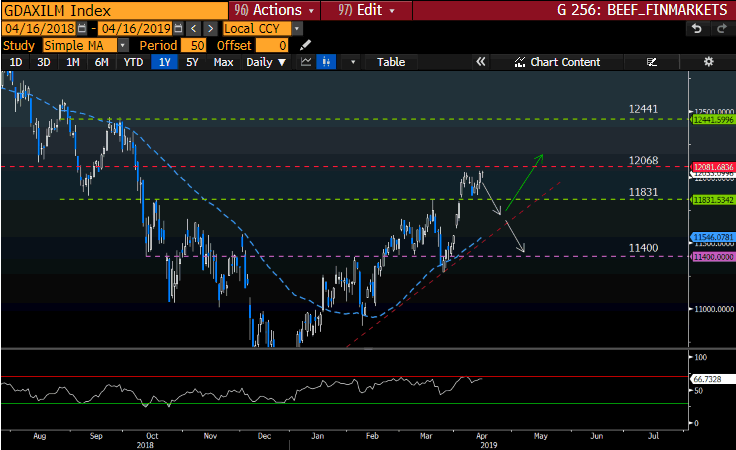

Looking at the chart of the Dax

The German Index has also gained some momentum along with the other major indices, but the price action is back at the 12068 Technical Resistance line.

Some technical points to look out for:

- The price action is still above the broader Head and Shoulders (H&S) technical pattern neckline at 11831. Price is currently re-testing this level and should be watched closely.

- Looking at the Relative Strength Index (RSI) we can see the price action is far from over bought levels but testing the 70 level on the indicator.

Source – Bloomberg

South Africa

Political tensions are heating up ahead of the local elections with just under a month to go with false hope and promises at the order. The economy will remain under immense pressure as statements from the Electricity Summit about the troubled power utility Eskom was that it is beyond saving.

Looking at the chart of the Alsi

Asian markets closed higher which might just push the Alsi higher on Tuesday but the Rand (ZAR) will be watched closely as it is above the R14.00 to the Dollar (USD) psychological mark once more.

Some technical points to look out for:

- The Index is above the technical support level of 52395 and might just push higher if it can remain above this technical level.

- The Index is still trading well above its major moving averages and above the 50-day Simple Moving Average (blue dotted).

- The Relative Strength Index (RSI) is at over bought levels so take care to inter the trade now at current levels.

Source – Bloomberg

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.