The World Economic Forum (WEF) is well underway and the markets have been reacting to news released from Davos. Commodities have been ticking lower over the last week as concerns of a global economic slowdown starts creeping in.

see our full report and charts in this note.

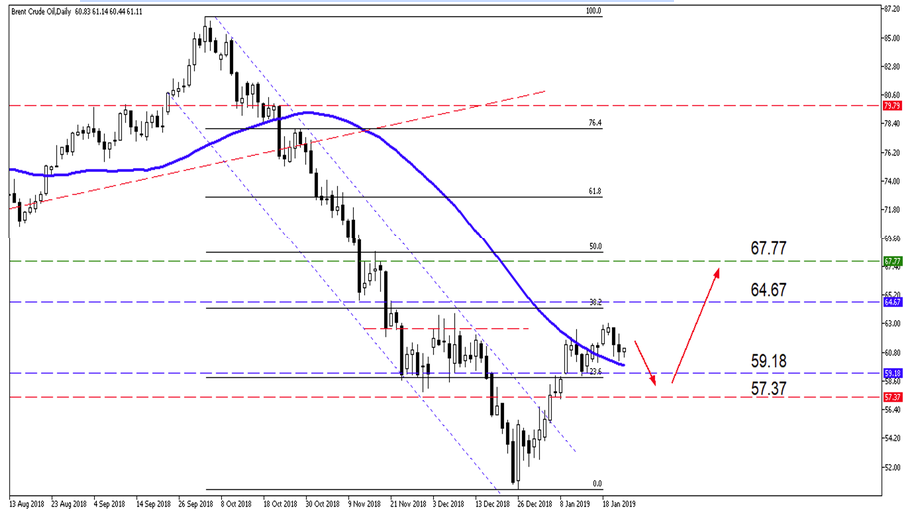

Brent Crude Oil

The outlook on Brent is pretty much the same as our last Commodity Report with a possibility that Oil might push higher to $64.67 per barrel. The Saudi Finance Minister, Mohammed Al-Jadaan live from Davos stated that they are committed and working towards a stable Oil market.

The slowing global economic growth concerns filtering through should be taken note of as it will have an impact on the demand for oil.

- Some technical aspects to take note of are that the price is trading above the 50-day Simple Moving Average (SMA) (blue line) once again. There is a possibility of an inverse head and shoulder pattern forming which would support the move higher.

Source – MetaTrader5

Gold

The precious metal is back at the $1276/oz support level and is showing signs of weakening in the short-term. If the support level does not hold, we might see the price action move lower to the $1266/ oz level. Price is well above the 50-day Simple Moving Average (SMA) (blue line) and the Relative Strength Index (RSI) neutral.

- There are a couple of technical levels coming into play on Gold, take note of the uptrend support line (solid red) which meets the 1276 support line. The price action might as well just rebound from these levels and move higher to $1297/ oz.

Source – MetaTrader5

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.