The commodity sector has certainly be a focal point for investors over the month of December 2018 and looking back at our last Commodity Report we were pretty spot on.

With Oil being the hot topic at the start of 2019 we have seen U.S Crude Oil and Brent Crude Oil gain over 3% on Wednesday. Oil is set for its longest consecutive day rally since 2017 and it seems that Brent Crude might be closing in on $64 per barrel soon.

- The optimism we have been seeing over the week has mainly to do with the Trade negotiations between the U.S and China and that a trade tensions would be resolved. Saudi Arabia, the world’s largest Oil exporter reported on Monday that it would cut Crude exports to 7.1 million barrels a day by month end.

see our full report and charts in this note.

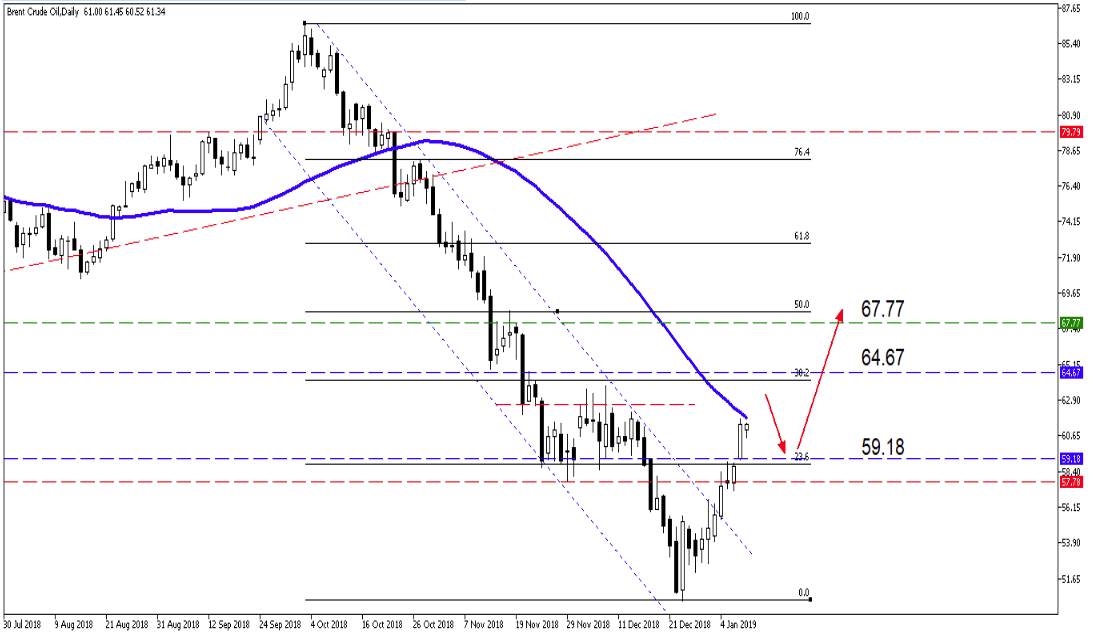

Brent Crude Oil

We can see that the price action finally broke out of the descending channel and is pushing higher to the $64.67 per barrel level. Take note that the 50-day Simple Moving Average (SMA) (blue line) might serve as some resistance. There might be a short-term pullback from the 30.0 Fibonacci retracement level before pushing higher.

Source – MetaTrader5

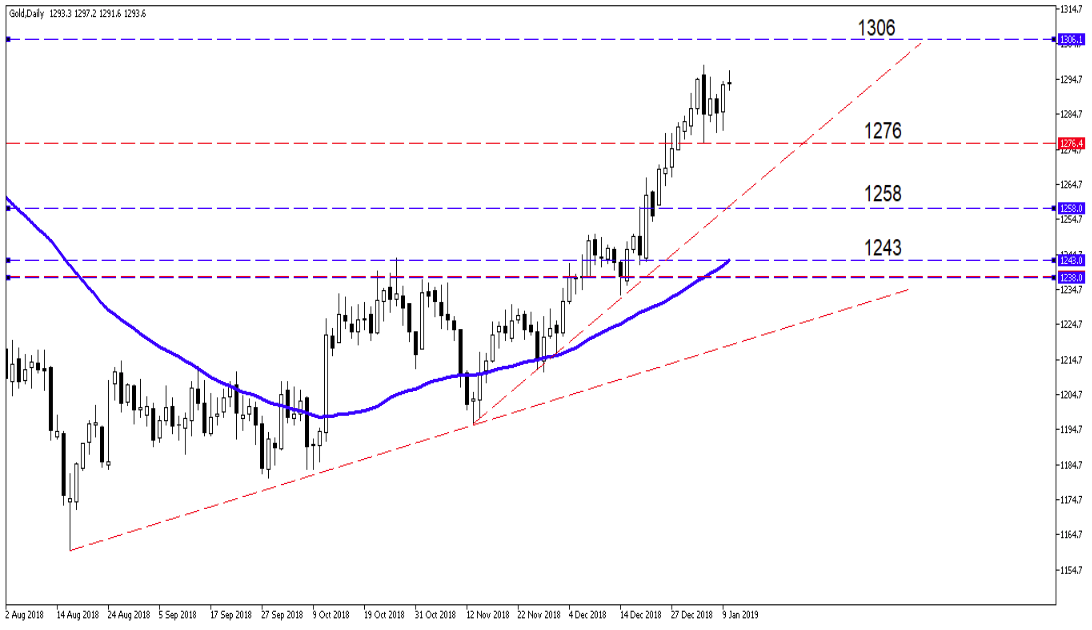

Gold

The precious metal has been pushing higher mainly off the back of international markets selling off over December as investors seek safe havens. When looking at the chart we can see that the price action seems to be consolidating a bit and finding support at the $1276/ ounce level. The price action might move lower in the short-term testing support once more before moving higher.

Source – MetaTrader5

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.