Commodities have been in focus over the last week as U.S jobs numbers disappoint, and a stronger Dollar (USD) comes into play on the precious metals.

Let’s take a closer look at some of the commodities:

Gold

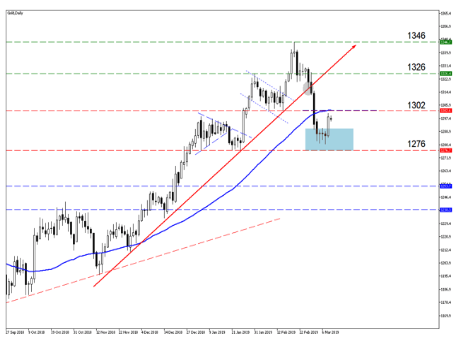

We have seen the precious metal under pressure over the last couple of weeks and moved lower as mentioned in the previous Commodity Report if the $1302/ oz level did not hold.

- Gold has been consolidating as seen in the chart below (blue block) and moved higher off the back of the jobs report last Friday.

- We need to see the price action close above the $1302/ oz price level as this level might act as resistance. We might see the price action move lower and consolidate above the $1276/ oz once more before we get some direction.

- The price action is also trading below it’s 50-day Simple Moving Average (SMA) (blue line) which supports a move lower at this stage.

Source – MetaTrader5

Brent Crude Oil

News broke on Sunday that Saudi oil minister Khalid al-Falih said it would be too early to change the Organization of the Petroleum Exporting Countries (OPEC)’s output policy at the group’s meeting in April and that China and the U.S. would lead healthy global demand for oil this year. – Reuters

The price of Oil rose today from these statements by the Saudi oil Minister as supply cuts are unlikely before June and reports showed a fall in U.S drilling activity (rig count).

- The price action has been consolidating between the $64,21/ barrel (support) and the $64.35/ barrel (resistance) price level.

- With the supply cuts to continue we might expect the price in oil to push higher from current levels. The price action still needs to cross the $64.35/ barrel level target price for the bulls to take control and push the price to $70/ barrel.

Source – MetaTrader5

Palladium

Palladium has moved lower from previous all-time highs and is currently consolidating above the $1500/ oz level which is acting as support. Dollar (USD) strength is starting to weigh on the precious metal sector but if Bank of America Merrill Lynch is anything to go by the Palladium market can still move higher.

Bank of America Merrill Lynch (BoAML) has revised their target higher by 22% as they see the precious metal averaging $1800/ oz.

- If the $1505/ oz which is acting as support does not hold, then we might expect the price to move lower to $1458/ oz in the short term.

- The price is still trading above its 50-day Simple Moving Average (SMA) (blue line) which still supports the move higher.

Source – MetaTrader5

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.