With the current global market uncertainty and with the U.S market selloff we have seen recently it is very clear that commodities might come back to life as investors seek safe havens.

Here is insight into what's happening with Gold, Silver and Brent Crude Oil accompanied by technical trading charts...

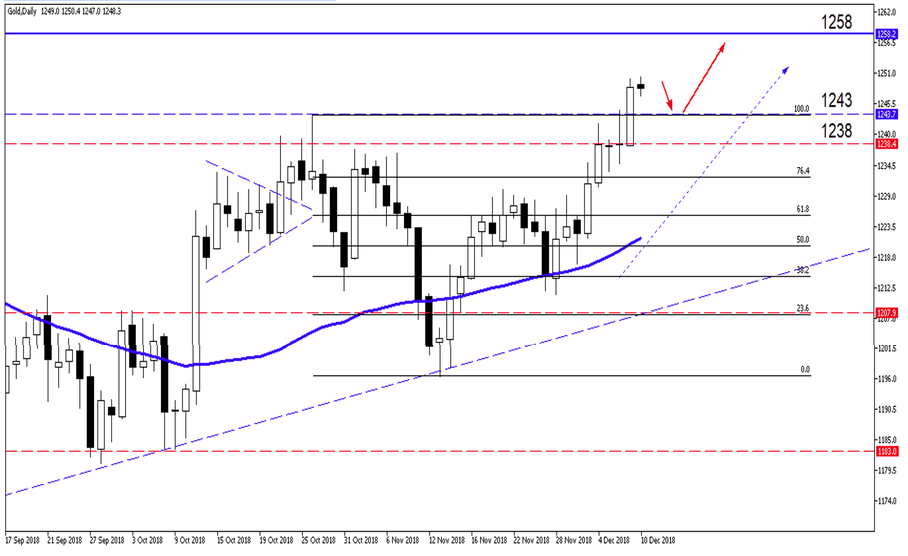

Gold

Gold has reached our first target price at $1238/oz as set out in our previous Commodity Reportand is currently moving higher. We might see a short-term pullback as the buyers return to the equity market, but this might be short lived. Our next target price on Gold is higher at $1258/ oz after an expected rebound from the $1243/ oz price level. The price action is also trading well above the 50-day Simple Moving Average (SMA).

Source – MetaTrader5

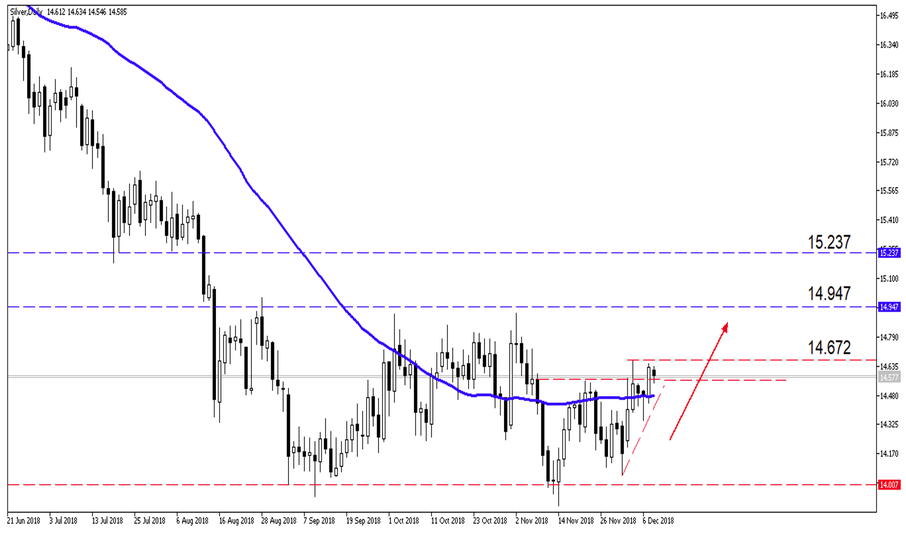

Silver

Silver has also moved higher and is currently trading above the 50-day Simple Moving Average (SMA). We also expect a short term pull back and will be watching the price action closely for a reversal. We need the price action to move above the 14.672 level to support the long bias to a first target level of 14.947.

Source – MetaTrader5

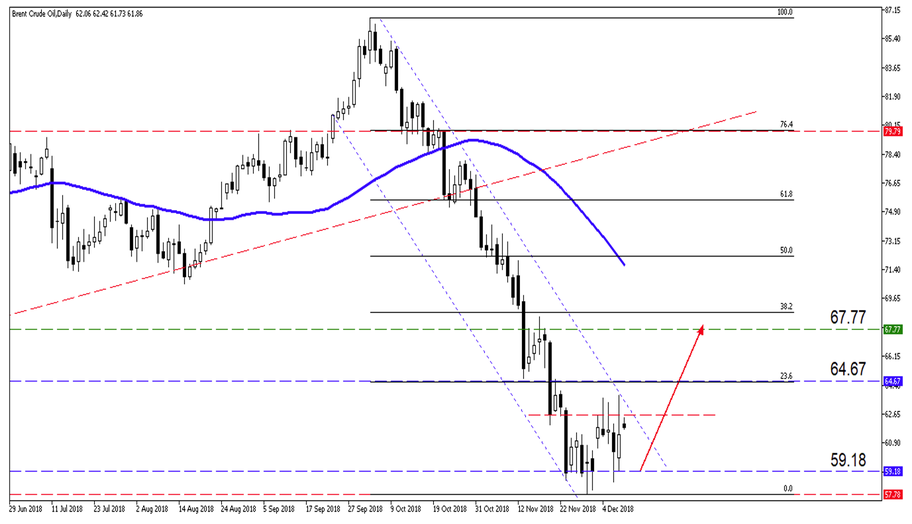

Brent Crude Oil

The Oil market was in the spotlight over the last week as the long-awaited OPEC meeting came to an end as an agreement to cut around 1.2 million barrels of oil a day was reached.

The price of Brent Crude Oil gained over 4% on Friday after the OPEC news was released but has since pulled back with more downside possibly on the cards.

Looking at the chart we can see the price of Brent is still trading within the descending channel. We need to see a daily close above the $64.67/ barrel level to support the long bias to a first target price of $67.77/ barrel.

Source – MetaTrader5

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.