With the G20 behind us and a positive outcome around the insuring tariff disputes between the U.S and China we are seeing the commodities starting to react.

Here is insight into what's happening with Oil, Gold and Silver accompanied by technical trading charts...

Brent Crude Oil

Oil has been the topic of much discussion at the start of the trading day on Monday as the price of Oil is on the rise. The Oil price reacted positively after the G20 meeting and it was also reported that Qatar was withdrawing from the Organization of the Petroleum Exporting Countries (OPEC). The week will be a big one for Brent Crude Oil as the OPEC countries will meet on the 6th of December in Vienna, Austria.

Looking at the chart we can see that the price action has been moving in a descending channel as Brent Crude Oil headed for a bear market. We might see a breakout from this channel but until we get certainty from the OPEC meeting later in the week it might be prematurely.

The price action might find some resistance at current levels as we need a daily close above the 23.6 Fibonacci level which coincides with the $64.60 per barrel. The Relative Strength Index (RSI) is also pointing higher which confirms that buyers are entering the market.

Source – MetaTrader5

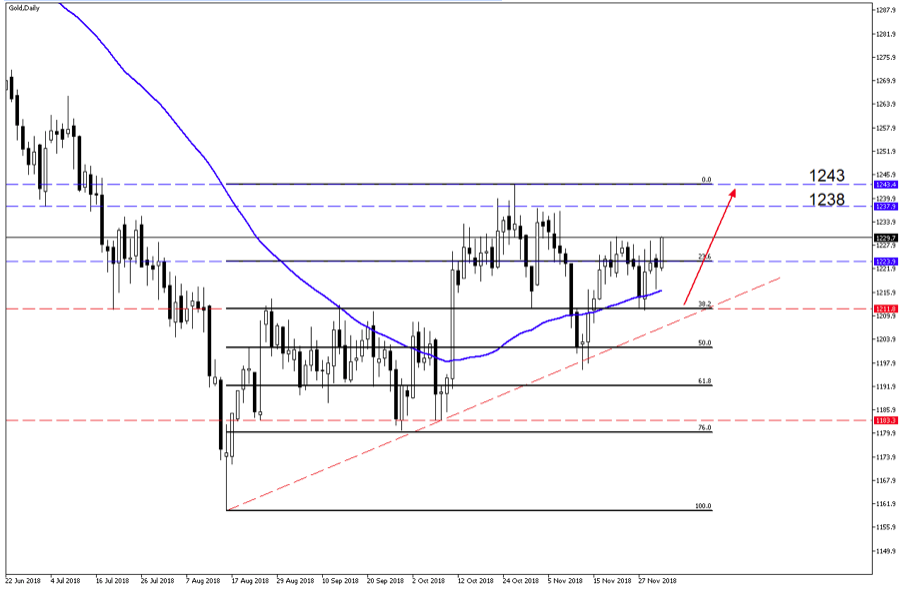

Gold

The precious metal is currently moving higher with the next resistance level around the $1238/oz level as a first target level. Price action is also trading above the 50-day simple moving average (SMA) which supports the price action moving higher.

Source – MetaTrader5

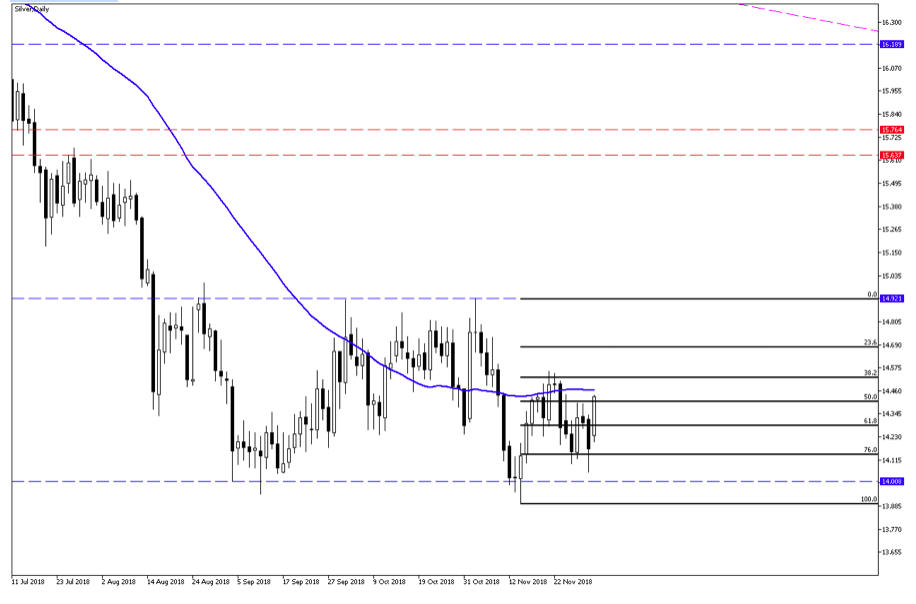

Silver

Silver also might deliver some results today but might find some resistance at the 50-day simple moving average (SMA). We need to see a close above the 14.526 level to support the move higher at this stage.

Source – MetaTrader5

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.