By Technical Analyst Colin Abrams

Recommendation: SELL SHORT A SLIGHT BOUNCE

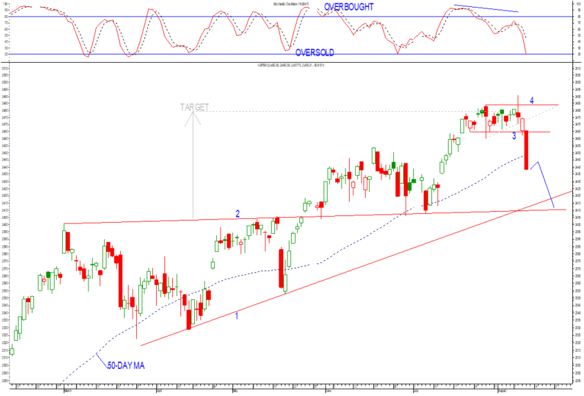

Current Trend: Short-term sideways. Med-term up but overbought. Long-term up.

Strategy: It can still be shorted but ideally on a minor (one to two day) bounce.

(chart: daily)

Chart Setup: The S&P broke down and triggered both our aggressive and conservative short signals. A big drop on Thursday night saw it reach some initial downside targets. But I'm expecting ongoing downside here, to lines 1 and 2.

- Its short-term Stochastic is reaching its oversold region but is likely to continue lower still; this after giving a negative divergence warning of the sell-off.

Strategy Details: Hold short if you still have part of the short position on. If not in, I can’t advise shorting after such a steep one day drop, the wait for a one or two day bounce to short on.

Target: Down to lines 1 and 2 at 2414-2409 respectively. In the interim, the price could bounce to as far as 2460. Look to short the bounce.

Stop-loss: A close above 2466. Then a breaking of its prior one-day high from 2420.

Read previous technical on the S&P500: /technical-take-colin-abrams-sp500

Download GT247.com MobiTrader app and start trading from your mobile phone immediately with R100 000 demo money:

To subscribe to more research by Colin please go to his website www.themarket.co.za

COPYRIGHT:

THIS NEWSLETTER IS TO BE READ ONLY BY CLIENTS OF GLOBAL TRADER. UNDER NO CIRCUMSTANCES IS IT TO BE SHOWN (OR GIVEN) IN PHYSICAL OR ELECTRONIC FORM TO ANY OTHER PERSON, WITHOUT THE PRIOR CONSENT OF THEMARKET.CO.ZA. FURTHERMORE, ELECTRONIC TRANSMISSION (EMAIL), REPRODUCING, AND/OR DISSEMINATING THIS DOCUMENT (OR PART THEREOF) IN ANY OTHER MANNER WITHOUT THE WRITTEN CONSENT OF THEMARKET.CO.ZA IS A VIOLATION OF THE COPYRIGHT LAW - AND IS ILLEGAL.

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

GT247.com: +27 87 940 6101

IT support & help desk: +27 87 940 6107

Client relations (new accounts): +27 87 940 6106

Sales: +27 87 940 6108