S&P500 - Holding but Vulnerable - Technical Take

By Technical Analyst Colin Abrams

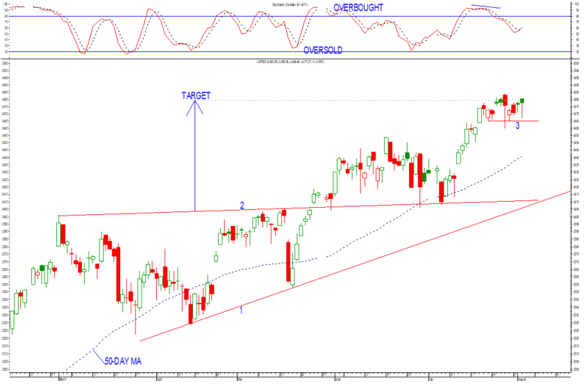

Recommendation: LOOK TO SELL SHORT

Current Trend: Short- and med-term up but overbought. Long-term up.

Strategy: Sell short a close below line 3, or a reversal week down (more conservative).

Chart Setup: The S&P 500 has moved sideways over the past week with no short signal given as yet. It can still edge a bit higher in the very short-term, but one should still be focusing on looking to sell short.

- Its short-term Stochastic has pulled back, without the price pulling back and this is often a bullish scenario.

Strategy Details: Nevertheless, I would not be buying at current levels, regardless of whether it continues up a bit more or not. Sell it short on a close below line 3 (2465) which will be a confirmation of the end of the current rally. Or sell short a reversal week down (which might be a more conservative entry).

Target: The price could still make it up to 2492. But once the short triggers, look for a drop to 2422 to lock in partial profit, and the rest at lines 2 and 1 at 2412.

Stop-loss: A close above the high of the current rally. Then a breaking of its prior two-day high from 2425.

Wishing you profitable trading until next time.

Colin Abrams

COPYRIGHT:

THIS NEWSLETTER IS TO BE READ ONLY BY CLIENTS OF GLOBAL TRADER. UNDER NO CIRCUMSTANCES IS IT TO BE SHOWN (OR GIVEN) IN PHYSICAL OR ELECTRONIC FORM TO ANY OTHER PERSON, WITHOUT THE PRIOR CONSENT OF THEMARKET.CO.ZA. FURTHERMORE, ELECTRONIC TRANSMISSION (EMAIL), REPRODUCING, AND/OR DISSEMINATING THIS DOCUMENT (OR PART THEREOF) IN ANY OTHER MANNER WITHOUT THE WRITTEN CONSENT OF THEMARKET.CO.ZA IS A VIOLATION OF THE COPYRIGHT LAW - AND IS ILLEGAL.

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

GT247.com: +27 87 940 6101

IT support & help desk: +27 87 940 6107

Client relations (new accounts): +27 87 940 6106

Sales: +27 87 940 6108