Today saw the rand weaken to R13.65 to the dollar, Judge Mlambo, set aside Shaun Abraham's appointment as NPA boss and requested that Deputy President, Cyril Ramaphosa choose his successor. In the local market we saw the sell-off in Steinhoff International Holdings N.V. [JSE:SNH] continue for the fifth consecutive day with the share closing down 40% at R6.00, as investors wait for more information on the accounting fraud and other financial irregularities to come to light.

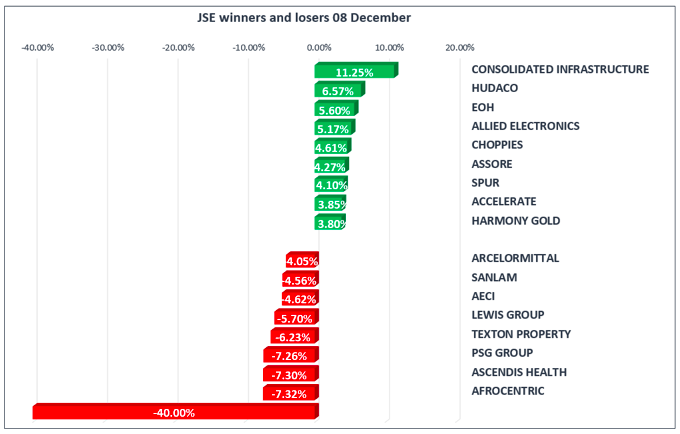

The All-Share index closed flat with the blue-chip Top40 up 0.03%, industrials up by 0.59%, whilst financials eased by 1.57%. More good news for resource stocks as the index edged up by 0.23% for the day with gold miners closing up 0.34%.

Elsewhere, the gold price weakened further to $1249/ounce whilst brent crude oil was up trading at $63.14/bbl, up 3.17%.

Global stocks rallied with positive news out of Asia, Japan’s GDP beating expectations at 0.6% whilst China showed imports grew by more than expected reaching a rate of 17.7% in November, while exports grew by 12.3%. European stocks followed their Asian counterparts trading firmer boosted by better then expected manufacturing numbers out of the UK of 0.1%, compared to the forecasted -0.1%.

Whilst the U.S. markets continued to push upwards with the S&P 500, Dow 30 and Nasdaq all firmer on the renewed hopes that the highly-anticipated U.S. tax reform will be passed before year end. Non-Farm payroll numbers beat expectations as the US created 228,000 jobs with average hourly earnings increasing by 2.5% compared to a year ago while the unemployment rate remained at 4.1%. As a result, the dollar index, climbed to 93.91, up 0.16%. This data provides the FED with a clearer picture of the labour market after the volatility caused from the recent hurricanes. Investors will now look to FED Chair Janet Yellen next week as a rate-hike could be a near-certainty.

Great news for Brexit negotiations and the pound as the British government finally agreed that there will be no "hard border" in Ireland, and EU citizens in the UK, and UK citizens in the EU, will see their rights protected.

Bitcoin retreated from previous highs trading at $15,286 as the market looks towards Monday when Cboe Global Markets Inc. will start trading their Bitcoin futures, after receiving the go ahead from the US futures regulator (Commodity Futures Trading Commission).