The JSE opened the week firmer as it was propelled by index heavyweight Naspers [JSE:NPN] and Rand hedge stocks.

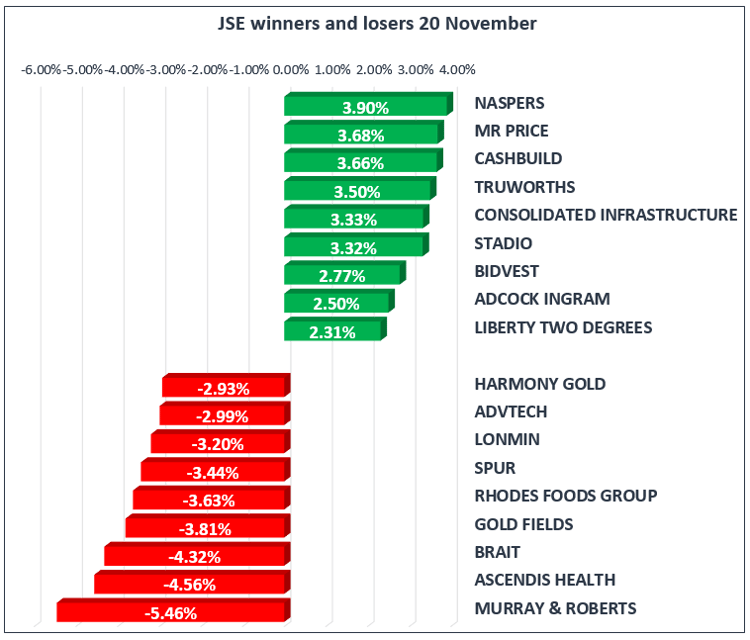

Mr Price [JSE:MRP] bounced on the back of the 6 months earnings results which were released this morning. Tough operating conditions were cited in the results however the stock reported an increase in diluted headline earnings per share of 23.6% which was mainly driven by their apparel brands. The stock closed the day up 3.68% at R201.99 per share.

Other retailers such as Spar Group [JSE:SPP], Massmart [JSE:MSM] and Truworths [JSE:TRU] recorded gains of 1.39%, 1.94% and 3.50% respectively. Rand hedges Richemont [JSE:CFR] and Mondi PLC [JSE:MNP] inched up 1.05% and 0.65% respectively.

Banking stocks were mixed as Barclays Africa [JSE:BGA] and Nedbank [JSE:NED] inched up 0.16% and 0.09% respectively, however First Rand [JSE:FSR] and Standard Bank [JSE:SBK] came under some pressure to end the day 0.71% and 0.30% lower.

Murray and Roberts [JSE:MUR] ended the day amongst the biggest losers as it closed down 5.46% at R14.20 per share. ArcelorMittal [JSE:ACL] and Ascendis Health [JSE:ASC] lost 2.83% and 4.56% respectively, whilst Brait [JSE:BAT] remained under pressure as it lost another 4.32% to close at R42.10 per share.

Gold miners traded weaker due to weaker Gold prices which resulted in stocks such as Harmony Gold [JSE:HAR] and AngloGold Ashanti [JSE:ANG] closing the day 2.93% and 2.46% weaker. Vodacom [JSE:VOD] and MTN [JSE:MTN] came under pressure to end the day 2.10% and 1.59% weaker.

The JSE All-Share Index closed the day 0.62% firmer, whilst the JSE Top-40 Index gained 0.78%. The Resources Index came under pressure to shed 0.97% whilst the Financials Index lost 0.31%. The Industrials jumped on the back of the move in Naspers to gain 1.78%.

The Rand was mostly unchanged from Friday’s close as it continued to hover just above R14 to the US dollar. The Rand was trading R14.04/$ when the JSE closed after having managed to peak to an intra-day high of R13.97 to the US dollar.

Brent Crude traded weaker compared to where it closed on Friday. The commodity failed to gain any significant momentum as traders await the outcome of the OPEC meeting scheduled to take place in Vienna, Austria on the 30th of November. Brent Crude was trading at $61.83 per barrel when the JSE closed.

Despite the US dollar coming under pressure earlier on, Gold came under pressure to reach an intra-day low of $1284.85/Oz. As a result the Gold mining index on the JSE lost 2.89% and the precious metal itself was recorded at $1285.30/Oz just after the JSE closed.

Platinum lost more than 1.50% to trade at $934.40/Oz when the JSE closed whilst Palladium had lost just over 0.20% to trade at $994.75/Oz.