What to look forward to this week

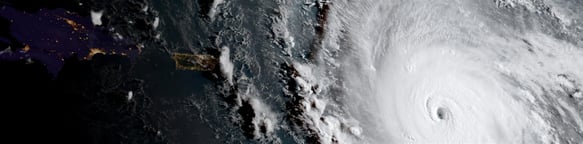

The main story from last week and continuing on into this week is the Hurricanes currently devastating the USA and the surrounding islands.

From what we have seen so far it does seem like the cost to repair and replace the damaged infrastructure will easily be in the billions of US Dollars. Speaking of the US Dollar, we saw the greenback reach lows last recorded in 2015 which helped Gold break above $1350 per ounce on safe-haven buying. Locally, we managed to get out of technical recession as GDP quarter-on-quarter jumped up by 2.5%. Volatility is definitely at its peak in the global markets and that sets up some interesting opportunities for traders. With that in mind we have highlighted a few key events that you can look forward to in this week of trading.

- Monday is expected to be subdued on the economic data front as we do not expect any significant sets of data from most of the major global financial markets. You can still expect Industrial Activity data from Japan, as well as Italian Industrial Production numbers. Locally, we are expecting AVI Limited to release its full year results.

- Tuesday will see the focus shift to the UK as they are expected to release their CPI numbers. The year-on-year number is expected to inch up to 2.8%, from a prior recording of 2.6%. Later on during the course of that day the USA will release the JOLTS Job Openings numbers. This is a number that traders can no longer afford to ignore as we have seen a significant reaction to that data in the most recent releases.

- On Wednesday South African Retail Sales numbers will be in focus. The year-on-year number is expected to decrease to 2.6% from a prior recording of 2.9%, whilst the month-on-month number is expected to come in at 0.00% from a prior recording of 0.20%. The UK will be in the spotlight again as we are expecting the Average Earnings Index numbers as well as the Unemployment Rate numbers. We are also expecting PPI data from Japan and the USA, as well as the weekly Crude Oil Inventories numbers from the USA.

- Thursday is a busy day in terms of economic data, and Australia kicks the day off with Unemployment Rate and Employment Change data. China is expected to release Industrial Production numbers which metal commodity producers will be watching closely. You can also expect the same set of numbers from Japan. China is also expected to release Fixed Asset Investment and Retail Sales numbers. For the Swiss Franc currency cross traders, the Switzerland Reserve Bank is expected to announce its interest rate decision which is expected to remain unchanged. The United Kingdom is also expected to announce its interest rate decision which is expected to remain unchanged. From the USA, we are expecting CPI data as well as the weekly Initial Jobless Claims numbers.

- On Friday US Retail Sales will be in focus with the month-on-month number expected to decrease to 0.1% from a prior recording of 0.6%. From the same market we are expecting Capacity Utilization Rate and Industrial Production data.

Political tensions seem to be slightly subdued this week however some interesting developments are taking place within the US government particularly amongst the Republicans. That could potentially set up for some interesting news during the course of this week. Locally rumours of potential conflicts within the ruling party are flying about and anything adverse could have major ramifications for the Rand and local equities.

See also Upcoming Results Roundup

We will be keeping tabs on the events in the markets. Check out our blog for market updates, insights from our GT247.com team, and our independent analysts. Not sure about a trade? Call the GT247.com Trading Desk on 087 940 6102, and bounce your idea off one of our dedicated traders.

Until next week, we wish you profitable trading!

Musa Makoni | Trading Specialist at GT247.com