The JSE tracked other global markets lower on Wednesday as investors fretted over the extended economic shutdowns as a result of the coronavirus.

The local bourse eased following consecutive sessions of healthy gains as the negative sentiment from other global markets weighed heavy. With all important US non-farm payrolls numbers being released this Friday, investors now shift their attention to the extent of job losses caused by the coronavirus outbreak. With most countries under lockdown, this similar trend of job losses could extend across all the major global economic centres.

The rand relinquished some of the prior session’s gains as it breached R18/$ again to pick at a session low of R18.07/$. The local unit was recorded trading 0.79% weaker at R17.98/$ at 17.00 CAT.

GT247, South Africa's Top Online Stockbroker, as voted by Intellidex, will continue to operate their powerful MT5 trading platform during the COVID-19 lockdown period. The trading team has assembled their workstations at home and are operational remotely. Clients may experience slight delays in support queries but trading online will resume as normal. Please use our FAQ self-help portal or email supportdesk@gt247.com if you require assistance.

On the JSE, MTN Group [JSE:MTN] closed amongst the day’s biggest gainers as it closed 19.19% higher at R48.39 following the issue of a no change statement. Sasol [JSE:SOL] issued a statement updating on its oil hedges as well as its response to the Covid-19 lockdown. This saw the share rocket 17.24% as it closed at R36.93. Absa Group [JSE:ABG] also issued a no change statement which saw the share jump 18.48% to close at R75.00. Other financials stocks were bolstered by the firmer rand which saw gains being recorded for Nedbank [JSE:NED] which rallied 12.92% to close at R82.66, as well as FirstRand [JSE:FSR] which climbed 7.42% to close at R40.27. Gains were recorded for listed property stocks which saw stocks such as Hammerson PLC [JSE:HMN] which rallied 15.45% to close at R16.96, as well as Growthpoint Properties [JSE:GRT] which surged 10.57% to close at R12.87. Significant gains were also recorded for Discovery Ltd [JSE:DSY] which advanced 6.62% to close at R77.96, Old Mutual [JSE:OMU] which added 8.02% to close at R11.85, and Capitec Bank Holdings [JSE:CPI] which closed at R880.00 after rising 6.26%.

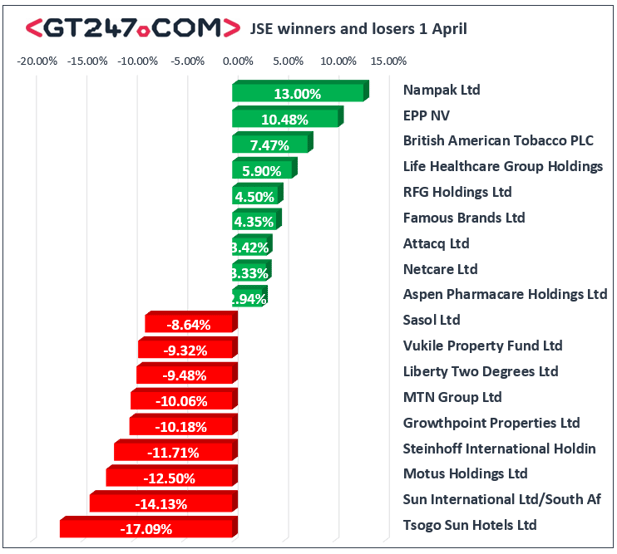

On the local bourse, Tsogo Sun Hotels [JSE:TGO] came under significant pressure as it plummeted 17.09% to close at R1.31, while its hospitality sector peer Sun International [JSE:SUI] fell 14.13% to close at R16.10. Motus Holdings [JSE:MTH] lost more ground in today’s session as it slipped 12.5% to close at R23.80, while Imperial Logistics [JSE:IPL] dropped 3.63% to close at R25.50. Listed property stock Growthpoint Properties [JSE:GRT] tumbled 10.18% to close at R11.56, Vukile Property Fund [JSE:VKE] dropped 9.32% to close at R6.42, while Capital & Counties [JSE:CCO] closed at R33.95 after losing 6.86%. Significant losses were also recorded for Sasol [JSE:SOL] which fell 8.64% to close at R33.74, as well as for MTN Group [JSE:MTN] which closed at R43.52 after losing 10.06%.

Nampak [JSE:NPK] found some traction in today’s session as it jumped 13% to close at R1.13, while EPP NV [JSE:EPP] surged 10.48% to close at R6.85. Rand hedge British American Tobacco [JSE:BTI] climbed 7.47% as it closed at R643.36, while RFG Holdings [JSE:RFG] added 4.5% to close at R15.10. Healthcare provider, Netcare [JSE:NTC] advanced 3.33% to close at R15.50, while its sector peer Life Healthcare [JSE:LHC] rose 5.9% to close at R19.55. Gains were also recorded for Aspen Pharmacare [JSE:APN] which gained 2.94% to close at R95.16, as well as Nedbank Group [JSE:NED] which closed at R85.00 after adding 2.83%.

The JSE All-Share index closed 1.7% lower while the JSE Top-40 index lost 1.75%. The Financials index lost a more modest 0.75%, while the Industrials and Resources indices fell 1.44% and 2.62% respectively.

At 17.00 CAT, Palladium was down 5.34% to trade at $2223.08/Oz, Platinum was 0.42% firmer at $725.19/Oz, while Gold was up 0.62% to trade at $1587.31/Oz.

Brent crude was trading 3.95% weaker at $25.31/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.