Trading on the local bourse was positive on Monday following a strong response to global markets. A surge in technology stocks helped lift Asian bourses to decade highs, whilst Friday’s weak U.S. data kept tightening expectations at bay.

The rand weakened 1% against a stronger dollar, and closed the session at R13.28 against the greenback.

South African retail sales growth eased by more than expected in July. Retail growth printed a moderate 1.8% in July, lower than the forecast of 2.9% from 3.2% in June. Retail sales were dragged down by weaker sales in general dealers. Analysts noted that although the economy has emerged out of the technical recession in the second quarter, these numbers suggest that economic activity remains weak and consumer confidence is fragile.

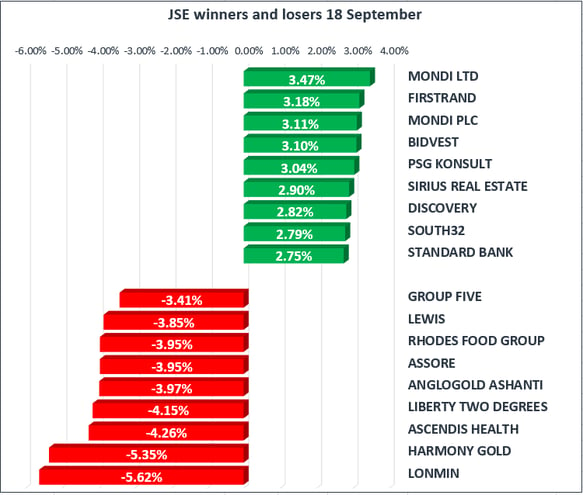

The All-share index gained 0.86%, followed while the blue-chip Top 40 climbed 1.09%. The positive move was driven by a rally in banking stocks with the banking index climbing 2.67%, and general financials up 1.35%. The gold index fell sharply by 3.03% following a drop in the price of gold.

Naspers [JSE:NPN] gained 1.09% assisted by a weaker rand and a 2.13% climb in the share price of Hong Kong listed Tencent.

Crude Oil prices edged slightly lower to $54.96 at the close of the JSE as a number of US refiners continue to come back online after getting shut down by Hurricane Harvey.

Gold prices pulled back this week to $1308, dropping 0.81% on Monday, with little in terms of immediate geopolitical threat to support the precious metal. Investors shrugged off recent North Korean missile launches while growing expectations that the US Federal Reserve will look to hike interest rates later this year kept the safe-haven asset subdued.

READ ALSO: "Discovery Growth Rating" /discovery-18-september-2017