US markets picked up on Wednesday afternoon, with the S&P500 up 0.17% and the Dow Jones 30 up 0.27% at the close of the JSE.

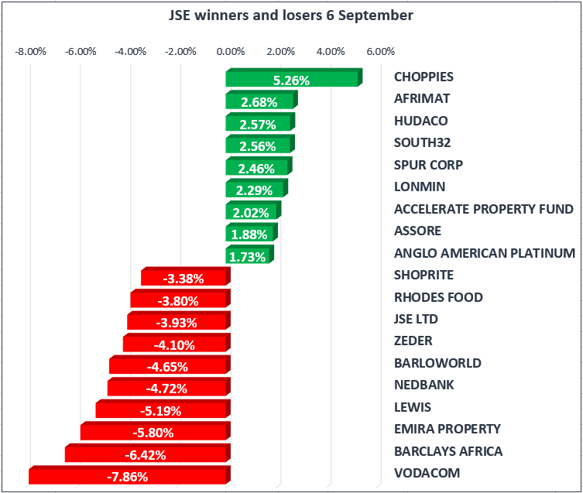

Banking stocks came under pressure on Wednesday with Barclays Africa [JSE:BGA] falling 6.42% to R140.37, Nedbank [JSE:NED] falling 4.72% to R203.23, FirstRand [JSE:FSR] losing 1.50% to R54.45 and Standard bank edging 1.410% lower to R163.27.

The All Share index dropped 1.18% and the blue-chip Top 40 moved 1.25% down with all major sectors in the red. The financial index took most of the brunt, and slipped 1.64%, followed by resources dropping 1.43%, industrial stocks edged lower by 0.94% and gold miners moved down by 0.33%.

The rand remained buoyant, and climbed 0.68% to R12.80 against the greenback amidst international dollar weakness and was supported by the positive GDP figures released on Tuesday. South Africa’s GDP numbers indicated growth off a low base in the second quarter of the year, by 2.5% from -0.6% previously

Vodacom [JSE:VOD] tumbled 8.02% to R164.00 a share on Wednesday after parent, Vodafone, announced a sale of 90 million shares in Vodacome in an accelerated book-build process to institutional shareholders in order to meet the JSE’s 20% free-float requirement.

This is after Vodafone disposed of its 35% stake in Kenya’s Safaricom to Vodacom, in the process increasing its stake in Vodacom from 65% to nearly 70%

The assets comprise the African assets of Steinhoff and STAR will remain a subsidiary of Steinhoff International. Discount and Value brands will account for 72% of revenue on a pro forma basis. These brands include PEP, Russells, Flash, Ackermans, Bradlows, and Rochester. Speciality brands will account for 28% of revenue and include Buco, Timbercity, Incredible Connection, HiFi Corp, Dunns, John Craig, Tekkie Town, and Sleepmasters.

To put the size of the listing in perspective, the market value of STAR is on par with Woolworths, and 55% of the market value of Shoprite.

Steinhoff and STAR have entered into a call option agreements whereby STAR will acquire a 23,1% interest in Shoprite and a voting interest of 50,6%. Shoprite will maintain its separate JSE listing and Shoprite management will remain independent.

Gold has continued to prosper in the wake of the prevailing global uncertainty, with the price moving slightly higher to $1340/Oz. Gold continues to gain as Russia joins China in rejecting U.S. calls for more sanctions on North Korea, and U.S. central bank officials.