Equity markets failed to bounce on Thursday as investors looked for more signs of government commitment from the Jobs summit held in Midrand today.

Asian markets continued to trade in the red on Thursday as investors took profit ahead of Fridays Non-Farm payroll number to be released at 14:30 South African Time. Recent data released out of the US clearly indicates that the US market is booming and could see more growth if this trajectory is sustained. The FED has indicated that if these numbers are sustained the central bank could push interest rates higher to levels where economic growth may be curtailed. The US 10-year yields are indicating to the market that the FED is likely to increase rates further from their current interest band. The Nikkei closed the day 0.56% to trade at 23975, whilst the Hang Seng closed the day down 1.73% at 26623.

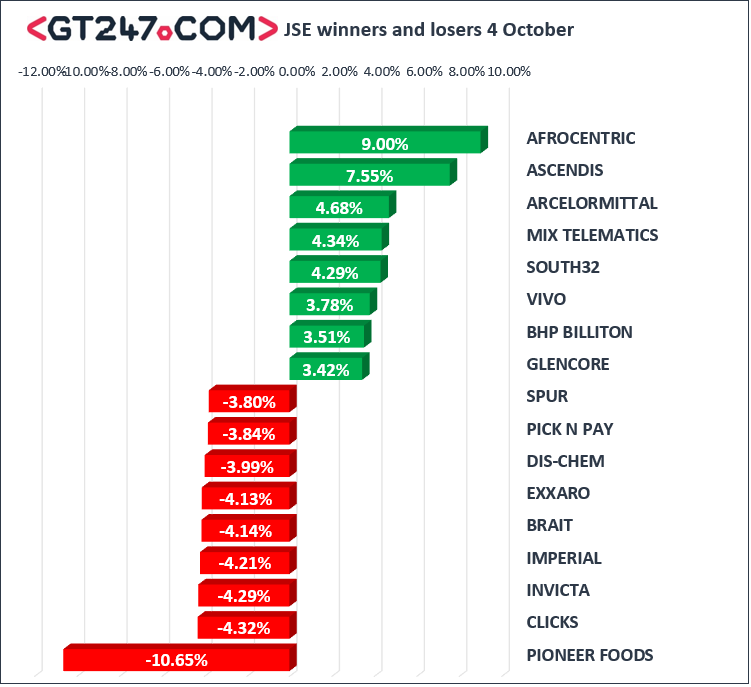

On the local market, Pioneer Foods [JSE: PFG] recorded a 10.65% loss on the day after it released its trading statement. The stock was trading at 8113c/share at the close of business as selling pressure mounted on the diversified foods group. Clicks [JSE: CLS], Invicta [JSE: IVT] and Imperial [JSE: IPL] sustained losses of 4.32%, 4.29% and 4.21% respectively.

Gains were recorded in Arcelor Mittal [JSE: ACL], Ascendis Health [JSE: ASC] and Afrocentric [JSE: ACT] as they advanced 4.68%,7.55% and 9% respectively

The resource 10 index continued to rally on Thursday, making it three consecutive days of gains, the index gained 1.68% on the day to trade at 44775 points. The Financial index pulled back 0.52% whilst the industrial index shed 1.13%. The All share closed the day in the red 0.26% whilst the Top40 retreated 0.17% to trade at 55030 and 48908 points respectively.

The Rand was weaker against the dollar on Thursday to trade at 14.70 to the dollar. The Rand eased against the Euro and the Pound on the day as the two majors clawed back lost ground against the dollar. Fears around Italy’s budget deficit falling outside the guidelines of the European Union mandate appear to have been allayed. Britain’s Prime Minister Teresa May appears to have hitched a plan to get a Brexit deal done with Brussels and attempt to fast track the deal through the House of Commons. The rand was trading at 16.96 to the Euro and 19.16 to the Pound at the time of writing. South African 10 Year Bond (R186) yields eased today after putting up a stiff fight on Wednesday, the benchmark bond yields were trading at 9.20% 11 basis points from their closing levels on Wednesday.

Commodities were mixed on the day as Gold was the stand out commodity to trade in the black as most commodities traded in the red for most of the South African session. Platinum and Palladium were weaker on the day and were trading at $834.60/ ounce and $1050/ounce respectively. Brent crude retreated on the day as Russia and Saudi Arabia revealed that they had both increased output. A barrel of crude was changing hands at $85.59 having posted an intraday high of $86.42

Crypto currencies were firmer on the day as Bitcoin gained 0.76% to trade at $6593/ coin whilst Ethereum rallied 0.88% to trade at $224/ ounce.