The trade tariff tensions between the U.S and China are escalating which has now focussed the spotlight firmly on the Federal Reserve to cut interest rates.

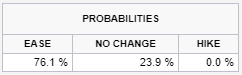

The CME’s FED Watch Tool, which is closely watched for any changes in sentiments that have gone from a 31% rate cut later in the year to a 76.4% probability that the FED might cut rates in December 2019.

The FED might only cut the interest rate if things get extremely worse, like a bear market and judging form a survey of global fund managers by Bank of America Merrill Lynch.

The tit-for-tat tariffs were kicked into high gear on Monday when China retaliated with imposing tariffs on some $60 Billion worth of U.S goods. This sent shockwaves into the markets which saw the DOW Jones drop over 2%.

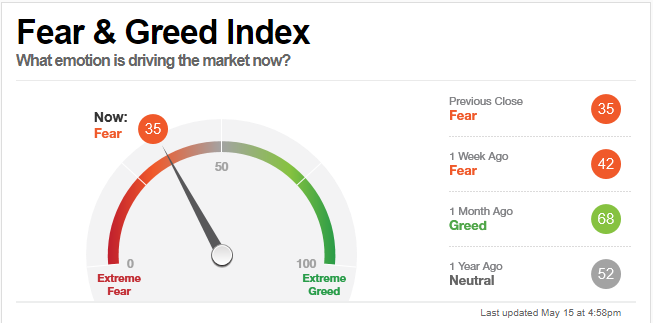

By looking at the CNNMoney Fear and Greed Index it is clear that fear in the market is on the rise from a week ago.

The United States

Just as the renewed tariff disputes pick up steam and the tit-for tat tariffs are well underway President Trump felt the need to restrict Huawei from selling equipment in America. To top it all off the U.S is putting Huawei on a blacklist that could forbid the global Chinese company from doing business with U.S companies.

Take note: that volatility is expected on the U.S Indices and all major markets while these tariff disputes continue.

Some technical points to look out for on the S&P 500:

- The S&P 500 has moved lower to the 2819 support which will be watched closely as it acted as a major resistance level.

- The price action is still below its 50-day Simple Moving Average (blue line) which supports the move lower.

- A descending channel is noted on the S&P 500 and a breakout to the upside from this channel might be bullish.

- The Relative Strength Index (RSI) has bounced from the oversold area and will be watched closely.

Source – Bloomberg

The Eurozone

The German DAX reacted positively in late afternoon trade as fears of economic slowdown seem to have subsided for now. The German economy, the largest economy in the Eurozone released its latest GDP figures which showed the economy expanded by 0.4% in the first quarter of 2019. The German economy narrowly escaped a recession last year and have put my fears of a slowdown to bed.

Some technical points to look out for on the DAX:

- The DAX has moved higher after finding support at the trendline as discussed in the previous Index note and is pushing higher.

- The price action is above the 50-day Simple Moving Average (blue line) which is supporting the move higher.

Source – Bloomberg

Source – Bloomberg

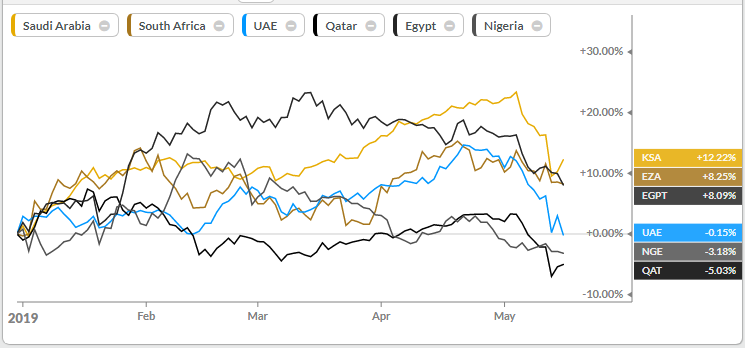

Middle East/ Africa

The Oil market takes centre stage once more this week as prices keep on rising as fears of supply distribution are high as Middle East tensions rise.

Brent crude has risen for its biggest weekly gain in six weeks which might continue if the OPEC + nations decide to continue with their second half of the year with supply cuts.

Source - KOYFIN

Source - KOYFIN

Bringing it back home the elections are finally over, and a new dawn is set for the country as we await the new cabinet. International Investors and Ratings Agencies alike are holding their breaths to see if the ruling ANC will include some officials accused of corruption amongst its candidates.

Some technical points to look out for on the Alsi:

- The price action has moved significantly lower since the U.S-China tariff dispute flared up again and has broken through trendline support.

- The price action has tested a major support level once more which will be watched closely around 49424.

- If the support level at 49424 does not hold then we might expect the price to move lower still to the next major support level at 47087.

Source – Bloomberg

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.