D-Day has arrived for the U.S-China Trade negotiations as 102 words on Twitter changed the course of the markets in an instant for the worse.

Markets have been under immense pressure as Trump stated on Sunday that he would increase tariffs on $200 billion worth of Chinese goods by 25% as of today. Negotiations are still underway to reach an agreement, but the deadline has passed, and the new tariffs will take effect. As the world holds its breath to see what counter measures the Chinese will impose the markets move lower.

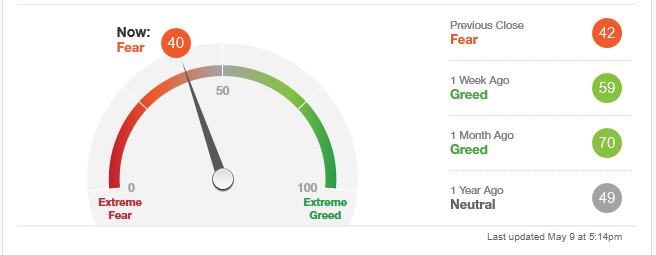

Looking at the major indices around the world we can see that fear has set in as all the major indices have been selling off since Trump made his statements. Judging by the CNNMoney Fear and Greed Index we have seen a dramatic change in market sentiment over the last month.

The United States

All the major U.S Indices have been trading lower from the statements made by President Trump who stated he has an alternative if no deal is reached. Uncertainty of how the U.S-China talks will pan out remains to be seen.

Take note that volatility is expected on the U.S Indices and all major markets today.

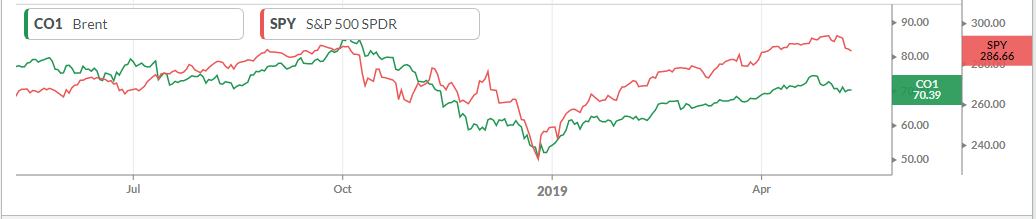

The correlation between the S&P 500 and Brent Crude Oil is still intact and will be watched closely as the Oil market has also seen some downside this week.

Source - KOYFIN

The Economic data being released today to take note of:

- U.S Core CPI at 14:30 SAST.

- U.S Baker Hughes Oil Rig Count at 19:00 SAST.

- U.S-China Trade Announcements – All day.

- Uber listing on Exchange.

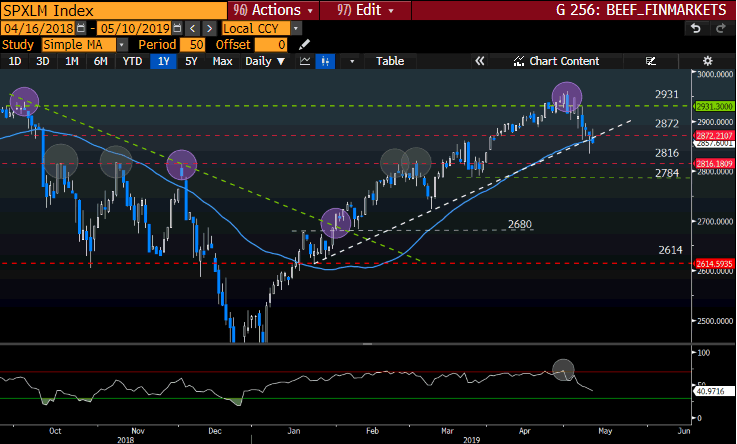

Some technical points to look out for on the S&P 500:

- The S&P 500 has reached the 2931 target price as described in the previous Index Note and has reversed lower to the 2816 support level.

- More downside is expected, and the 2816 support level will be watched closely.

- The price action is also below its 50-day Simple Moving Average (blue line) which supports the move lower.

- The Relative Strength Index (RSI) is also moving lower from the overbought area to the oversold area.

Source – Bloomberg

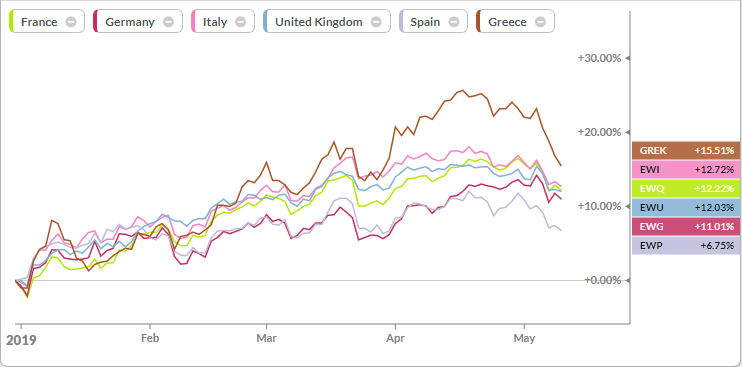

The Eurozone

The Eurozone has not been spared from the trade U.S-China conflicts as the German Automotive suppliers Bosch and Continental do not expect the global auto market to recover soon. Vehicle demand has been slowing down, especially in China, the worlds largest car maker.

The German DAX also the Eurozone’s biggest economy has been under pressure of late but still managed a 11% gain YTD. By looking at the chart below we can see the Eurozone’s major Indices start to move lower as the U.S-China Trade dispute takes effect.

Source – KOYFIN

The Economic data being released today to take note of:

- German Trade Balance released at 08:00 SAST, increased to 20.0B

- U.K GDP data to be released at 10:30 SAST.

- U.K Manufacturing Production at 10:30 SAST.

Some technical points to look out for on the DAX:

- The DAX has been in a solid uptrend since the start to 2019 making Higher Highs and Higher Lows supporting the upward momentum.

- Price action is finding support at the 11847 level and might reverse from here back to the resent high of 12455.

- The DAX is trading above its 50-day Simple Moving Average (Blue line) which supports the move higher.

- The Relative Strength Index (RSI) has mover lower from overbought levels and will be watched closely for a turnaround.

Source – Bloomberg

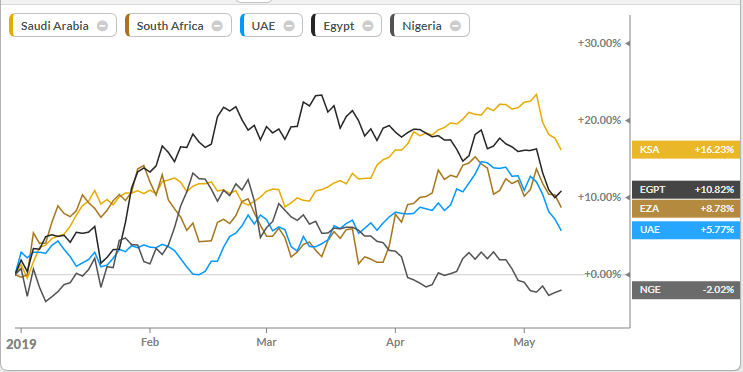

Middle East/ Africa

While the Oil market has also been under pressure the South African elections have been placed firmly in the spotlight this week.

Counting of votes are close to being finalized and it seems that the ruling ANC support will come in below 60%, the opposing DA also lower than the previous election and the EFF gaining support currently at 10%.

The below chart illustrates the YTD normalized returns of some of the major indices in the Middle East/ Africa sector.

Source - KOYFIN

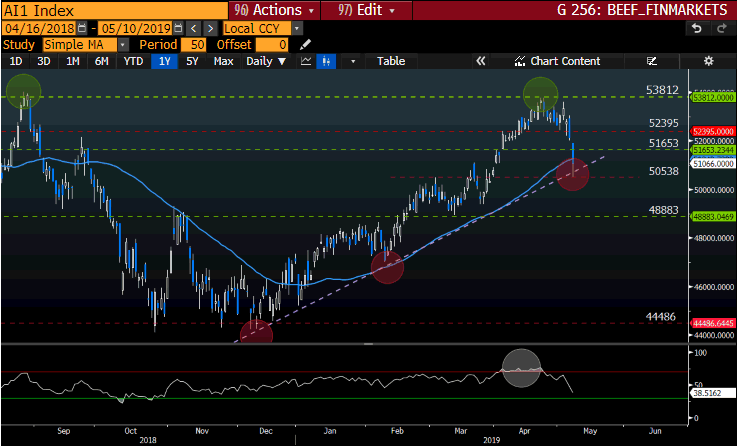

Some technical points to look out for on the Alsi:

- The price action has moved significant lower from the U.S-China trade disputes this week which has seen the price action move back to the trend line.

- The Relative Strength Index (RSI) is approaching the oversold boundary from overbought levels.

- The 50-day Simple Moving Average is currently at the price level which might act as either support of resistance.

- We need to see the price action preferably close above the 51653-price level to support a possible move higher. If support does not hold then we might see the price action move lower still to 48883.

Source – Bloomberg

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.