Local

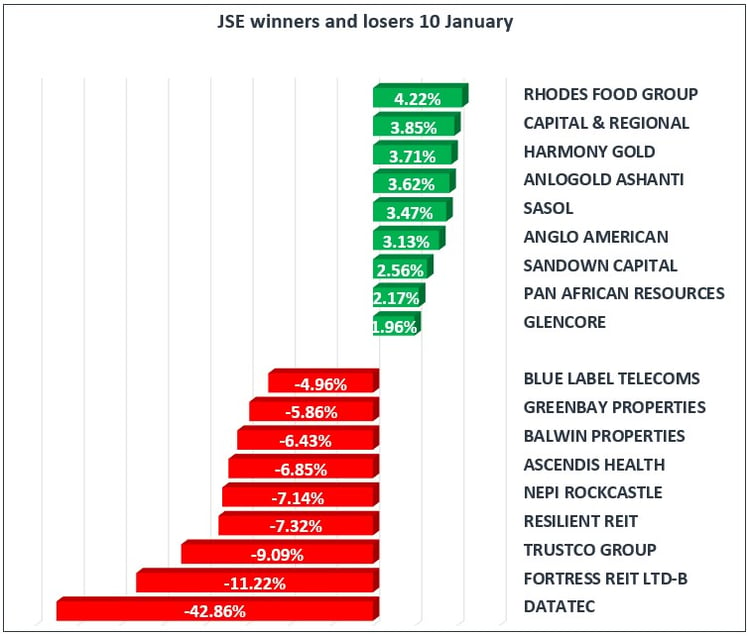

A mixed day for our local market saw resources and gold miners trade higher up 1.36% and 2.05% respectively. Harmony Gold [JSE:HAR] was the best performer, recouping some of the losses from yesterday while Anglo American [JSE:AGL] continued to rally, up 3.13%.

The All-Share index moved lower, down by 0.22%, followed by the blue-chip Top40 down by 0.03% and industrials down by 0.28%. Financials were the worst performing sector down on the day by 0.94% with the major banks all closing in the red and TrustCo Group Holdings [JSE:TTO] giving back some of the gains from yesterday. Today saw Datatec [JSE:DTC] trade excluding the special cash dividend of R23.00 account for the major move down.

Elsewhere, the South African Chamber of Commerce and Industry’s business confidence index rose for a second straight month to 96.4 for December as investors focused on the first meeting of the ANC's new NEC for hints on Zuma’s future and land reform. At the close of our market the local currency was slightly weaker against major currencies, trading at R12.43 against the dollar, R16.81 against the pound and R14.89 to the euro.

Commodities

Gold prices strengthened to $1319.90/ounce while silver was down 0.35% at $17.07/troy ounce. Platinum managed to ease the gap to Palladium, up 0.90% to $973.04/troy ounce and down 0.67% to $1,094.86/troy ounce respectively.

Oil hits three-year high and data shows Crude Oil Inventories declined confirming increased demand for the commodity. WTI is up 0.43%, currently trading at $63.23 while Brent Crude is up 0.29% currently trading at $69.02/bbl.

Global Stocks

Asian markets took a breather after a strong start to 2018, with Hong Kong’s Hang Seng Index the only index closing higher, up 0.2% and edging closer to the all-time high of 31,958.41, which was set in 2007.

Most of the European markets closed lower, however the FTSE was in positive territory after the U.K.’s manufacturing production numbers came in at 0.4% beating expectations. This is positive for the pound as the manufacturing accounts for approximately 80% of overall industrial production.

U.S. equities traded lower amid concerns that China is considering halting or cutting its purchases of U.S. bonds. The market will look to Friday’s US CPI number as a key point in which to test the bond market.

Cryptocurrencies

Bitcoin and Ripple selloff continues, bitcoin has fallen to $14,060 and Ripple to $1.88 after falling as low as $1.61 earlier, down by more than 50% from last week’s peak. Meanwhile, Ethereum blockchain has climbed to $1,333, up by 11.91%.