The Week Ahead

The Local market eased last week as heavy weight Naspers pulled the JSE lower. Geopolitical tensions between the US and North Korea saw investors scurrying into safe haven assets. Gold advanced breaking through key resistance levels and is looking to test the $1300/ounce as North Korea continues to threaten the US territory of Guam.

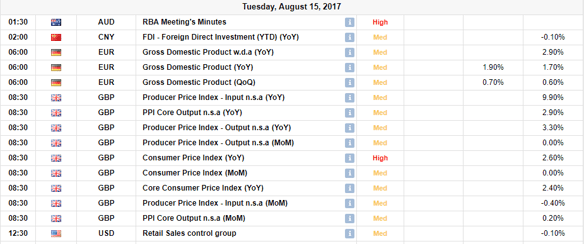

On the local front, the much-anticipated Moody’s review on Friday was called off as the ratings agency announced that they will not be reviewing SA’s credit rating as there was nothing to review. Moody’s have indicated that they will provide the market with an Economic review on Tuesday the 15th of August.

The No confidence vote in Jacob Zuma in the South African parliament last week has rattled the ANC gage as senior members of the ANC are asking for the “sell outs” to be punished for voting against Jacob Zuma. It will be interesting to find out how the ANC will identify the “sell outs” as the voting was done via secret ballot. All we can say is its all fun and games in the Republic until the decisive ANC National Elective Conference.

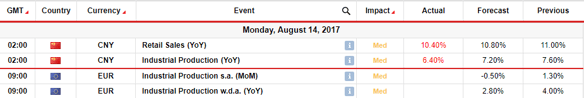

This week we see the major economies reporting retail sales. The Chinese retail sales number came in at 10.8% this morning ahead of market expectations of 10.4%. The retail sales number gives the market an indication of the state of the retail market. A strong retail sales number indicates that you and I have cash in our pockets and we are going out there and spending it.

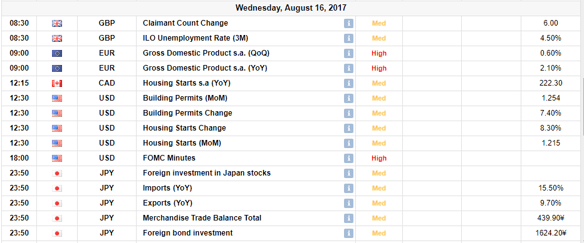

On Wednesday, we will get an update on the oil inventories from the US market. Lower inventory levels show that the market has been consuming more crude and there is demand for crude. Brent Crude prices have been firmer in the last 2 weeks as the US dollar continues to trade at depressed levels due to Monetary Policy uncertainty and geo-political tensions. The “gang of thieves” in the form of OPEC will remain at the forefront of the crude market as potential supply cuts could be on the cards, which could keep oil prices firmer.

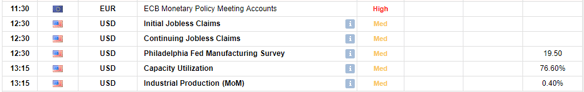

The Fed’s Open Market Committee minutes will be released on Wednesday at 20:00 hrs SAST. From these minutes the market can read how the Fed would like to go forward in crafting US Monetary policy and if there will be any further rate hikes in the US this year.

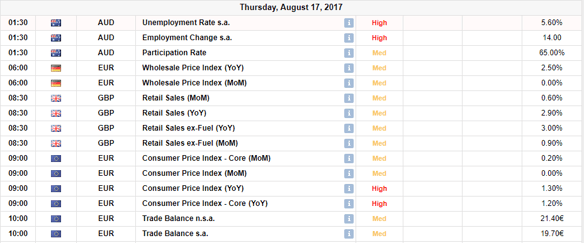

It’s the same old song on Thursday as we see the release of the weekly Jobs numbers in the US. Friday sees the release of the Michigan confidence number, which again will remain key for policy makers in determining the steps forward.

We will be keeping tabs on the events in the markets. Check out our blog for market updates, insights from our GT247.com team, and our independent analysts. Not sure about a trade? Call the GT247.com Trading Desk on 087 940 6102, and bounce your idea off one of our dedicated traders.

![]()

Until next week, we wish you profitable trading!

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

Download GT247.com MobiTrader app and start trading forex from your mobile phone immediately with R100 000 demo money: