Global stocks including the JSE weakened on Wednesday as mounting signals of a global economic slowdown surfaced.

With demand for sovereign bonds souring on safe-haven buying, the US 2-year and 10-year Treasury bond yields inverted for the first time since 2007. This is significant as most recessions in the USA have been preceded by such an inversion. An inversion is phenomena where shorter dated yields are higher than longer dated yields. This inversion combined with a contraction in German GDP of 0.1% in the last quarter saw European stocks plummet on Wednesday, while US stocks quickly erased their prior session’s gains at the open.

Locally, Statistics SA released South Africa’s retail sales data for the month of June as they expanded 2.4% YoY which is higher than the prior recording of 2.3%, while retail sales MoM advanced 0.3% from a prior recording of 0.1%.

Investors also eagerly awaited Tencent Holdings’ 2nd quarter results which topped net income estimates but failed to beat on revenue. This resulted in its biggest shareholder Naspers [JSE:NPN] coming under significant pressure in Johannesburg as it eventually closed 3.96% lower at R3354.10..

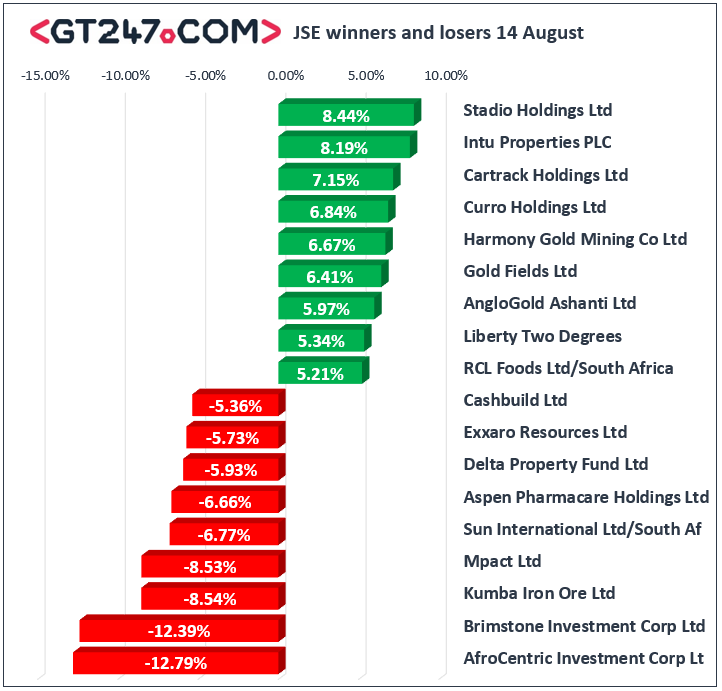

Other blue-chips on the JSE also struggled on the day with significant losses being recorded for Kumba Iron Ore [JSE:KIO] which tumbled 8.54% to close at R414.96, while diversified mining giant Anglo American PLC [JSE:AGL] lost 4.49% to close at R137.44. Exxaro Resources [JSE:EXX] fell 5.73% to close at R137.44 following the release of its half-year trading statement which highlighted that the company is expecting a drop in earnings. Sasol [JSE:SOL] resumed its recent decline as it lost 4.82% to close at R279.19, while Barloworld [JSE:BAW] weakened by 4.19% to close at R109.51 after the company renewed a cautionary statement with regards to its process to acquire a Mongolian based equipment dealer.

Intu Properties [JSE:ITU] had some relief as it rallied 8.19% to close at R7.00, while its sector peer Capital and Counties [JSE:CCO] managed to gain 1.38% to close at R34.64. Curro Holdings [JSE:COH] was buoyed by the release of its half-year results which highlighted decent increases in revenue and earnings. The stock closed 6.84% to close at R17.80. Gold miners continue to see-saw and in today’s session they traded mostly firmer. Harmony Gold [JSE:HAR] surged 6.67% to close at R45.87, Gold Fields [JSE:GFI] added 6.41% to end the day at R89.68, while AngloGold Ashanti [JSE:ANG] gained 5.97% to close at R310.00.

The JSE Top-40 index closed 2.37% weaker while the broader JSE All-Share index lost 2.05%. All the major indices closed in the red. Industrials fell 2.64%, Financials dropped 2.27% and Resources fell 1.3%.

The rand struggled in today’s session as it fell to a session low of R15.43/$ before being recorded trading 1.92% weaker at R15.41/$ at 17.00 CAT.

Brent crude tumbled from its overnight highs to be recorded trading 3.38% weaker at $59.23/barrel just after the JSE close.

At 17.00 CAT, Palladium was down 1.39% at $1434.85/Oz, Gold was up 0.98% at $1516.07/Oz, and Platinum had lost 0.71% to trade at $848.95/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.