Are we headed for a correction? Global economic growth fears have returned to the markets driven by the renewed trade disputes between the U.S and China.

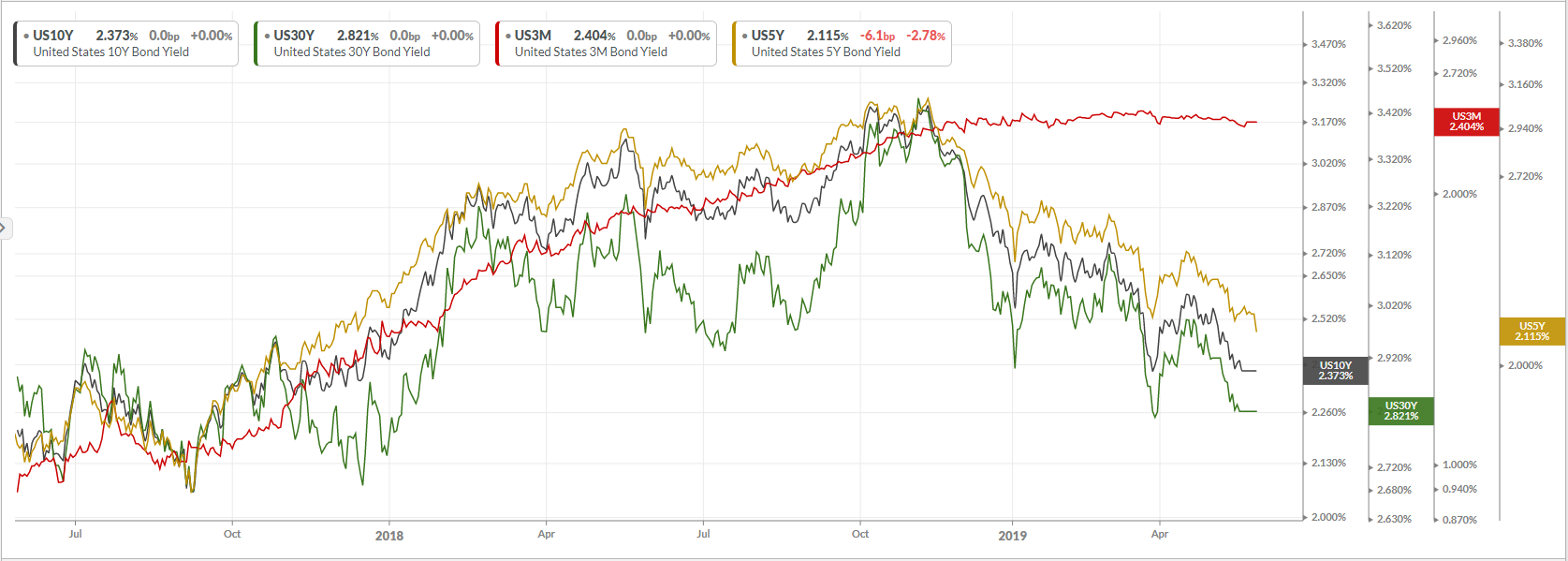

Bond Yields

Global economic recession fears have returned which saw long term Bond Yields move to multiyear lows accompanied by disappointing economic data. A Global recession might be to early to call but investor fears have certainly returned to the market. The graph below illustrates some of the major long-term Bond Yields in the U.S compared to the short-term U.S 3-month Treasury Bond Yield (red line).

Source- KOYFIN

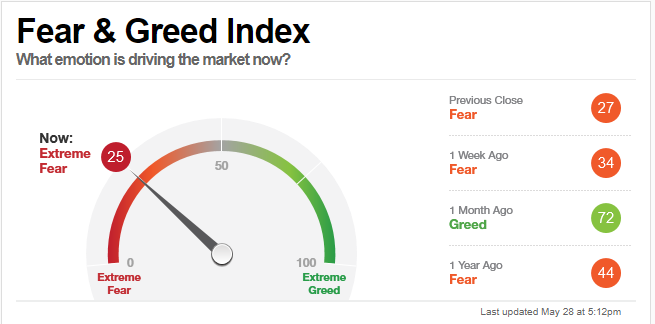

Market Sentiment

By looking at the CNNMarkets Fear and Greed Index we can see that the market is currently entering extreme levels of fear. As uncertainty over the U.S-China trade disputes continue we might see more pressure on the major Equity markets.

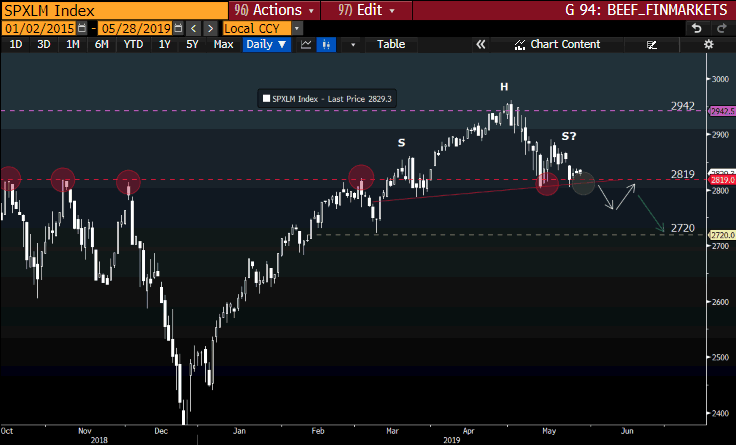

The S&P 500

Taking a closer look at the chart of the S&P 500 Index we can see the sell-off from the all-time highs as renewed vigour returned to the U.S-China negotiations.

Technically we might see more downside in the short term if the Head & Shoulders Technical pattern plays out which might see the price target the 2720 price level. If the technical pattern does not playout then we might see the price action return to the 2900 level.

Source - Bloomberg

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.