The market rally we have seen over the last week has come to a halt as the U.S-China trade deal comes back into focus with President Trump stating that he is the one holding up the trade deal with China. The G20 Summit is seen as a last hope for a breakthrough between the two superpowers as President Trump stated he has scheduled talks with Chinese President Xi Jinping during the summit.

Markets

Asian markets turned lower on Wednesday setting the tone for the day as we await the U.S inflation data later this afternoon. Bond Yields and Interest rates have been firmly placed in the back of our minds as fears of a Global recession looms.

Bond Yields

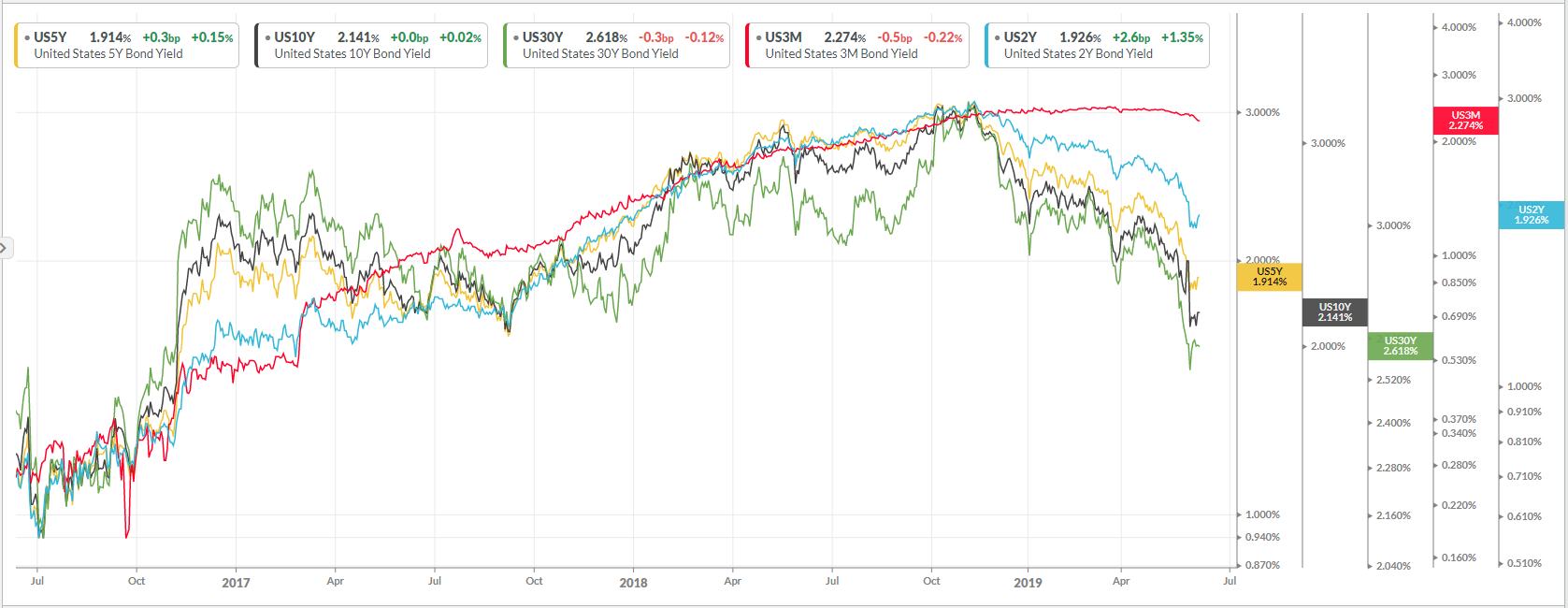

U.S Treasury yields have been on the slight rebound from the multi-year lows we have seen lately but remain on a downward slope. The U.S 10-year Treasury Yield was at 2.141% on Tuesday with the U.S 30-year Treasury yield pretty much unchanged at 2.618% from the day before.

Source - KOYFIN

The FED

Today’s CPI data will be watched closely to see if we can expect the FED to cut interest rates next Wednesday. The consensus with analysts seems to be that the FED will hold steady at the June meeting and cut interest rates in July by 25 basis points.

The U.S Inflation data will be released later today at 14:30 SAST.

The S&P 500

The S&P 500’s gains over the last week has also been halted from news events in Asia and renewed fears surrounding the U.S-China trade negotiations. The major news to look out for will be the CPI data and the FED moving into a rate cut cycle.

By looking at the history of the S&P500, the Index has moved lower and not higher as believed through a rate cutting cycle by the FED. The Index has gain in value from 2009 to 2019 when the FED’s outlook was to increase rates or to hold.

Source - Bloomberg

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.