The JSE closed firmer in today’s session as the weaker Rand buoyed Rand hedge stocks on the local bourse.

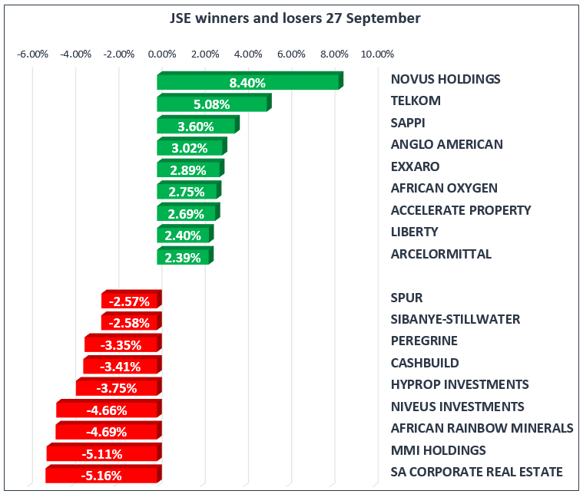

Following up on yesterday’s move lower, the Rand weakened further mainly on the back of US Dollar strength. The local currency weakened to an intra-day low of R13.60/$, which bode well for Rand hedge stocks such as Richemont (JSE:CFR) and British American Tobacco (JSE:BTI) which closed up 1.68% and 1.97%. Other major gainers included Anglo American PLC (JSE:AGL) which gained 3.02% whilst, Telkom (JSE:TKG) recovered slightly from yesterday’s big drop to gain 5.08%.

Gold miners were among the biggest losers with Harmony Gold (JSE:HAR) and Gold Fields (JSE:GFI) shedding 2.18% and 0.05% respectively. African Rainbow Minerals (JSE:ARI) lost 4.69% whilst Sibanye-Stillwater (JSE:SGL) continued in its downtrend as it lost 2.58%. Retailers, Truworths (JSE:TRU) and Shoprite (JSE:SHP) lost 1.81% and 0.83% respectively. Financial shares were not spared as First Rand (JSE:FSR) and Barclays Africa (JSE:BGA) lost 1.38% and 0.64% respectively.

The blue chip JSE Top-40 Index managed to close up 0.41%, whilst the JSE All-Share Index gained 0.26%. The Industrials Index gained 0.27% whilst the Resources Index jumped 1.10%, however the weaker Rand weighed down on the Financials Index as it lost 0.32%.

The strength in the US Dollar came as a result of US Fed Chair, Janet Yellen’s comments last night on the Fed’s hawkishness and the increasing possibility of a December interest rate hike. The US Dollar also jumped on the back of President Donald Trump’s tax plan announcement which is expected later on this evening. The US Dollar was firmer against major currency pairs as indicated by the US Dollar Index which climbed up to intra-day highs of 93.607 index points.

Gold weakened on the back of this US Dollar strength to reach an intra-day low of $1282.61 per ounce. The US Dollar did ease slightly from its strong rally which resulted in Gold rebounding marginally as it was recorded at $1286.99 per ounce just after the JSE closed.

Brent Crude eased marginally in today’s session, and despite a draw in US Crude Inventories the commodity failed to gain any significant upside immediately thereafter. The sentiment on Brent Crude is relatively bullish at the moment and this should ease OPEC’s concerns of the subdued oil prices that have prevailed over the past year. The commodity was trading at $57.88 per barrel just after the JSE closed.