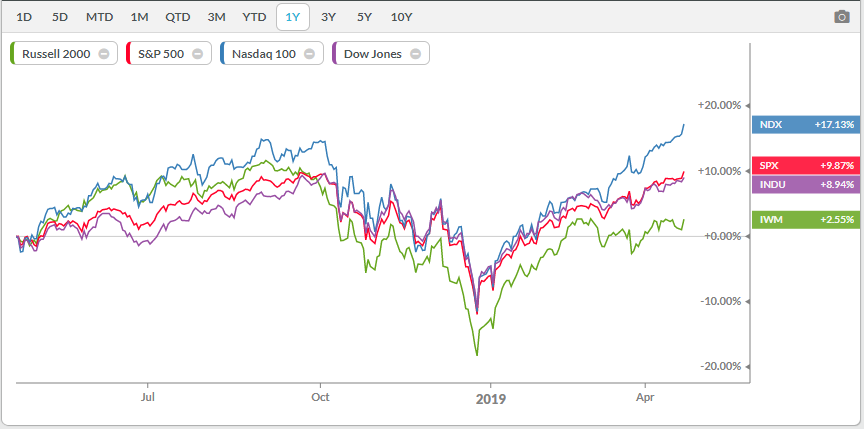

U.S markets have reached record highs once more on Tuesday as the world awaits the advance U.S GDP data on Friday around 14:30 SAST.

The S&P 500 reached all-time highs, reaching our target price and closed higher by 0.88% with the Dow lagging the major U.S Indices and only managed to gain 0.55%. The Tech sector had a stellar run on Tuesday with the Nasdaq up 1.32% also reaching a new record.

Source – KOYFIN

Wall Street

The Wall Street 30 index has been lagging the rest of the U.S markets in reaching new highs as earnings season gains traction. Some of the notable Companies reporting earnings today are Boeing (BA), Caterpillar (CAT), Facebook (FB), Tesla (TSLA) and Microsoft (MSFT).

The Boeing Company (BA).

Boeing (BA) will release its earnings before the U.S market open today and is widely expected to miss analysts’ expectations by some margin. Also, the news surrounding the Dow’s largest constituent has seen the share price under pressure since the tragic events surrounding the Boeing 737 MAX plane.

- Boeing (NYSE:BA) it is targeting approval by the Federal Aviation Administration of its software fix for the 737 MAX aircraft as early as the third week of May and to lift the grounding of the MAX by around mid-July, Reuters reports. – Carl Surran

U.S-China Trade update

The latest news from the U.S-China trade tariff negotiations driving the markets are that an agreement is in sight. The U.S Trade Representatives will be traveling to Beijing next week as both sides work to reach a draft agreement as early as May.

Wall Street 30 Index

By looking at the chart of the Wall Street 30 below we can see that the price action is closing in on our target price of 26824. We might see some downside today as the company earnings trickle in and Boeing missing estimates early in the trading session.

Some technical and fundamental points to look out for:

- The ascending triangle technical pattern might see a retest of the support level, previous resistance at 26298 if earnings disappoint.

- Price action is still trending above its major moving averages with the 50-day Simple Moving Average (blue line) ticking higher.

- The Relative Strength Index (RSI) is still below the over bought level which might indicate the Index might has some fuel left in the tank and push higher.

Source – Bloomberg

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.