Trade Conviction: Medium

Just as quick as the U.S. market reached new highs on Tuesday, sending the S&P to a new intraday record we saw an abrupt sell off as news surfaced that former lawyer of U.S. President Trump, Michael Cohen pleaded guilty to illegal campaign finance charges and this just before the president’s former campaign chairman Paul Manafort was convicted on eight counts of tax and bank fraud charges.

In this note i will share with you, two potential trade opportunies on the Wall Street Index.

Market events to note:

- Take note that the trade talks continue today between U.S. and China trade representatives and we might see signs that the month long spat will be resolved.

- We are also expecting the U.S. Federal Open Market Committee (FOMC) meeting minutes to be announced later tonight around 20:00 local time. The outcome of the minutes will give guidance on when the FED will raise interest rates later in the year, this announcement will affect the U.S. market later tonight.

- Central bankers, finance ministers and other market participants gather at the Jackson Hole economic symposium on Friday to discuss monetary policies. Market volatility is expected on Friday so take care with open positions.

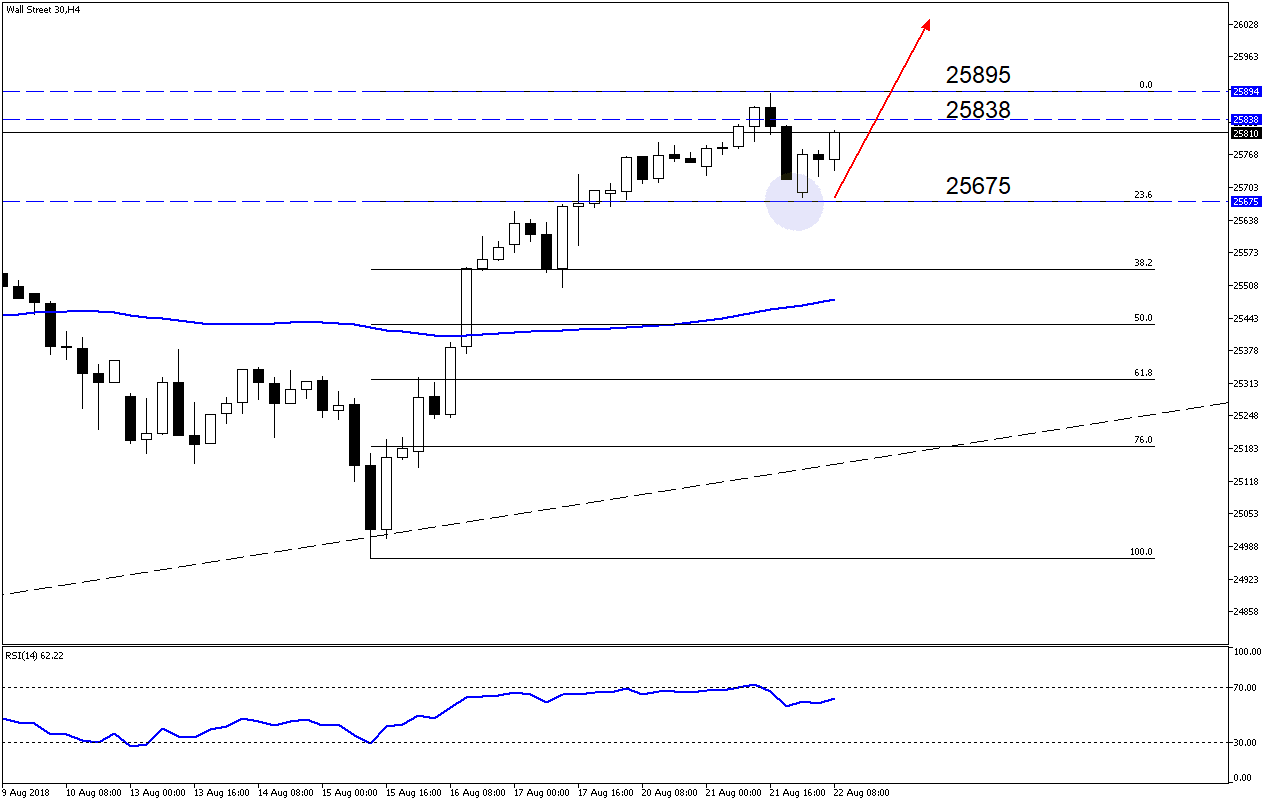

Looking at the intraday chart (H4)

The price action retraced from the highs back to the 23.6 Fibonacci level (25675 on chart) and subsequently moved higher from there. If the 25675 level does not hold, we could see the price action move lower. The price is creeping back to yesterday’s highs and I am looking for a clear break through the 25838 level before I enter a long trade.

Chart Source: Metatrader5

The Trade Outlook Long & Short Positions – (Medium Conviction)

This week there are multiple factors that might affect the price action in the U.S Markets so tread lightly and be aware of what’s happening in the world as the picture can change in an instant. I will look at two trade possibilities playing out on Wall Street 30.

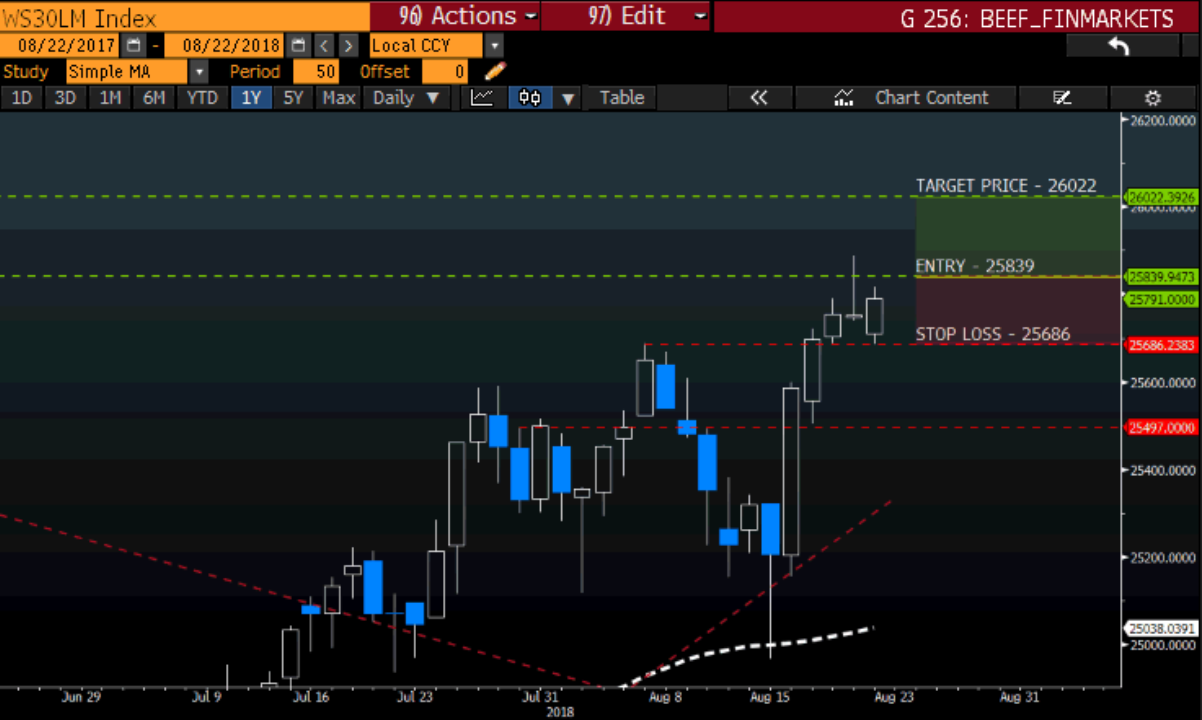

Trade: Wall Street 30 (Long)

- Entry (Buy): 25839

- Stop loss: 25686

- Target price: 26022

Chart Source: Bloomberg

Trade: Wall Street 30 (Short)

- Entry (Sell): 25839

- Stop loss: 25686

- Target price: 25497

Chart Source: Bloomberg

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.