We saw the U.S markets rise on Tuesday after news broke that the U.S and China’s top negotiators have reengaged talks for the first time since the G20 Summit. President Trump stated on Tuesday that he would intervene in the case against Chinese telecommunications executive Meng Wanzhou if it would help secure a trade deal with Beijing.

The market rally was short lived as by the U.S open we saw the bears retake control which drove the market lower once more as the Border Wall issue steps back into the spotlight.

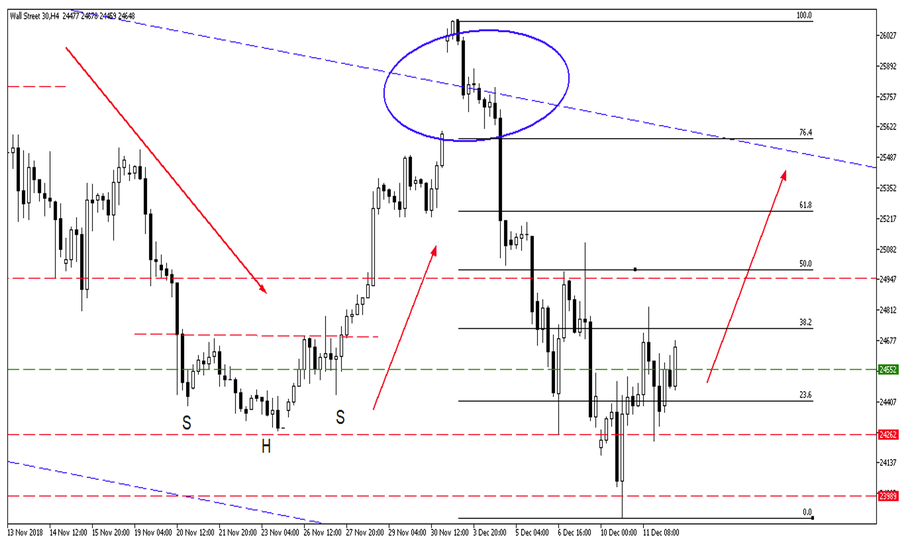

Let's take a look at the technical charts...

Market factors

- Global uncertainty seems to be at the forefront of market turmoil on Wednesday as news broke earlier today that the U.K Prime Minister Theresa May is set for a vote of no confidence later today.

Taking a closer look at the Daily chart of Wall Street 30, we can see that the price action is still trading within this descending channel. We might see the price action move higher back to the 24966 level as a first target.

Source – MetaTrader5

If we zoom into the 4-hour chartwe can see the price action is rising but might encounter some resistance at the 38.2 Fib retracement level which coincides with the 24731 level. If we see positive fundamental factors materialize then we can see the price action move significantly higher.

Source – MetaTrader5

Image Source: Wolf of Wall Street

Remember that trading puts your capital at risk. Always trade cautiously and never above your means.

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.