Has the U.S-China trade negotiations reached the final hurdle before the long-awaited Trade War can be laid to rest?

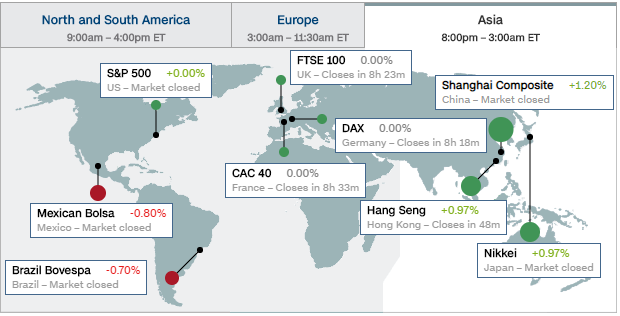

Well the markets are reacting as Asian markets seem to think that the U.S-China trade negotiations are on track to reach an agreement this time around with the Hang Seng and the Nikkei up close to a percent on Wednesday.

Source – CNN Business

U.S Market Outlook

Markets around the world are reacting and the U.S Markets are no exception as U.S Yields turn higher and Jobs Friday expected to impress as economic slowdown fears subside. The Dow might be lagging the rest of the U.S markets primarily due to events around The Boeing Company (BA)”s grounding of the 737 MAX.

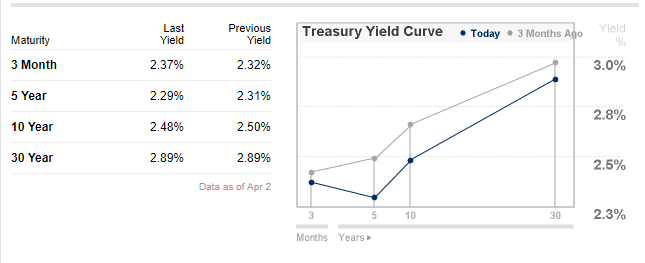

U.S Treasury Yields

The below chart shows the current U.S Treasury yields to take note of and to keep a keen eye on moving forward.

Source – CNN Business

Wall Street 30 Outlook

Renewed vigour has returned to Wall Street and we might be set for another week filled with upward momentum on the Indices. The Wall Street 30 is at a breakout point and if the Trade negotiations fundamentals pan out coupled with the technical setup the Dow might just push higher to recent highs.

Some technical and fundamental points to look out for:

- The price action is still well above its major moving averages which supports the move higher moving forward.

- Ascending Triangle pattern forming on the wall Street 30 which might support a breakout from the 26298-resistance level.

- The price action is currently testing a major technical resistance level at 26298 and if this level does not hold we might see a push higher to 26824.

Source – Bloomberg

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.