Warning signs are on the wall for another volatile period to come in global markets as coronavirus infection numbers increase at an alarming rate in the U.S and Europe.

Positive earnings from Microsoft and others could not stem the mixed picture across the board and with the U.S Presidential election only 6 days away, things are set to get bumpy.

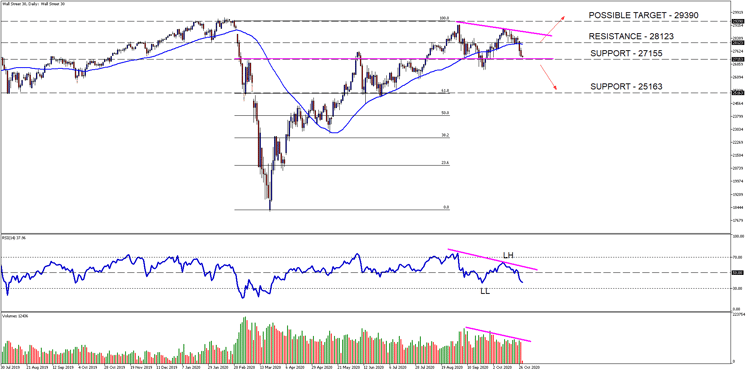

The Wall Street 30 Technical Analysis

With muted U.S stimulus talks and increasing COVID-19 infections across the globe the Wall Street 30 will undoubtedly be under pressure over the next couple of weeks.

With no positive news around U.S stimulus and with the increased number of coronavirus infections making waves, the price action did sell-off to lower levels as mentioned last week.

The 28123-support level did not hold and has now become a resistance point of interest with the current price action resting firmly on the 27155-support level. We might see a descending triangle forming as the price action starts to form lower highs and lower lows. If the 27155-support level does not hold then we might see short sellers drive prices lower to 25163.

Technical key areas to keep an eye on - WS30 Daily Chart Timeframe

- The price action on the WS30 needs to stay above the 27155-support level to negate the current negative outlook.

- The 50-day SMA (blue line) is above the price action, pointing lower which supports a possible move lower.

- The Relative Strength Index (RSI) is also making lower lows and lower highs towards the oversold levels.

- Volume is also declining, which could signal a pending move in either direction.

Chart Source: Wall Street 30 Daily Timeframe - GT247 MT5 Trading Platform

Take note: The outlook and levels might change as this outlook is released prior to the current day (Wednesday the 28TH of October 2020) U.S Market open.

Sources – MetaTrader5, Reuters

Barry Dumas | Market Analyst at GT247.com

Barry has 12 years experience in the financial markets. He enjoys educating clients on trading / investing and providing punchy technical analysis on securities. He currently holds a Wealth Management qualification and is studying towards becoming a Chartered Market Technician® (CMT) designation holder.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.